Investing can sometimes feel like walking through a thick forest full of fog. Words that are difficult to understand are everywhere, and it seems like the way to make money is hidden. But what if I told you there is a strong, guiding principle that can be your compass? This strategy is so basic that financial experts and experienced investors have called it the most important factor in your investment success. This, my friends, is what asset allocation can do.

Welcome to the ultimate guide on a subject that may seem complicated but is really basic and has a big effect. We’re not just going to explain what asset allocation is; we’re also going to break it down, look at its subtleties, and give you useful, actionable advice on how to use its power in your finances. Understanding asset allocation is the key to your success, whether you’re a recent graduate with your first paycheck, a mid-career professional looking to build serious wealth, or someone nearing retirement who wants to protect their hard-earned nest egg.

So, get comfortable and grab a drink. Let’s start our journey to learn the art and science of asset allocation. At the end of this deep dive, you’ll not only know what asset allocation is, but you’ll also know how to confidently set up your portfolio for the future and handle the market’s constant changes like a pro.

What exactly is asset allocation, and why is it so important?

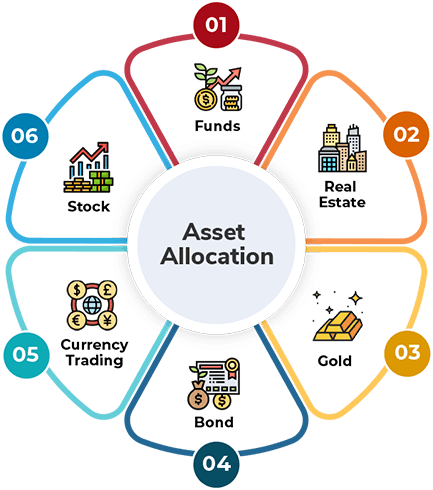

At its core, asset allocation is the planned way to split up your investments into different types of assets, like stocks, bonds, real estate, and cash. Think of it as preparing a meal that benefits your financial future. You wouldn’t eat the same thing for every meal, would you? A healthy investment portfolio is also spread out over different types of assets, each with its set of risks, rewards, and characteristics.

The main goal of asset allocation is not to buy the hottest stocks or time the market perfectly, which is a waste of time for even the most experienced investors. It’s not about picking the best investments; it’s about putting together a group of investments that fits your financial goals, how much risk you’re willing to take, and how long you plan to invest. Benjamin Graham, the famous investor who wrote “The Intelligent Investor,” said that the most important part of managing investments is managing risks, not managing returns.

Source: The U.S. is a favorable place to start learning about asset allocation. The website Investor.gov, which is operated by the Securities and Exchange Commission, provides valuable information.

Why Asset Allocation Should Be Your Portfolio’s North Star

It is essential to allocate your assets correctly. In fact, many studies have indicated that the way you divide up your assets is what causes most of the changes in your portfolio’s return over time. Think about that for a minute. It’s not about picking individual stocks that will go up; it’s about how you mix your assets.

Here are some reasons why a favorable asset allocation strategy is important:

Risk Management: Different types of assets respond differently to the same economic events. For example, when the stock market is going down, high-quality bonds often keep their value or even go up in price. You can lessen the effects of a bad performance in any one asset class by having a mix of assets. We will talk more about the idea of diversification later, but this is an example of it in action.

Your asset allocation should be a direct reflection of your financial goals in life. Are you putting money aside for a down payment on a house in five years? Your allocation will be more cautious. Are you 25 years old and saving for retirement in 40 years? You can take on more risk if you think it will lead to more growth.

Emotional Discipline: A set asset allocation strategy is like an anchor in the stormy seas of market volatility. When the market is happy, it stops you from getting too excited and buying risky assets. On the other hand, it helps you not to sell everything in a panic when the market crashes. Warren Buffett said, “Temperament, not intellect, is the most important quality for an investor.”

Our friends at The Motley Fool can help you learn more about the rules of long-term investing.

Breaking Down the Building Blocks: The Main Asset Classes

To build a strong financial house, you need to know what you’re working with. Let’s take a look at the main types of assets that will make up the core of your asset allocation plan.

- Stocks: The Engine of Growth

What they are: When you buy a stock, you own a small part of a public company.

Characteristics: Stocks have historically had the best chance of growing over time. But they also have the most ups and downs. Their value can change a lot in the short term depending on how well the company is doing, what is happening in the industry, and the state of the economy as a whole.

Types:

By the size of the company (market capitalization):

Large-cap: Big, well-known companies like Apple and Microsoft. They are usually more stable.

Mid-Cap: Companies that are medium-sized and have a lot of room to grow.

Small-Cap: These are smaller, often younger companies that have a lot of room to grow but are also riskier.

By Area:

Domestic: Stocks of companies that are based in your country.

International: Stocks of companies in developed economies that aren’t your own (like Japan or Europe).

Emerging Markets: Stocks of companies in developing countries like Brazil, India, and China. These stocks have a lot of room to grow, but they also have more political and currency risk.

By Style:

Growth stocks anticipate faster growth than the overall market. They might not pay dividends and instead reinvest their profits.

Value Stocks: Companies that the market doesn’t seem to value enough. They might not be popular right now, but they have strong fundamentals. - Fixed-Income (Bonds): The Force That Keeps Things Steady

What they are: When you buy a bond, you are basically lending money to a government or corporation in exchange for regular interest payments (the “coupon”) and the return of the principal amount at a later date (maturity).

Bonds are generally thought to be less risky than stocks and give you a more stable stream of income. Their prices don’t change as much, and they often do well when the stock market is having a difficult time, which makes them an important way to spread risk.

There are subcategories:

National governments issue government bonds, such as U.S. Treasury bonds. They are thought to be very safe and have a low chance of default.

Corporate Bonds: These are bonds that companies sell to get money. They pay more interest than government bonds because they are a little riskier. Agencies like Moody’s and S&P often give them a rating based on how likely they are to pay back their debts (from investment-grade to high-yield or “junk” bonds).

Municipal bonds are those that are issued by state and local governments. In the U.S., the interest income from these bonds is usually not taxed by the federal government.

International Bonds: These are bonds that are issued by companies and governments in other countries. - Real Estate: The Physical Asset

What it is: This includes owning physical property directly (like a home or a business) or investing in real estate investment trusts (REITs), which are companies that own and often run income-generating real estate.

Real estate can give you both capital gains and rental income. Property values and rents tend to go up with the cost of living, so it has been a beneficial way to protect yourself against inflation in the past. But owning something directly can be hard to sell and requires a lot of money and management. REITs are a better, more liquid, and easier way to invest in real estate. - Commodities: The Unprocessed Goods

What they are: These are basic goods or raw materials, like oil, gold, natural gas, and farm products.

Characteristics: The prices of goods can change a lot because of how much is available and how much people want it. They can protect against inflation and add variety to a portfolio because their prices don’t always move with the stock and bond markets. People often consider gold to be a “safe-haven” asset when the economy is uncertain. - Cash and Cash Equivalents: The Safety Net

What they are: The safety net includes short-term government bills, money in savings accounts, and money market funds.

Characteristics: This category category is the asset class that is the easiest to sell and the least risky. It gives you a backup plan for emergencies and money to invest when good opportunities arise. But having too much cash can hurt you in the long run because inflation can lower its value.

Interlink: If you are keen to learn more about the different kinds of investments, read our full guide, “Exploring the Investment Universe: From Stocks and Bonds to Alternatives.”

Making Your Own Plan: How to Divide Your Assets

Now that we understand the components, how do we integrate them? Various proven methods exist for allocating assets, each with a unique approach to managing your investment mix.

- The Set-it-and-Forget-it (Almost) Method for Strategic Asset Allocation

This is the most common and highly recommended strategy for people who want to invest for a long time. This strategy involves setting target allocations for each asset class based on your risk tolerance and holding period. Then, you need to periodically rebalance the portfolio to keep those targets.

You choose the best mix, like 60% stocks and 40% bonds, for example. This balance will change over time as the market goes up and down. If stocks do well this year, your portfolio could be 70% stock and 30% bond. To get back to your original 60/40 split, you would need to sell some stocks and buy more bonds.

Advantages: It’s simple to follow, encourages discipline, and stops you from making quick decisions based on short-term market noise.

Set a schedule to check your portfolio for rebalancing, maybe once or twice a year, or when an asset class goes off target by a certain amount (like 5%).

- The Active Tweaker’s Strategy: Tactical Asset Allocation

This is a more active approach that lets you change your strategic allocation for short periods of time to take advantage of market opportunities that you see.

How it works: You still have a long-term strategic mix, but you might temporarily put more weight on an asset class that you think is going to do well or less weight on one that you believe is too expensive. Should you perceive emerging markets as undervalued, consider increasing your allocation from 10% to 15% temporarily.

Benefits: This strategy could help you increase your profits by capitalizing on market inefficiencies.

Considerations: This plan requires additional research and a deeper understanding of the market. There is also the chance of making the wrong tactical bets, which could hurt performance.

- Dynamic Asset Allocation: The Approach That Changes With the Market

This is a more active strategy in which the mix of assets is constantly changing based on changes in the economy and the market.

How it works: Your portfolio’s allocation changes as the market changes. If the economy is good, you may invest more in stocks; if it’s bad, you may invest in bonds and cash.

Benefits: This strategy could significantly reduce the risk of losing money when the market declines.

Things to think about: Such an allocation is a complicated strategy that is best used by professional money managers most of the time. It can also make transactions pricier.

Source: This Vanguard paper provides great information for a detailed comparison of different asset allocation models.

What do you like? Figuring out how much risk you’re willing to take and how long you want to wait

Choosing the right asset allocation is a very personal decision. Two people who want to reach the same financial goals might have completely unique asset allocations because they are comfortable with different levels of risk.

Finding Out How Much Risk You Can Handle

Your risk tolerance is how much you can handle and are willing to accept changes in the value of your investments. Consider these questions:

What would I do if my portfolio lost 20% of its value in one year?

A) Get rid of everything and switch to cash. (Low risk tolerance)

B) Feel anxious, but hold on and trust my long-term plan. (You can handle a moderate amount of risk.)

C) Look at it as a chance to buy something something and put more money into it. (High risk tolerance)

What is the main goal of my investment?

A) Protect my money at all costs. (Low risk tolerance)

B) A mix of growth and protection. (Moderate risk tolerance)

C) Make the most of my long-term growth. (High risk tolerance)

How much experience do I have with investing?

New investors often think they can handle less risk until they’ve been through a full market cycle.

Helpful Hint: A lot of online brokerage sites and financial advisor sites have free risk tolerance tests. Think about taking one to learn more about yourself. This one from Bankrate is a good place to start.

Setting Your Time Frame

The time frame for your investments is how long you plan to keep them before you need the money.

- Your time frame is short if you want to save for a car or make a down payment on a house in less than five years. To protect your principal, you’ll want a more conservative asset allocation with a higher percentage of cash and short-term bonds.

- For goals like paying for a child’s education, you have a little more time in the medium term (5 to 10 years). A balanced portfolio of stocks and bonds lets you take on a moderate amount of risk.

- Long-term (10+ years): You have a long time to save for retirement, especially when you’re young. If you put more money into stocks, you can take on more risk to get the most long-term growth. This advantage advantage is because you’ll have plenty of time to recover from any market downturns.

Age-Based Asset Allocation Models: A Good Place to Start

Your age can help you divide your assets, but your risk tolerance is the most important factor. Here are some models that are based on age:

The Growth Phase for Young Investors in Their 20s and 30s

Time frame: 30 to 40 years until you retire.

Focus: Rapid growth.

Sample Distribution:

80–90% of stocks:

40–50% U.S. Big-Cap

15% to 20% in the U.S. Mid- and Small-Cap

20–25% Developed Countries

5%–10% Emerging Markets

Bonds: 10–20%

Bonds from the U.S. government and businesses comprise this mix.

0–5% Alternatives (Optional):

Invest a modest sum in real estate (REITs) or commodities to enhance diversification.

Reason: Young investors can afford to take on a lot of risk for the chance of getting higher returns because they have decades until they retire. They have a lot of time to wait out market swings.

The Mid-Career Professional (40s and 50s): The Balancing Act

Time frame: 10 to 25 years until retirement.

Focus: Finding a balance between growth and keeping your wealth.

Sample Distribution:

60–70% of stocks:

35 to 40 percent of the U.S. Big-Cap

10 to 15 percent of the U.S. Small- and Mid-Cap

15–20% Developed Countries

5% Emerging Markets

30% to 40% Bonds:

The portfolio consists of a blend of government and corporate bonds, each with varying maturities.

5–10% Alternatives (Optional):

REITs and commodities can help you diversify even more.

Reason: As retirement gets closer, the focus shifts from aggressive growth to a more balanced approach. Protecting the wealth that has already been built up is now more important than growth.

The Pre-Retiree and Retiree (60s and older): The Income and Preservation Phase

Time Frame: In or close to retirement.

Focus: Keeping your money safe and making a steady stream of money.

Sample Allocation (Before Retirement):

40-– to 50 percent stocks:

25–30% U.S. Large-Cap (usually with a focus on stocks that pay dividends)

5 to 10% U.S. Mid- and Small-Cap

10% Developed Countries

50–60% Bonds:

A lot of money goes into high-quality government and corporate bonds.

5–10% Cash and Other Options:

The goal is to provide individuals with financial stability and safeguard them against inflation.

Sample Allocation (During Retirement):

30–40% stocks:

The majority of these stocks are blue-chip stocks that offer dividend payments.

50–60% Bonds and Fixed Income:

The goal is to generate a consistent flow of income.

10–20% in cash and cash equivalents:

You aim to cover your living expenses for a period of one to two years.

Reason: The main goal is to make the money last for the rest of your life. The main goal is to make money and keep the principal safe from big drops in the market.

A Note on the “100 Minus Your Age” Rule: A common rule of thumb for stock division is to take 100 and subtract your age. However, due to increased life expectancy, many financial planners now recommend starting with 110 or 120. This document document is a simple guide, but it can help beginners get started.

The Modern Portfolio in 2025 and Beyond: How to Deal with Current Trends

The rules for asset allocation are always true, but the economy is constantly changing. As we enter the second half of the 2020s, several factors are influencing how investors should approach the division of their assets.

Inflationary Pressures: The recent rise in inflation has reminded investors of how important it is to have assets that can keep up with rising prices. People are once again interested in assets like real estate, commodities, and some stocks (companies that can set their prices). People also like Treasury Inflation-Protected Securities (TIPS).

Interest Rate Environment: We are in a new situation after a long time of very low interest rates. Bonds can be more appealing when interest rates are higher because they pay higher yields. But higher rates can also lower the value of bonds that are already out there.

Uncertainty in geopolitics: Events around the world keep the markets unstable. A portfolio that is well diversified and includes investments in different geographic areas can help lower the risks that come with putting all your money in one country or region.

The Rise of Alternatives: More and more investors are looking at alternatives to stocks and bonds, such as private equity, private credit, and infrastructure, to get better returns and more diversification. Institutional and high-net-worth investors usually have an easier time getting into these, but there are more ways for regular investors to do so.

According to a recent report from Fidelity International, a flexible and globally diversified approach to asset allocation will be crucial for dealing with the changing economy in 2025.

The Hidden Enemy: How Behavioral Biases Can Ruin Your Asset Allocation

Your feelings and mental biases can throw off even the best asset allocation plan. The first step to getting over these bad habits is knowing what they are.

Herd Mentality: This is the tendency to do what everyone else is doing, like buying when everyone else is buying (often at the top of the market) and selling when everyone else is selling (often at the bottom). A disciplined strategy for rebalancing is the best way to protect yourself from the crowd.

Recency Bias: This condition condition is when you put too much weight on things that have happened recently. If stocks are doing well, you may want to invest all your money in them. Keep in mind that what happened in the past does not mean what will happen in the future.

Confirmation Bias: This phenomenon phenomenon is the tendency to look for information that supports what you already believe and ignore information that goes against it. If you think a stock will do well, you might only read good news about it.

Loss Aversion: We’ve already talked about how the pain of losing money is worse than the pleasure of getting it. This can make portfolios too safe or cause people to sell winning investments too soon to make a small profit.

To fight against biases, write down your investment plan, including your long-term goals and the assets you want to own. When you want to make an emotional choice, look back at your written plan. This simple thing can help you get the emotional distance you need to make a better choice.

Your Asset Allocation Toolkit: Useful Advice for Regular Investors

We’ve talked about many things. Let’s break it all down into some useful, doable things you can do right now.

Make a Financial Plan First: Before you even think about how to divide your assets, you need to know what your financial goals are, how long you have to reach each one, and what your current financial situation is.

Be Honest About How Much Risk You Can Handle: Use online tools and your thoughts to figure out how much risk you can handle.

Pick Your Target Asset Allocation: Based on your plan and how much risk you’re willing to take, choose the best mix of stocks, bonds, and other assets for you.

Use Low-Cost Funds to Carry Out Your Allocation: For most investors, the best and cheapest way to carry out an asset allocation strategy is to use low-cost index funds or exchange-traded funds (ETFs). These funds let you instantly spread your money across hundreds or even thousands of individual stocks.

Automate Your Investments: Make sure your investment accounts get money automatically every month. This makes investing less emotional and makes sure that you always have money working for you.

Rebalance on a regular basis: Follow your rebalancing schedule, which could be once a year, twice a year, or when the percentage points change. This strategy encourages you to purchase at a low price and sell at a high price, which is the optimal approach to investing.

Stay the Course: Once you have a successful plan, the hardest thing to do is often nothing. Don’t let the daily noise of the market get to you. Trust in your long-term plan.

You can change your asset allocation as your life changes. If you get married, have kids, or change jobs, you may need to look over and change your portfolio.

The Last Word: Your Path to Financial Strength

Asset allocation won’t make you rich right away. It’s a long-term, disciplined plan that gives you the tools you need to build a strong and successful investment portfolio. It’s about admitting that the future is uncertain and that the best way to get ready for it is to build a portfolio that can handle a wide range of economic situations.

You are making a giant step toward reaching your financial goals by taking the time to learn about asset allocation, honestly evaluating your own financial situation and personality, and committing to a disciplined approach. With the compass of asset allocation in hand, you can navigate the financial forest with confidence and clarity.

So, what are you waiting for? Your asset allocation is the first and most important step on the road to your financial future.