When you have a structured settlement, deciding on an annuity company to manage your payouts is a significant decision. Structured settlement annuities provide a reliable, steady income stream that can support your financial needs for years.

However, the right structured settlement annuity company can make all the difference in ensuring your peace of mind and maximizing the value of your settlement.

This guide will take you through the essential factors to consider when choosing a structured settlement annuity company, help you identify reputable companies, and outline the benefits and potential downsides of different providers.

What Is a Structured Settlement Annuity?

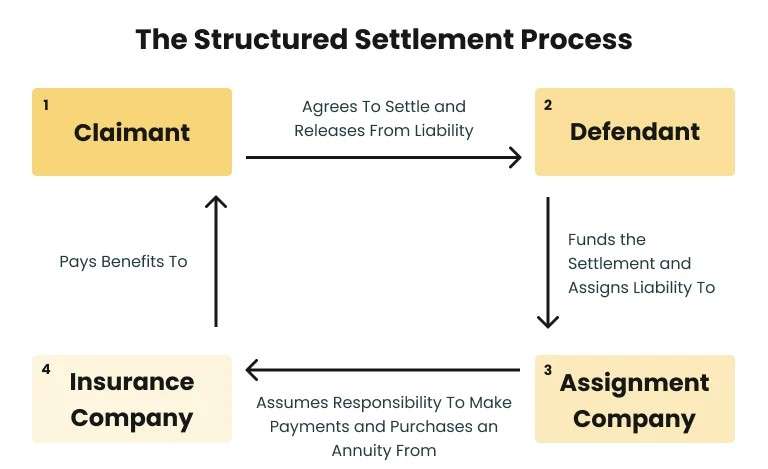

Structured settlements are commonly awarded in personal injury cases, worker’s compensation claims, or lottery winnings. Instead of receiving a lump sum, the recipient receives periodic payments over time, typically designed to provide long-term financial security.

- Advertisement -

A structured settlement annuity is the product that funds these scheduled payments, managed by an insurance company or financial institution.

Choosing the right company to handle your structured settlement annuity is crucial because it affects how smoothly you receive payments and, ultimately, your financial stability.

Why Selecting the Right Structured Settlement Annuity Company Matters

The structured settlement process involves more than just a payment schedule; it also involves legal, tax, and financial considerations. Some key reasons to prioritize choosing the right company include:

Reliability of Payments: Your financial future is on the line. A reliable company ensures timely payments, helping you avoid financial hardship.

Protection Against Inflation: The right company may offer inflation-protected annuities, which help your payouts keep pace with the cost of living.

Customer Service and Support: From tax reporting to account management, excellent customer service is crucial for long-term peace of mind.

Legal Compliance and Tax Benefits: Structured settlement payments may be tax-free in certain jurisdictions. A reputable company will help you navigate these considerations.

Factors to Consider When Choosing a Structured Settlement Annuity Company

Choosing a structured settlement annuity company is a long-term commitment, so consider these factors carefully:

1. Company Reputation and Stability

Since structured settlements may extend for decades, working with a financially stable company is essential. Look for companies with a solid reputation and a track record of delivering on their promises. A few ways to gauge a company’s reliability include:

AM Best Rating: AM Best evaluates and rates insurance companies based on their financial stability. Ratings from “A” to “A++” indicate high stability.

Consumer Reviews: Online reviews and Better Business Bureau (BBB) ratings can give insight into a company’s customer satisfaction and responsiveness.

Company Longevity: Established companies with a long history are more likely to provide reliable service.

2. Payment Options and Flexibility

Not all structured settlement annuities are alike. Some companies offer more flexibility in terms of payment schedules, allowing you to choose between monthly, quarterly, or yearly payouts. Key factors in payment flexibility include:

Fixed vs. Variable Payments: Some companies allow you to opt for variable payments, which may increase over time to account for inflation.

Lump Sum Options: Some companies may offer partial lump sum options if you ever need a larger payout for an emergency.

3. Customer Service and Accessibility

Your relationship with your annuity company may last for years, making quality customer service vital. Evaluate the company’s:

Communication Channels: Look for multiple ways to reach customer support, such as phone, email, or online chat.

Account Management Tools: Some companies provide online portals for easy access to payment schedules, account information, and tax forms.

Customer Support Hours: Choose a company that offers flexible support hours to accommodate your needs.

4. Fees and Expenses

The cost of managing a structured settlement can vary significantly from one provider to another. Here’s what to look out for:

- Administrative Fees: Some companies charge administrative fees, which can add up over time.

- Hidden Costs: Read the contract carefully to identify potential hidden costs, such as early withdrawal penalties or fees for altering your payment schedule.

- Rate of Return: If the annuity company invests your funds, inquire about the expected rate of return and how it might impact your payouts.

Researching Top Structured Settlement Annuity Companies

To ensure you’re making the right choice, invest time in researching potential companies. Here are a few companies known for their structured settlement annuities:

1. MetLife

- Reputation: With over 150 years in the insurance business, MetLife has a strong reputation for stability.

- Financial Ratings: Consistently high AM Best ratings for financial strength.

- Specialization: MetLife offers a variety of annuity types, including structured settlement annuities, making it a versatile option for different needs.

2. Prudential Financial

Reputation: Known for its financial stability and customer-centric approach.

Financial Ratings: Prudential has excellent ratings from AM Best, Moody’s, and S&P.

Customer Support: Provides dedicated support for structured settlement annuity holders and online account access.

3. Pacific Life

Reputation: Pacific Life is widely respected for its financial stability and long-term commitment to customers.

Special Features: Offers a range of structured settlement products, including those with inflation protection.

Ratings: Holds high ratings from AM Best and other rating agencies, indicating reliability.

4. Berkshire Hathaway Life Insurance

Reputation: Part of the Berkshire Hathaway conglomerate, this company is highly stable and trustworthy.

Financial Strength: Often praised for its strong financial base, making it a dependable option.

Specialization: Focuses on structured settlements and other annuity products, offering tailored solutions for long-term needs.

Red Flags to Watch for When Choosing a Structured Settlement Annuity Company

While many companies are reputable, some signs may indicate potential issues. Watch out for these red flags:

Unclear or High Fees: Excessive fees can diminish your payouts over time. If a company is vague about costs, consider it a warning sign.

Poor Customer Reviews: Check reviews on the BBB or Trustpilot. Repeated complaints about payment delays or poor customer service may indicate problems.

Aggressive Sales Tactics: Reputable annuity companies should not pressure you into decisions. Pushy sales tactics often indicate a lack of transparency.

The Role of a Financial Advisor in Choosing an Annuity Company

Working with a financial advisor can provide insight into the often-complex annuity landscape. Advisors can help by:

Comparing Company Offers: An advisor can analyze different companies’ fee structures, payment schedules, and other terms.

Explaining Financial Stability: They can help you understand financial ratings and how they impact your settlement.

Tailoring to Your Needs: Advisors can help match your settlement with your specific needs, guiding you in choosing the most suitable company.

Benefits and Drawbacks of Selling Your Structured Settlement Annuity

Some people may choose to sell their structured settlement annuity for a lump sum payment, often to meet urgent financial needs. However, this decision comes with pros and cons.

Benefits:

- Immediate Cash: If you face unexpected expenses, a lump sum can provide instant relief.

- Greater Flexibility: You can use a lump sum payment for various needs, such as buying a home or paying off debts.

Drawbacks:

- Loss of Future Income: By selling, you lose the security of regular income.

- Potential Loss in Value: Companies that buy structured settlements usually pay less than the annuity’s total value, meaning you may receive less overall.

Before selling, consult with a financial advisor to fully understand the consequences.

Making the Right Choice for Long-Term Financial Security

Choosing the best structured settlement annuity company is crucial to ensure financial security and peace of mind. From assessing a company’s reputation to understanding fee structures, there’s a lot to consider. Researching reputable companies, consulting with financial advisors, and carefully analyzing your own financial goals can guide you in making an informed decision.

Investing time in this process ensures you select a structured settlement annuity provider that will provide reliable payments and support your long-term financial well-being.