When it comes to safeguarding your financial future, insurance plays a crucial role. Whether you’re a young professional starting your career or someone preparing for retirement, the right insurance policies can offer peace of mind and help protect you and your loved ones against unforeseen events. In this blog post, we’ll take a detailed look at the different types of insurance you might need, and how to choose the right coverage for your unique situation.

Why Insurance Is Essential

Insurance is more than just a safety net for catastrophic events—it’s an essential tool for financial planning. It helps to protect you from financial loss in situations where the unexpected happens, whether it’s an accident, a natural disaster, or health issues.

Without proper insurance, a single misfortune can lead to overwhelming debt, wiping out savings and affecting long-term financial security.

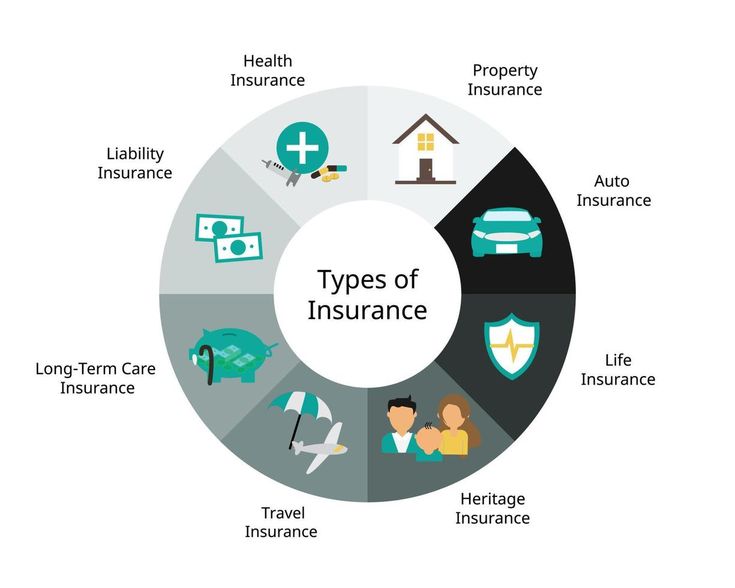

The world of insurance can be overwhelming due to the variety of options available, so understanding your needs is vital. By comprehensively understanding different types of insurance, you’ll be better prepared to make informed decisions.

1. Health Insurance

Health insurance is perhaps the most important form of coverage for individuals and families. It helps cover medical expenses, ensuring that you can receive care when necessary without facing substantial out-of-pocket costs. Health insurance can cover routine check-ups, emergency room visits, surgeries, prescriptions, and mental health services.

For families, the financial benefits are especially significant. Major medical procedures or extended hospital stays can quickly add up, leading to potentially devastating bills. With the right health insurance plan, you can avoid this financial burden.

Types of Health Insurance

- Private Health Insurance: Available through employers or purchased individually. These plans typically offer more flexibility in terms of the doctors and hospitals you can visit.

- Public Health Insurance: Government-sponsored programs like Medicare (for seniors) or Medicaid (for low-income individuals and families) can provide crucial coverage at affordable rates.

- Short-Term Health Insurance: Designed to fill gaps in coverage, such as between jobs or during transitional periods.

When choosing a health insurance plan, it’s essential to consider factors such as premiums, deductibles, out-of-pocket maximums, and the extent of coverage for various healthcare needs.

2. Life Insurance

Life insurance is vital for anyone who has dependents or financial obligations that would be difficult for others to manage in their absence. This type of insurance ensures that your loved ones are financially protected after your death. The benefits can help cover funeral costs, pay off outstanding debts, and provide for your children or spouse’s living expenses.

Types of Life Insurance

- Term Life Insurance: Provides coverage for a set period (e.g., 10, 20, or 30 years) at a relatively low premium. If the policyholder dies during the term, beneficiaries receive the death benefit.

- Whole Life Insurance: A permanent policy that provides coverage for the entire life of the insured, with an added savings component that grows over time.

- Universal Life Insurance: A flexible policy that combines life coverage with an investment savings component, allowing for changes in premium and death benefit amounts.

Life insurance is particularly important if you have a family, mortgage, or significant debts. It’s crucial to select the right coverage amount to ensure that your loved ones can maintain their lifestyle without financial hardship.

3. Auto Insurance

Auto insurance is mandatory in most states, offering protection in the event of accidents or damage to your vehicle. Not only does it cover repair costs, but it can also provide liability coverage if you’re at fault in an accident.

Types of Auto Insurance Coverage

- Liability Coverage: Pays for damage to others’ property or medical expenses if you’re responsible for an accident.

- Collision Coverage: Covers repairs to your own vehicle if it’s damaged in an accident.

- Comprehensive Coverage: Covers non-collision-related damage, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re involved in an accident with a driver who doesn’t have sufficient insurance.

Having the right auto insurance policy can save you from expensive out-of-pocket expenses, especially if you’re involved in a significant accident or your vehicle is damaged in a way not covered by your standard policy.

4. Homeowners Insurance

If you own a home, homeowners insurance is essential to protect your property and belongings from unexpected damages. Whether your house is damaged by fire, theft, or natural disasters, homeowners insurance can provide the financial support necessary to repair or replace what’s lost.

Types of Homeowners Insurance

- Basic Homeowners Insurance: Offers coverage for damage caused by fire, lightning, or theft, but may not cover natural disasters such as floods or earthquakes.

- Comprehensive Homeowners Insurance: Covers a broader range of risks, including natural disasters, vandalism, and personal liability.

- Renters Insurance: Ideal for those who don’t own their homes but want coverage for their personal property in the event of loss, theft, or damage.

Homeowners insurance is an investment in protecting your property and assets, especially given the high costs of home repairs and the potential loss of belongings.

5. Disability Insurance

Disability insurance provides income replacement in the event that you’re unable to work due to illness or injury. This type of coverage is especially important if you’re the primary earner in your household.

Types of Disability Insurance

- Short-Term Disability Insurance: Provides coverage for a short period, typically up to six months, following an illness or injury.

- Long-Term Disability Insurance: Offers income replacement for an extended period, often until the person can return to work or reaches retirement age.

Disability insurance is crucial for maintaining financial stability when you’re unable to earn an income due to health issues, and it provides a safety net when you need it most.

6. Emergency Fund: A Key Component of Financial Planning

While insurance protects against various financial risks, an emergency fund is just as essential for covering unexpected costs. An emergency fund is a savings buffer that can help you manage medical bills, car repairs, or emergency travel without relying on credit cards or loans.

How Much Should You Save?

Financial experts recommend saving three to six months’ worth of living expenses in an easily accessible account. This fund should cover rent or mortgage payments, utilities, groceries, and other essential living costs. Having this cushion can help alleviate the financial strain of unexpected events, and it’s often the first line of defense before insurance is needed.

7. Long-Term Care Insurance

Long-term care insurance covers the costs associated with long-term care, such as nursing home stays or home healthcare, which may not be covered by traditional health insurance or Medicare. As people live longer, the need for long-term care becomes more prevalent, and having this insurance can protect your retirement savings from being drained by high medical bills.

Types of Long-Term Care Insurance

- Traditional Long-Term Care Insurance: Offers coverage for a variety of care needs, including home care, assisted living, and nursing homes.

- Hybrid Long-Term Care Insurance: Combines life insurance and long-term care coverage, allowing you to access a portion of your death benefit while alive to cover long-term care costs.

8. Umbrella Insurance

Umbrella insurance provides additional liability coverage beyond the limits of your other policies. If you’re found liable for damages or legal costs that exceed your regular insurance limits, umbrella insurance steps in to cover the difference.

When to Consider Umbrella Insurance

- High-Net-Worth Individuals: If you have substantial assets, umbrella insurance can protect them from lawsuits.

- Homeowners or Renters: Those with significant liability risks—such as owning a pool or a dog—may find umbrella insurance especially valuable.

9. Travel Insurance

Whether you’re going on a vacation, business trip, or a spontaneous getaway, travel insurance can provide protection for unexpected incidents while you’re abroad. It covers emergencies, cancellations, lost luggage, and medical emergencies while traveling.

Types of Travel Insurance

- Trip Cancellation Insurance: Reimburses the cost of your trip if you have to cancel due to unforeseen circumstances.

- Emergency Medical Insurance: Provides coverage for medical expenses that occur while traveling.

- Travel Interruption Insurance: Covers additional costs if your trip is unexpectedly interrupted, such as for medical emergencies.

Conclusion

Navigating the world of insurance can be complex, but understanding the various types of coverage available ensures that you can make the right choices for your future. Whether you’re securing health insurance, preparing for the unexpected with life insurance, or protecting your property with homeowners insurance, each policy serves as a vital part of your financial safety net.

Moreover, incorporating an emergency fund into your financial strategy can further enhance your preparedness for the unknown. A solid mix of insurance policies and a well-established emergency fund can provide the peace of mind you need to face life’s challenges without financial strain.

In the end, insurance is about protecting what matters most—your health, your family, your home, and your future. By making informed decisions, you ensure that you’re not just securing your assets but also securing a stable, confident path ahead.