When it comes to operating systems, few names resonate as strongly in the professional world as Microsoft Windows. For decades, Windows has been the backbone of businesses across the globe, dominating office environments with a significant market share.

But what is it about Windows that has made it so ubiquitous in the workplace? In this blog post, we’ll delve into the reasons why Windows has become the go-to operating system for offices, exploring its history, features, compatibility, and much more.

1. Historical Dominance: The Legacy of Windows

Windows has been a staple in the business world since its inception. Microsoft’s journey began in the mid-1980s with the release of Windows 1.0, which laid the foundation for future iterations.

However, it wasn’t until the release of Windows 3.0 in 1990 that the operating system began to gain significant traction in offices. This version introduced a more user-friendly graphical user interface (GUI) and enhanced memory management, making it a viable option for businesses.

- Advertisement -

The real game-changer, however, was Windows 95. This version brought the start menu, taskbar, and a much more intuitive interface that resonated well with both businesses and individual users.

Its success cemented Windows as the dominant OS in the corporate world, a position it has maintained through subsequent versions like Windows XP, Windows 7, and the current Windows 10 and 11.

Key Takeaway: Windows’ early adoption in businesses and its continued evolution have built a legacy of trust and familiarity, making it the default choice for office environments.

2. Wide-Ranging Software Compatibility

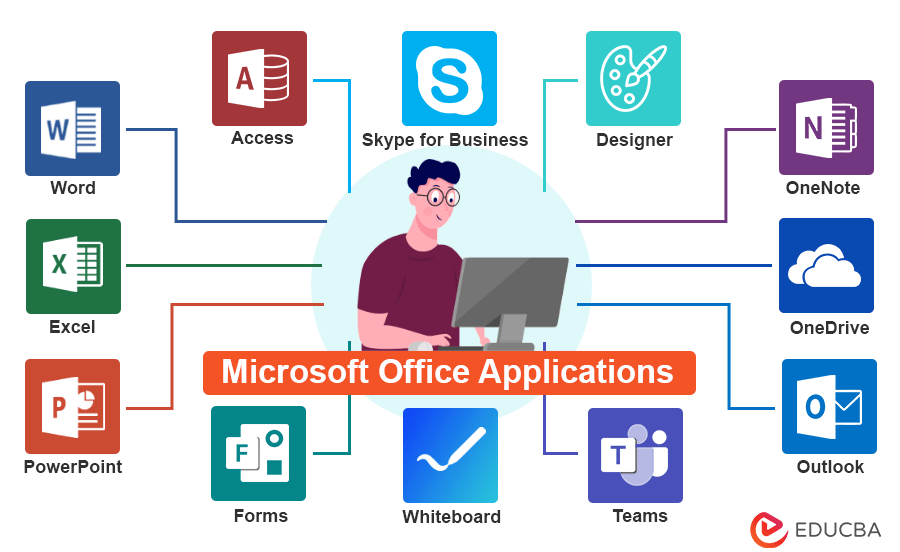

One of the primary reasons for Windows’ dominance in offices is its unparalleled software compatibility. Most business software, from Microsoft Office Suite to industry-specific applications, is designed primarily for Windows. This creates a seamless experience for users who rely on a variety of tools to perform their tasks efficiently.

For example, Microsoft Office, which includes Word, Excel, PowerPoint, and Outlook, is the most widely used office suite globally. While it is available on macOS and other platforms, its full functionality and seamless integration are best experienced on Windows.

Additionally, countless other essential software tools, such as Adobe Creative Suite, AutoCAD, and SAP, are optimized for Windows.

Furthermore, many businesses develop custom applications tailored to their specific needs. Windows’ robust development environment, including Visual Studio and .NET, makes it easier for developers to create and maintain these custom solutions.

Key Takeaway: Windows’ extensive software compatibility ensures that businesses can run the tools they need without compatibility issues, making it the preferred choice for office environments.

3. Hardware Compatibility and Availability

Another significant factor contributing to Windows’ popularity in offices is its broad hardware compatibility. Unlike macOS, which is limited to Apple’s hardware, Windows can run on a vast array of devices from different manufacturers. This includes desktops, laptops, tablets, and even some mobile devices.

This hardware flexibility allows businesses to choose from a wide range of devices that suit their budget and specific needs.

Whether it’s a high-end workstation for graphic design or a budget-friendly laptop for administrative tasks, there’s a Windows device that fits the bill. Moreover, because Windows supports such a wide range of hardware, it can easily integrate with existing office equipment like printers, scanners, and network devices.

Key Takeaway: The ability to run on a wide range of hardware gives Windows a significant advantage in office environments, where different roles require different types of devices.

4. Enterprise-Level Features and Support

Windows offers a wealth of features specifically designed for businesses. One of the most critical is Active Directory, a directory service that facilitates user and resource management across a network.

Active Directory allows IT departments to manage user accounts, enforce security policies, and deploy software updates across an organization, all from a central location.

In addition to Active Directory, Windows offers robust security features, including BitLocker for full-disk encryption, Windows Defender for antivirus protection, and advanced firewall settings. These features help protect sensitive business data from cyber threats, which is crucial in today’s digital landscape.

Furthermore, Microsoft provides extensive support options for businesses, including enterprise-level customer support, regular security updates, and long-term service releases (LTSB/LTSC) for organizations that require stable, long-term deployment cycles.

This level of support ensures that businesses can rely on Windows to keep their operations running smoothly.

Key Takeaway: Windows’ enterprise features and comprehensive support make it an ideal choice for businesses that require robust security and management tools.

5. Familiarity and Ease of Use

Over the years, Windows has become synonymous with computing for many people, both in and out of the workplace. This familiarity reduces the learning curve for employees when they start using Windows in a professional setting.

Most people are already accustomed to the Windows interface, including the Start menu, taskbar, and file explorer, which means they can be productive from day one.

This ease of use is further enhanced by Windows’ consistent design language across versions. While there have been changes and improvements, the core experience remains familiar, which helps reduce training costs for businesses.

Additionally, Windows’ integration with other Microsoft services, such as OneDrive, Teams, and Azure, further streamlines the user experience, making it easier for employees to collaborate and access their files from anywhere.

Key Takeaway: Windows’ widespread familiarity and user-friendly interface make it easier for employees to be productive, reducing the need for extensive training.

6. Cost-Effectiveness and Licensing Flexibility

Cost is always a consideration for businesses, and Windows offers several advantages in this regard. Windows PCs are generally more affordable than their macOS counterparts, which is a significant factor for businesses looking to equip large numbers of employees with computers.

Additionally, Windows offers flexible licensing options tailored to different business needs. For example, Windows 10 Pro and Enterprise editions provide advanced features like device encryption, remote desktop access, and group policy management, which are essential for businesses. Volume licensing options allow organizations to purchase licenses in bulk, further reducing costs.

Moreover, Windows’ long-term service releases (LTSB/LTSC) provide businesses with a stable version of the OS that receives security updates without the need for frequent feature updates. This stability is particularly important for organizations that require a reliable and consistent computing environment.

Key Takeaway: Windows’ affordability and flexible licensing options make it a cost-effective choice for businesses of all sizes.

7. Integration with Existing Business Infrastructure

Many businesses have built their IT infrastructure around Windows. From server environments running Windows Server to networks managed with Active Directory, Windows is deeply integrated into the fabric of many organizations. This integration extends to other Microsoft products, such as SQL Server, SharePoint, and Exchange, which are commonly used in business environments.

Windows also integrates seamlessly with a wide range of third-party software and services. For example, Windows is often the preferred OS for running enterprise resource planning (ERP) systems, customer relationship management (CRM) software, and other business-critical applications. This level of integration makes Windows the natural choice for businesses looking to maintain a cohesive IT ecosystem.

Key Takeaway: Windows’ deep integration with existing business infrastructure makes it the logical choice for companies that rely on a variety of software and services to run their operations.

8. Adaptability and Scalability

Businesses are constantly evolving, and their IT needs change over time. Windows is designed to adapt to these changes, offering scalability that suits both small businesses and large enterprises. For small businesses, Windows offers straightforward deployment and management options, while larger organizations can take advantage of advanced features like virtualization, cloud integration, and remote management.

Windows’ adaptability is also evident in its support for various computing environments. Whether it’s a traditional office setup, a remote work scenario, or a hybrid model, Windows can accommodate different working styles and environments. This flexibility is crucial in today’s dynamic business landscape, where the ability to adapt quickly can be a competitive advantage.

Key Takeaway: Windows’ adaptability and scalability make it a versatile choice for businesses of all sizes, helping them grow and evolve with changing demands.

Windows as the Backbone of Business

The dominance of Windows in office environments is not the result of a single factor but rather a combination of historical legacy, extensive software and hardware compatibility, enterprise-level features, cost-effectiveness, and adaptability. Microsoft’s continuous innovation and commitment to meeting the needs of businesses have ensured that Windows remains the operating system of choice for offices worldwide.

As technology continues to advance, Windows is well-positioned to remain at the forefront, providing businesses with the tools and support they need to thrive in an increasingly digital world. Whether it’s through integration with emerging technologies like cloud computing and AI or by continuing to refine its core features, Windows will likely remain the backbone of business for years to come.

Final Thoughts: While other operating systems have their merits, Windows’ unique blend of features, compatibility, and support makes it the most popular and reliable choice for offices around the globe. As businesses continue to evolve, Windows will undoubtedly continue to play a pivotal role in their success.