Creating a budget is one of the most empowering financial decisions you can make. A budget gives you control over your money, ensures you can meet your needs, and allows you to save for your future. However, creating a budget that works for you can seem daunting, especially if you’ve never done it before.

In this guide, we’ll walk you through a step-by-step process for creating a personalized budget that aligns with your financial goals, helps you track your spending, and sets you up for financial success.

What Is a Budget and Why Do You Need One?

A budget is simply a financial plan that allocates your income toward various expenses, savings, and goals. It helps you track where your money is going and ensures you don’t overspend. A well-organized budget can also:

- Help you save money: By setting aside a portion of your income each month for savings, you can start building an emergency fund, saving for retirement, or working toward specific financial goals like buying a home or going on vacation.

- Give you peace of mind: Knowing that you have a clear plan for your finances reduces stress and helps you avoid anxiety about unexpected bills or financial shortages.

- Control your spending: A budget helps prevent impulse purchases and ensures that you prioritize spending on what matters most to you.

By creating a budget that fits your lifestyle, you’ll be able to track your spending habits and adjust them to suit your goals.

Step 1: Understand Your Income

The first step in creating a budget is to understand how much money you have coming in each month. This is your total monthly income, which may include:

- Salary or wages: This is the income you receive from your primary job.

- Freelance or side job income: If you work as a freelancer or have a side hustle, include any additional income you make.

- Other sources of income: This could include rental income, investments, government benefits, or child support.

Once you’ve determined your total monthly income, you’ll know how much money you have to allocate to your expenses and savings.

Step 2: Track Your Expenses

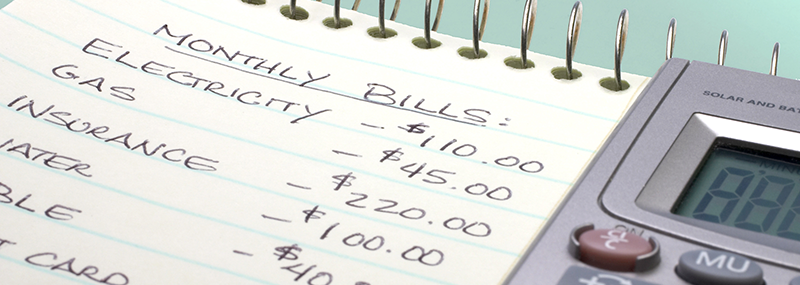

Next, you need to take a close look at your monthly expenses. Start by categorizing them into fixed and variable expenses:

- Fixed expenses: These are predictable monthly costs that generally don’t change, such as rent or mortgage payments, utilities, car payments, insurance premiums, and loan repayments.

- Variable expenses: These are costs that can fluctuate month to month, like groceries, transportation, entertainment, and dining out.

For the first month, it’s essential to track everything you spend, including small, seemingly insignificant purchases. You can do this manually, with budgeting apps, or by using a spreadsheet. This will give you an accurate picture of your current spending habits.

Step 3: Categorize Your Spending

Once you’ve tracked your expenses, break them down into categories. Here are some common categories to include in your budget:

- Housing: Rent or mortgage, utilities, property taxes, and home maintenance.

- Transportation: Car payment, gas, insurance, public transportation, or ride-sharing services.

- Food: Groceries, dining out, takeout, and snacks.

- Healthcare: Health insurance, doctor visits, medications, and any other healthcare expenses.

- Savings and Investments: Contributions to an emergency fund, retirement accounts, or other investment vehicles.

- Entertainment: Movies, concerts, hobbies, and other leisure activities.

- Miscellaneous: Clothing, gifts, and any other irregular spending.

By categorizing your spending, you’ll be able to pinpoint areas where you might be overspending and make adjustments.

Step 4: Set Your Financial Goals

A budget is more effective when you have clear goals in mind. Your financial goals will shape how you allocate your income. Some examples of goals might include:

- Paying off debt: If you have high-interest debt like credit cards or personal loans, making debt repayment a priority is a smart financial move.

- Building an emergency fund: Having an emergency fund provides financial security in case of job loss, medical emergencies, or unforeseen expenses.

- Saving for retirement: Setting aside money for retirement early ensures that you’ll be financially comfortable in your later years.

- Buying a house: If homeownership is one of your goals, you’ll need to save for a down payment and closing costs.

- Travel or big purchases: Whether it’s a vacation, a new car, or a home renovation project, it’s important to save for large expenses.

Setting specific, measurable goals helps you stay motivated and focused while you work to balance your budget.

Step 5: Create Your Budget Plan

Now that you understand your income, expenses, and financial goals, it’s time to create your budget. You can use several different methods to do this, depending on your preferences:

50/30/20 Rule

One of the simplest budgeting methods is the 50/30/20 rule, which suggests allocating your after-tax income in the following way:

- 50% for Needs: These are essential expenses, such as housing, utilities, food, and transportation.

- 30% for Wants: This includes discretionary spending on things like entertainment, dining out, and hobbies.

- 20% for Savings and Debt Repayment: This portion should go toward building your emergency fund, saving for retirement, and paying off debt.

Zero-Based Budgeting

Zero-based budgeting means that you assign every dollar of your income to a specific category, ensuring that your income minus your expenses equals zero. This method works well for people who prefer a more detailed, hands-on approach to managing their money.

Envelope System

The envelope system is a more hands-on method that involves putting cash into envelopes designated for each spending category. When you run out of cash in an envelope, you can’t spend any more money in that category for the month. This method helps curb overspending.

Step 6: Monitor and Adjust

Creating a budget is not a one-time activity—it’s an ongoing process. To ensure that your budget remains effective, it’s important to monitor your progress regularly. At the end of each month, review your spending to see if you stayed within your budget and met your financial goals.

If you find that you’ve overspent in certain areas, adjust your budget for the following month. Maybe you need to cut back on entertainment or dining out, or perhaps you need to increase the amount you save for retirement. Your budget should be flexible and adaptable to your changing needs.

Step 7: Use Budgeting Tools and Apps

There are many tools and apps that can help you create and stick to a budget. Some popular options include:

- Mint: This app automatically tracks your income and expenses, categorizes your spending, and helps you set savings goals.

- YNAB (You Need A Budget): YNAB helps you allocate your income to specific categories and prioritize savings and debt repayment.

- EveryDollar: Created by financial expert Dave Ramsey, EveryDollar helps you create a zero-based budget and track your spending.

- PocketGuard: PocketGuard tracks your income and expenses, and helps you find opportunities to save money.

Using a budgeting app can make tracking your finances more convenient and help you stay on track with your goals.

Step 8: Stay Consistent and Be Patient

Creating a budget that works for you takes time and discipline. It’s important to stay consistent and be patient with the process. If you encounter setbacks, don’t get discouraged. Financial success is a marathon, not a sprint.

Final Thoughts

Creating a budget is one of the most powerful tools you can use to take control of your finances. By understanding your income, tracking your spending, and setting clear financial goals, you can create a budget that works for you. Stay disciplined, make adjustments as needed, and you’ll soon see the benefits of budgeting—more financial security, less stress, and the ability to achieve your financial goals.

By creating a personalized budget, you’ll be well on your way to managing your finances successfully, paving the way for a brighter financial future.