In a world full of tempting purchases and important life events, being able to carefully plan for a big purchase is more than just a skill—it’s a key part of good money management. If you want to buy your first home, get a new car for your growing family, or go on a once-in-a-lifetime trip around the world, you need more than just wishful thinking. They need a well-thought-out saving plan, clear financial goals, and careful budget planning.

This detailed guide will help you get ready for a big financial project by walking you through the whole process. We’ll talk about the psychology behind big purchases, look at ways to save money that work, and give you the tools you need to take charge of your financial future. By the end of this masterclass, you’ll not only know how to make your next big purchase with confidence, but you’ll also know how to make your financial life safer and more successful.

The Psychology Behind the Purchase: Knowing Your “Why”

Before we get into the details of saving and budgeting, it’s important to know what makes us want to make a “big purchase.” These purchases are often linked to our feelings, goals, and the pressure we feel from society.

The Draw of the Big Ticket Item

It’s not always about the item itself when you buy something big. A new car can mean success and freedom, while a house can mean stability and a place to make memories that will last. The first step in making a smart choice is to understand how much emotional weight you give to a purchase. Being aware of yourself can help you tell the difference between a real need and a passing desire. This can stop you from making decisions that could ruin your financial goals.

Needs vs. Wants: The Key to Smart Spending

When smart marketing and social media are involved, it can be hard to tell the difference between a need and a want. You need a car that works well to get to work. You probably want a high-end luxury car with all the latest gadgets.

Useful Advice: Before you start saving for a big purchase, take a moment to think about how it will fit into your life. Think about this:

- Will this buy really make my life better in the long run?

- Are there other options that would do the same thing but cost less?

- Is this want coming from outside forces or an internal goal?

This self-reflection exercise will help you understand your true values and make sure that your financial goals are in line with them.

Setting SMART financial goals is the first step in

Once you’ve found a meaningful “big purchase,” the next step is to turn that desire into a real goal. This is where the power of setting SMART financial goals comes into play. The letters in SMART stand for:

- Specific: It’s hard to act on goals that aren’t clear, like “save for a car.” “I want to save $15,000 for a down payment on a new Honda CR-V” is a clear goal.

- Measurable: You need to be able to measure your goal. How much do you need to put away? You can keep track of your progress better if you know the exact amount.

- Achievable: It’s great to have big dreams, but your financial goals need to be doable. If you set a goal that you can’t reach, you might get discouraged and give up. Think about your current income, expenses, and time frame.

- Relevant: Your goal should fit in with your larger life goals. Is this big purchase part of your long-term financial plan?

- Time-bound: A deadline makes you feel like you have to do something right away and keeps you motivated. “I will save $15,000 for a down payment on a new Honda CR-V in the next 24 months,” for example.

The Key to Your Financial Success: Learning How to Plan Your Budget

Your big purchase will be easier to get to if you make a good budget. It’s the most important tool in your “money management” toolbox because it lets you see exactly where your money is going and find ways to save money.

The 50/30/20 Rule: A Simple but Strong Framework

The 50/30/20 rule is a well-known and useful way to plan your budget. This framework breaks down your income after taxes into three groups:

- 50% for Needs: This includes basic costs like rent, utilities, food, transportation, and insurance.

- 30% for Desires: This category includes spending on things like eating out, going to the movies, doing hobbies, and buying things you don’t need.

- 20% for Saving and Paying Off Debt: This is the part of your income that you will set aside for your financial goals, such as your saving plan for a big purchase, retirement contributions, and paying off debt.

Tip for the Real World: You might need to change these percentages if you’re actively saving for a big purchase. To speed up your savings, think about lowering the amount of things you “want” for a short time.

How to Make a Detailed Budget: A Step-by-Step Guide

Keep track of your income: After taxes, add up all of your monthly income from all sources.

Keep an eye on your spending: For at least a month, keep track of every single expense in detail. You can use a notebook, a spreadsheet, or a budgeting app to keep track of your spending. This will help you see how you spend your money.

Look at your spending: At the end of the month, look over what you’ve spent. Are there any surprises? Are you spending more in some areas than you thought you would?

Set Spending Limits: Use the 50/30/20 rule and your research to set reasonable spending limits for each category.

Make your savings automatic: This will change the game. On payday, set up an automatic transfer from your checking account to a savings account just for that purpose. Paying yourself first keeps you from wanting to spend that money on other things.

Look over and change: Your budget isn’t set in stone. Check it often and make changes when your income or expenses change.

This NerdWallet article has everything you need to know about making a budget.

A Strategic Saving Plan: The Engine of Your Financial Goals

Now that you have a good budget, it’s time to work out the details of your saving plan. Just putting money under the mattress won’t work. You need to have a plan for how to make your money work for you.

High-Yield Savings Accounts: The Best Way to Save

If you want to save money seriously, you need a high-yield savings account. Online banks usually offer these accounts, which pay much higher interest rates than regular banks. This means that your money will grow faster, which will help you reach your financial goals faster.

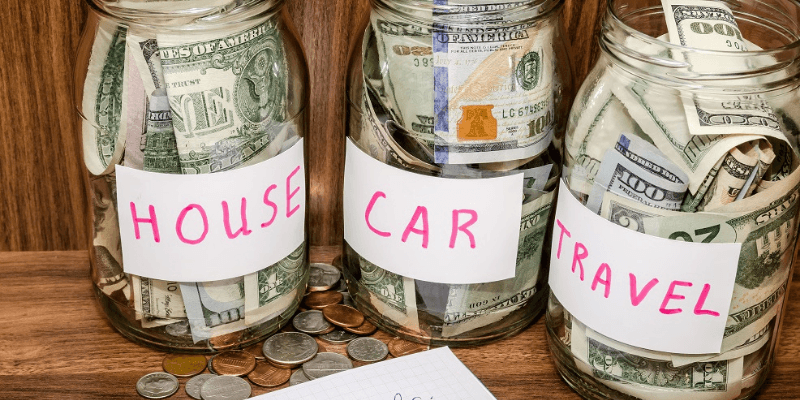

Tip: Set up a separate high-yield savings account just for your “big purchase.” To keep you motivated, give it a name like “Dream Home Fund” or “New Car Savings.”

Automate, Automate, Automate

We’ve said it before, but it’s worth saying again: the best way to save a lot of money for your big purchase is to automate your savings. You are less likely to miss money when it is out of sight and out of mind.

How to Find Extra Money: Unlocking Your Savings Potential

It’s true that cutting back on lattes and streaming subscriptions can help, but you might need to get more creative to really boost your saving plan.

- Talk to Your Bill Collectors: Call your cable, internet, and cell phone companies to try to get a lower rate. You’d be surprised at how much a simple phone call can do.

- The “No-Spend” Challenge: For a weekend or even a whole week, don’t spend any money except on things you really need.

- Get Rid of Things You Don’t Want: Get rid of things you don’t want and sell them on sites like Facebook Marketplace or eBay.

- Embrace Frugal Hobbies: Instead of going out to expensive places, try free or cheap things like hiking, picnics in the park, or going to the library.

- Make More Money: You could get a side job, freelance, or ask your boss for a raise at your current job. Even a small raise in pay can make your saving plan go a lot faster.

The Last Step: Buying the Big Thing with Confidence

After months or even years of careful budgeting and saving, you’re finally ready to buy the big item you’ve been wanting. But the trip isn’t over yet. There are still a few important things you need to do to make sure the transaction goes well.

Do Your Homework: Research is the Best Thing You Can Do

Learn everything you can about what you’re buying before you sign the contract.

- For a Car: Look into different makes and models, compare prices at different dealerships, and get pre-approved for a loan from your bank or credit union.

- For a Home: Hire a good real estate agent, have a full home inspection, and know all the costs that come with closing.

- For a Big Trip: Look at reviews, compare prices for flights and hotels, and make a detailed travel plan and budget.

Link to the source: Edmunds is a great place to get honest car reviews and price information. For information about real estate, visit Zillow.

The Art of Negotiation: Don’t Be Afraid to Ask for a Better Deal

A lot of people don’t want to negotiate, but it can save you thousands of dollars on a big purchase.

- Be Ready: Find out what the item you’re buying is worth on the open market. * Stay Calm and Polite: Being friendly and polite will get you much further than being aggressive.

- Be ready to walk away: If you can’t get a price you like, be ready to walk away. This is the best way to negotiate.

Getting to Know Your Financing Options

It’s important to know your financing options if you aren’t paying for your big purchase in cash.

- Mortgages: If you want to buy a house, you’ll need a mortgage. Look around for the best rates and terms.

- Auto Loans: Just like with mortgages, it’s a good idea to look at offers from different lenders for auto loans.

- Personal Loans: You might be able to get a personal loan for other big purchases. Make sure you read the fine print and know what the interest rate and repayment terms are.

- **”Buy Now, Pay Later” (BNPL) Services: These services are easy to use, but if you don’t pay off the balance before the promotional period ends, you may have to pay a lot of interest. Be careful when you use them.

The Consumer Financial Protection Bureau has a lot of information about different ways to get money.

After the Purchase: Keeping Your Money Healthy

It’s a big deal to make a big purchase, but it’s not the end of your financial journey. You need to keep practicing good money management to stay financially healthy in the long run.

Putting Money Back in Your Savings

Your savings may be gone after a big purchase. Having a plan for how to rebuild your emergency fund and keep saving for other financial goals, like retirement, is very important.

How to Avoid Buyer’s Remorse

A lot of people feel buyer’s remorse, which is the awful feeling of regret that comes after making a big purchase. To stay away from it:

- Stick to Your Budget: Don’t spend more than you can afford. * Give it Time: Take a “cooling-off” period before making a final decision. Wait at least 24 to 48 hours before making a big purchase.

- Don’t Just Look at Price: A cheap item that doesn’t meet your needs is a waste of money. * Celebrate Your Achievement: You worked hard to reach this goal. Recognize and celebrate your success!

Financial Success: Apps and Tools You Can Use

There are many tools and resources you can use to help you with your budget planning and saving plan in this digital age.

- Budgeting Apps: Apps like You Need A Budget (YNAB), Monarch Money, and Simplifi can help you keep track of your spending, make a budget, and see how you’re doing on your way to your financial goals.

- Providers of High-Yield Savings Accounts: For good interest rates, check out online banks like Ally Bank, Marcus by Goldman Sachs, and Discover Bank.

- Podcasts and Blogs About Money: Follow trustworthy financial blogs and listen to podcasts that talk about personal finance and money management to stay up to date and motivated.

Your Path to Financial Freedom Begins Now

Planning for a big purchase is a journey that takes discipline, patience, and a clear goal. You can make your dreams come true without hurting your finances by learning about the psychology behind your desires, setting SMART financial goals, mastering budget planning, and putting a strategic saving plan into action.

Keep in mind that every little thing you do brings you closer to a safer and more prosperous future. The rules of good money management that you use when you make your next big purchase will help you for the rest of your life. They will give you the confidence and foresight to handle any financial problem. So, take a deep breath, make your plan, and start your journey to being financially free. The rewards, both real and not, are well worth the work.

Source Links: