Managing your finances effectively starts with creating a solid monthly budget. A budget helps you understand your income, control your spending, and work towards your financial goals. Whether you want to pay off debt, save for a dream vacation, or build an emergency fund, a budget serves as a financial roadmap tailored to your needs. In this guide, we will break down how to create a monthly budget that works for you, step by step.

1. Understand the Importance of Budgeting

Before diving into creating a budget, it’s crucial to understand why budgeting matters. A budget is more than just a list of expenses; it’s a plan that empowers you to make informed financial decisions, prioritize what’s most important, and achieve your goals. Here are a few key benefits of budgeting:

Financial Awareness: Knowing where your money goes each month can prevent overspending and help you identify areas for improvement.

Debt Reduction: By allocating a portion of your income to debt repayment, you can pay off loans faster.

- Advertisement -

Goal Achievement: A budget helps you save for short-term and long-term goals, such as buying a car, saving for retirement, or starting a business.

Stress Reduction: When you have a clear plan for your money, financial stress can be significantly reduced.

2. Assess Your Current Financial Situation

The first step to creating a budget that works for you is assessing your current financial situation. This involves understanding your income, expenses, debts, and financial goals.

a) Calculate Your Total Monthly Income

Your income includes your salary, wages, freelance earnings, side hustle income, investment income, and any other sources of regular cash flow. Use your net income (after taxes and deductions) to build your budget.

b) Track Your Expenses

For one or two months, track every expense you make. This includes:

Fixed Expenses: These are consistent monthly costs, such as rent, mortgage payments, insurance premiums, and utility bills.

Variable Expenses: These can change month to month, like groceries, dining out, entertainment, and transportation costs.

Occasional Expenses: These are irregular expenses, such as holiday gifts, home repairs, or annual subscriptions.

Use tools like budgeting apps, spreadsheets, or notebooks to record your expenses accurately.

c) Analyze Your Spending Habits

Once you have a record of your expenses, categorize them and see where your money goes. Identify spending patterns and areas where you can cut back or reallocate funds.

3. Set Clear Financial Goals

Setting clear, achievable financial goals gives your budget a purpose. Goals can be short-term (within a year), medium-term (1-5 years), or long-term (over 5 years). Examples include:

- Short-Term Goal: Save $1,000 for an emergency fund.

- Medium-Term Goal: Pay off credit card debt.

- Long-Term Goal: Save for retirement or buy a house.

When setting goals, use the SMART framework: Specific, Measurable, Achievable, Relevant, and Time-bound. For instance, instead of saying, “I want to save money,” say, “I want to save $5,000 for a vacation in 12 months.”

4. Choose a Budgeting Method

There are several popular budgeting methods to choose from. Select the one that best aligns with your financial goals and preferences.

a) 50/30/20 Rule

This method allocates your income as follows:

- 50% Needs: Essentials like rent, utilities, groceries, and insurance.

- 30% Wants: Non-essential expenses such as dining out, entertainment, and hobbies.

- 20% Savings and Debt Repayment: Emergency fund contributions, retirement savings, and debt repayment.

The simplicity of this method makes it easy to follow, but you may need to adjust the percentages based on your personal circumstances.

b) Zero-Based Budgeting

In a zero-based budget, every dollar of your income is assigned a specific purpose, leaving you with a “zero” balance at the end of the month. This approach encourages meticulous tracking and can help prevent wasteful spending.

c) Envelope System

This cash-based system involves allocating cash for different spending categories and using physical envelopes to store the cash. Once the money in an envelope is gone, you cannot spend more in that category for the month. This method helps curb impulse spending and promotes discipline.

d) Pay Yourself First

This method prioritizes savings by automatically setting aside a portion of your income before covering expenses. For example, you might decide to save 15% of your income before paying bills or spending on discretionary items.

5. Build Your Budget

Now that you have a clear picture of your financial situation and have chosen a budgeting method, it’s time to build your budget.

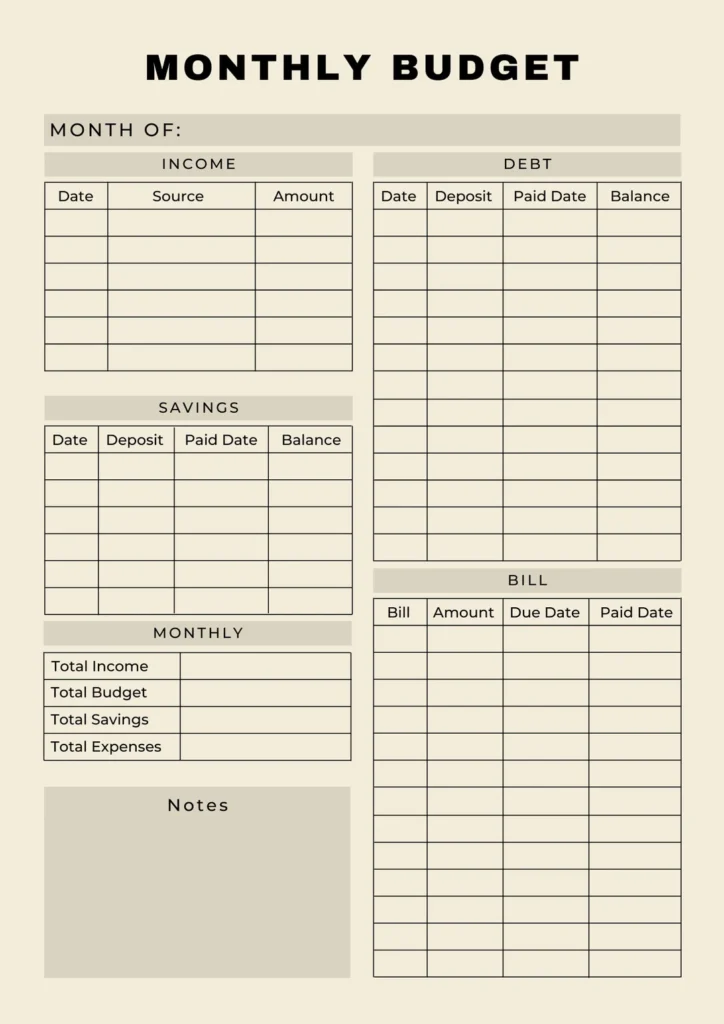

a) List Your Income and Expenses

Start by listing all your sources of income and total them up. Next, list your monthly expenses, categorizing them into fixed, variable, and occasional expenses.

b) Prioritize Your Expenses

Assign priority to your expenses. Needs such as housing, utilities, food, and insurance come first, followed by savings and debt repayment. Wants and discretionary spending are last.

c) Allocate Money to Each Category

Based on your chosen budgeting method, allocate money to each category. For example, if you follow the 50/30/20 rule, ensure that no more than 50% of your income goes toward needs.

d) Adjust as Needed

Your first budget may not be perfect, and that’s okay. Adjust your budget as necessary to accommodate unexpected expenses or changes in income.

6. Track and Adjust Your Budget Regularly

A budget is not a static document; it requires regular monitoring and adjustments. Review your budget at least once a month to ensure you’re staying on track. If you notice overspending in one category, find ways to cut back or reallocate funds.

a) Use Budgeting Tools

Leverage technology to make budgeting easier. Budgeting apps like Mint, YNAB (You Need a Budget), and PocketGuard can help you track expenses, monitor goals, and receive alerts when you exceed budgeted amounts.

b) Be Flexible

Life is unpredictable, and unexpected expenses can arise. Build flexibility into your budget to accommodate changes without derailing your financial goals.

7. Tips for Sticking to Your Budget

Sticking to a budget can be challenging, especially if you’re accustomed to a different spending pattern. Here are some tips to stay on track:

- Automate Savings and Bill Payments: Set up automatic transfers to your savings account and automatic bill payments to avoid late fees and ensure consistent savings.

- Limit Impulse Purchases: Before making a non-essential purchase, wait 24 hours to see if you still want it.

- Review Your Goals Frequently: Remind yourself of your financial goals to stay motivated and focused.

- Find an Accountability Partner: Share your goals with a friend or family member who can help keep you accountable.

- Reward Yourself: Celebrate small wins to stay motivated. If you reach a savings milestone, treat yourself within reason.

8. Address Common Budgeting Challenges

Budgeting isn’t always easy, and you may encounter challenges along the way. Here are some common issues and how to overcome them:

a) Irregular Income

If your income fluctuates, base your budget on your average monthly income or the lowest expected income. Save extra money during high-earning months to cover expenses during lower-income months.

b) Unexpected Expenses

Build an emergency fund to cover unexpected expenses, such as medical bills, car repairs, or job loss. Aim to save at least three to six months’ worth of living expenses.

c) Debt Management

If you have significant debt, allocate a portion of your income to debt repayment. Consider using the debt snowball method (paying off the smallest debts first) or the debt avalanche method (paying off debts with the highest interest rates first).

9. Review and Refine Your Budget

Creating a budget is a continuous process. Periodically review your budget to reflect changes in income, expenses, and goals. Make adjustments as needed to ensure that your budget remains effective.

a) Quarterly Check-Ins

Every three months, take a closer look at your budget to see if you’re on track to meet your goals. Adjust your spending, savings, and debt repayment plans accordingly.

b) Annual Review

Conduct an annual review of your budget to assess your progress over the past year. Reflect on your successes and challenges, and set new financial goals for the upcoming year.

10. Achieving Financial Wellness Through Budgeting

Creating a monthly budget that works for you is a powerful tool for achieving financial stability, reducing stress, and reaching your long-term goals. By understanding your income, tracking your expenses, setting clear goals, and choosing the right budgeting method, you can take control of your finances.

Remember, the key to a successful budget is consistency, flexibility, and a commitment to regular review. With time, patience, and dedication, you can create a budget that empowers you to live a financially healthy and fulfilling life.