Dollar-cost averaging is a simple but compelling strategy that stands out in the often-volatile world of finance, where fortunes can change in the blink of an eye. It is a sign of the wisdom of patience and a way to stay stable. This approach isn’t a scheme to get rich quickly or a complicated formula that only the best people on Wall Street know how to use. On the other hand, dollar-cost averaging is a straightforward, proven method that prioritizes consistency over intuition, providing the average investor with a means to accumulate wealth.

Many people perceive investing as a closed circle that is difficult to enter. The huge number of charts, the constant stream of financial news, and the fear of a market crash can all make it difficult to make decisions. But what if there was a way to avoid the noise and build a strong portfolio not by timing the market but by spending time in it? This concept is the main idea behind dollar-cost averaging, which is a strategy that we’ll talk about more in depth. It’s not just about how money works; it’s also about learning how to think like an investor.

This detailed guide will explain the theory behind dollar-cost averaging and how to use it in real life. We will go into detail about how it works, discuss its many benefits, acknowledge its limitations, and give you steps you can take to use this powerful tool in your financial life. Get ready to learn how the simple act of investing regularly and with discipline can help you achieve long-term financial freedom.

What is the meaning of dollar-cost averaging? The Simple Beauty

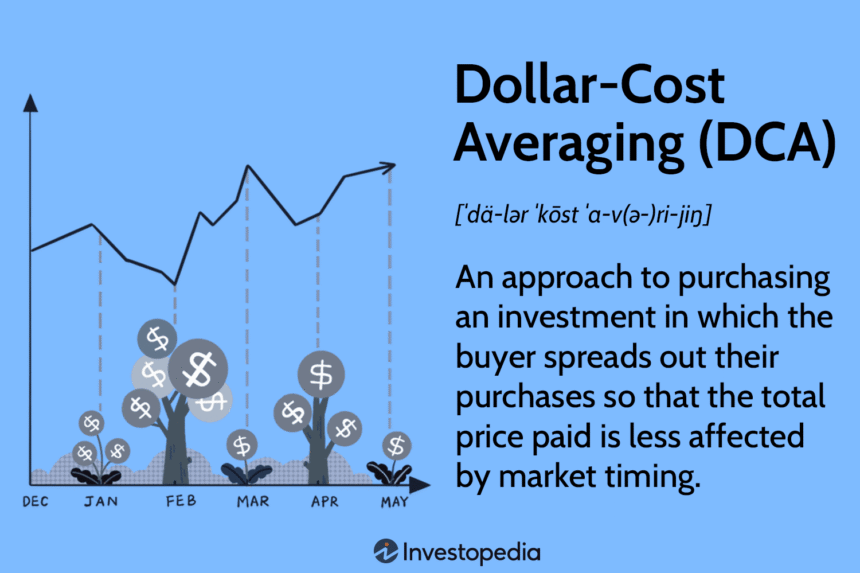

Dollar-cost averaging (DCA) is an investment strategy in which you put a set amount of money into a certain asset at regular times, no matter what its price is. You could invest in stocks, mutual funds, exchange-traded funds (ETFs), or even cryptocurrencies once a week, every other week, or once a month.

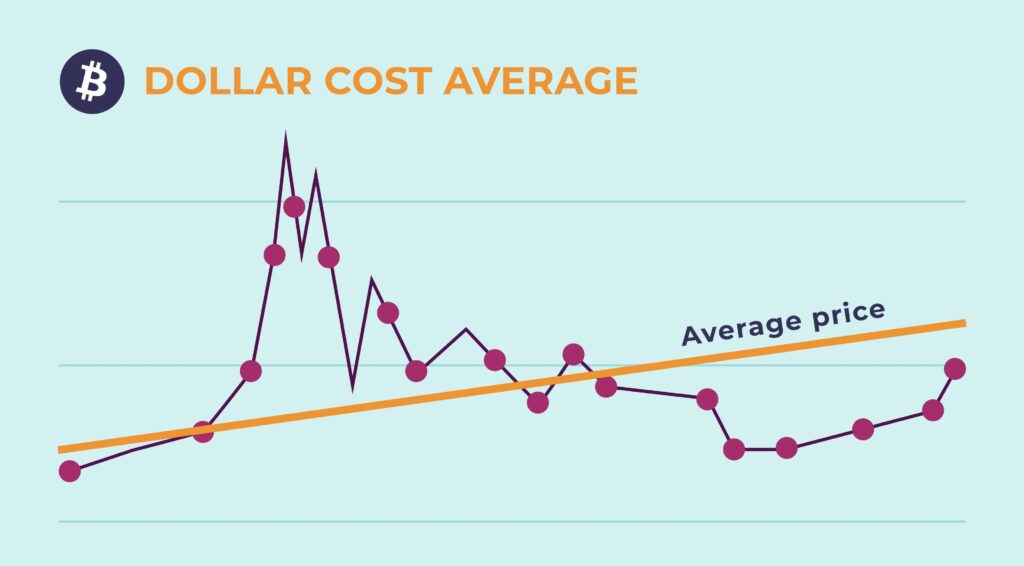

Instead of trying to “time the market” by buying at the very bottom and selling at the very top, dollar-cost averaging makes investing easier. When you invest the same amount of money every time, you naturally buy more shares when prices are low and fewer shares when prices are high. Over time, such an approach can lower the average cost per share compared to putting all your money in at once, especially in a market that changes a lot.

If you promise to put $200 into a certain ETF every month, that $200 will buy you more units of the ETF when its price is $50 per unit than when its price is $100 per unit. This disciplined method smooths out the price of your purchases over time, lowering the risk of putting a lot of money into the market just before it goes down.

The Clear Benefits of Dollar-Cost Averaging

The enduring popularity of dollar-cost averaging stems from a collection of compelling benefits that address both the practical and psychological challenges of investing.

- Taming the Beast of Market Fluctuations

The stock market is constantly changing. Prices change every day because of a complicated mix of economic data, world events, and how investors feel. For someone who is new to investing, this volatility can be scary. It is very tempting to sell in a panic when the market is declining or to chase returns when it is rising.

Dollar-cost averaging is a powerful strategy for navigating this emotional rollercoaster. When you stick to a regular investment schedule, you see market drops as chances to buy instead of disasters. When prices go down, your fixed investment amount goes further, letting you buy more assets at a lower price. You are in a favorable position to take advantage of the market’s recovery when it happens. This methodical approach makes volatility a long-term benefit instead of a source of anxiety. NerdWallet’s guide on dollar-cost averaging during volatility is a great resource for learning more about how to deal with market swings.

- Taking Emotion Out of the Equation: The Psychological Edge

One of the hardest things about investing is how people think. Fear and greed are strong feelings that can make people make bad choices. We are hardwired to avoid pain and seek pleasure, which in the world of investing often means selling low (because we’re afraid) and buying high (because we’re greedy), which is the opposite of a good investment strategy.

Dollar-cost averaging gives you a way to deal with these negative feelings. Automating your investments eliminates the need for decision-making during market stress. Your pre-planned strategy keeps going, so you stay on track regardless of what the market is doing. The discussion by Green Ridge Wealth Planning on the psychology of DCA makes it very clear that this disciplined, unemotional approach is key to building wealth over time.

- Helping people develop a disciplined habit of saving

Dollar-cost averaging is a great way to build financial discipline, in addition to its market-related benefits. The strategy’s regular and automatic nature helps people get into the habit of saving and investing consistently. The “set it and forget it” method helps many people put their financial future first.

A lot of employer-sponsored retirement plans, like 401(k)s, are excellent examples of dollar-cost averaging in action. Every month, a part of each paycheck is automatically put into chosen funds. This process happens every month and every year. This steady, passive method has helped millions of people save a lot of money for retirement.

- Open to All Investors

You don’t need a lot of money to start dollar-cost averaging. In fact, it’s a fantastic way to start investing if you don’t have a lot of money to put in right away. You can slowly build up a large portfolio over time by starting with a small, manageable amount and investing regularly. This process makes investing more accessible to people from all walks of life, making it a useful way to build wealth.

The Other Side of the Coin: Knowing What Dollar-Cost Averaging Can’t Do

Every investment strategy has its pros and cons, so it’s important to look at dollar-cost averaging from all sides.

The “Cost of Waiting”: A Lump Sum vs. Dollar-Cost Averaging

The most common complaint about dollar-cost averaging is that in a market that is always going up, a lump-sum investment will usually do better. Investing all your money at the start of a long bull run gives it more time to grow. With dollar-cost averaging, some of your money stays on the sidelines, which means you might miss out on those early gains.

This assumption is often backed up by historical data. In the long run, markets have usually gone up. So, statistically, there’s a better chance that putting a large sum of money into an investment as soon as you have it will pay off. AES International has done an impressive job of looking at the past performance of lump-sum investing and dollar-cost averaging.

But this argument has a major flaw: it assumes you’re okay with the risk of investing a lot of money at once. Many people can’t handle the mental stress of seeing a big investment drop shortly after making it. In this case, dollar-cost averaging is a trade-off: you might give up some potential gains in exchange for a big drop in downside risk and stress.

Why Choosing the Right Assets is Important

It’s important to remember that dollar-cost averaging is a way to invest, not a way to choose what to invest in. If you keep putting money into an asset that isn’t doing well, you’ll still end up with a bad investment. It is still critical to do a lot of research on the underlying assets, whether they are individual stocks, ETFs, or mutual funds. Dollar-cost averaging into a company that is fundamentally flawed or a fund that is too expensive will not magically make money.

Costs of Transactions

Depending on the brokerage or platform you use, making many trades can raise your costs, which can lower your returns. Fortunately, the rise of trading platforms with no fees or low fees has made this worry much less of a problem for many investors. When using a dollar-cost averaging strategy, it’s important to be aware of any fees that may apply and to pick a platform that works with a plan to make regular, smaller investments.

How to Use Dollar-Cost Averaging in Your Daily Life: A Practical Guide

Now that we’ve talked about the theory, let’s talk about how to use dollar-cost averaging in real life.

- Please determine the amount and frequency of your investments.

The first thing you need to do is figure out how much money you can comfortably invest on a regular basis. Your goal should be an amount that you can stick to without putting too much strain on your budget. It’s better to start with a smaller, more manageable amount than to be too ambitious and have to stop giving.

Next, pick how long you want to invest. For most people, it is sensible and effective to align their investments with their pay cycle, such as every two weeks or every month. The most important thing is to be consistent.

- Pick Your Investment Vehicle

As I said before, choosing the right assets is crucial. Low-cost, broadly diversified index funds or ETFs are a great choice for most long-term investors, especially those who are just starting out. These funds provide you with access to a large part of the market, like the S&P 500, which lowers the risk of buying individual stocks. Target-date funds, which automatically change how they invest as you get closer to retirement, are another good choice for people who want to be less involved.

Dollar-cost averaging can also be used on individual stocks and even cryptocurrencies, which are riskier investments. In fact, dollar-cost averaging can be especially helpful in very volatile markets like crypto because it helps lower risk. Coinbase gives a helpful overview of how to use this strategy with digital assets.

- Make the Process Automatic

Automating your dollar-cost averaging strategy is the best way to make sure it works in the long run. Most brokerage platforms and robo-advisors let you set up automatic transfers from your bank account and regular investments in the assets you want.

You can’t change your strategy if you automate the process. Investments happen in the background, so you can focus on other things while your money grows.

- Please adhere to your plan and review it periodically.

After setting up your automated investment plan, the most important thing is to stick to it, even when it’s hard. The market will go down at times and up at other times. Don’t let short-term market noise make you change your plan.

It’s a good idea to review your investment plan every so often, maybe once or twice a year. Things in life change. You might get a raise, go through a big event, or your financial goals might change. A regular review helps you make sure that your investment plan is still in line with your long-term goals. For example, you might choose to invest more money on a regular basis.

A Hypothetical Example of Dollar-Cost Averaging in Action

Let’s use a simple example to show how powerful dollar-cost averaging can be. Think of two people who want to invest: Lump-Sum Laura and DCA Dan. At the start of the year, they both have $12,000 to put into an ETF.

Laura puts all of her $12,000 into the ETF in January, when the price is $100 per share. She buys 120 shares.

DCA Dan chooses to put $1,000 into an investment every month for a year.

This is how the year might go for Dan:

Month, Investment, Share Price, and Shares Bought

January: $1,000; $100; 10.00

February: $1,000, $90, and 11.11

In March, $1,000 was $85, or 11.76.

April: $1,000; $95; 10.53

May: $1,000, $105, 9.52

June: $1,000, $110, 9.09

July: $1,000.00; $100.00; 10.00

August: $1,000; $95; 10.53

$1,000 in September, $115 in October, and $8.70 in November

October: $1,000, $120, 8.33

November: $1,000; $110; 9.09

December: $1,000, $125, and 8.00

Total: $12,000,116.66

Average Price: $102.86

Send to Sheets

In this case, the stock price is $125 at the end of the year.

- The 120 shares Laura bought are now worth $15,000. She made $3,000 in profit.

- Dan’s investment is now worth $14,582.50, which is 116.66 shares times $125. He made a total of $2,582.50.

- Laura emerged victorious in this rising market. But what if the market ends up lower than it started? Let’s think about that.

Month, Investment, Share Price, and Shares Bought

January: $1,000, $100, 10.00

February: $1,000, $80, and $12.50

March: $1,000, $70, 14.29

April: $1,000, $85, and $11.76

May: $1,000, $90, and 11.11

June: $1,000, $75, and 13.33

$1,000 in July, $80 in August, and $12.50 in September

August: $1,000, $95, 10.53

September: $1,000; $85; 11.76

$1,000 in October, $70 in November, and $14.29 in December

November: $1,000, $90, and 11.11

$1,000 in December, $95 in January, and $10.53 in February

Total: $12,000.71

Average Cost: $83.50

Send to Sheets

The price of a share at the end of this year is $95.

- Laura’s investment is now worth $11,400 (120 shares times $95). She lost $600.

- Dan’s investment is now worth $13,652.45, which is 143.71 shares times $95. He made $1,652.45.

In this unstable market that is slowly going down, dollar-cost averaging led to a much better result. These simple examples show the main idea: DCA works best in markets that are uncertain and change a lot because it lowers your average cost.

The Verdict: Why Consistency is the Best Investment Power

In a world that often praises the daring and risky moves of market timing, dollar-cost averaging is a more reliable and less stressful way to reach your financial goals. It is a strategy based on discipline, patience, and the power of compound growth, not on guessing what will happen.

You turn investing from a risky bet into a planned way to build wealth by sticking to a plan. You leverage time to your benefit and leverage market volatility to your advantage. You not only build a financial portfolio, but you also learn how to be financially disciplined and emotionally strong.

So, whether you’re a new graduate getting your first paycheck, a seasoned professional looking to boost your retirement savings, or anyone in between, the message is clear: you don’t need a crystal ball to get your finances in order. You need a plan, a promise to stick to it, and the knowledge that the steady, unwavering investor usually wins the race in the long run. Today is the day to start dollar-cost averaging. Let the power of consistency work for you. Investopedia’s guide to dollar-cost averaging is a great place to start if you want a full picture.

Source Links:

- Investopedia—Dollar-Cost Averaging (DCA) Explained

- NerdWallet—Dollar-Cost Averaging During Volatility

- Green Ridge Wealth Planning—The Psychology of DCA

- AES International—Lump Sum vs. Dollar-Cost Averaging

- Coinbase—What is Dollar-Cost Averaging (DCA)?

- Standard Chartered—How to use Dollar Cost Averaging to build long-term wealth