In recent years, cryptocurrency has transitioned from a niche investment to a mainstream financial asset. With the growing interest in digital assets, many investors are exploring platforms that can offer seamless access to cryptocurrencies.

Among these, Fidelity’s Crypto Services have gained considerable attention, thanks to the trusted reputation of the financial giant behind it. But is Fidelity’s crypto offering the right fit for your investment goals? Let’s break down the key features of Fidelity’s crypto services to help you make an informed decision.

Understanding Fidelity’s Crypto Services

Fidelity Investments, a name synonymous with reliable financial services, has ventured into the world of cryptocurrency through Fidelity Digital Assets, their dedicated arm for crypto investments. The platform offers users access to the buying, selling, and storing of popular digital currencies like Bitcoin (BTC) and Ethereum (ETH).

Fidelity’s crypto services stand out due to their integration into the broader financial ecosystem that investors are already familiar with. The platform aims to offer institutional investors a secure and regulated avenue for investing in digital currencies. But what does this mean for individual investors?

Key Features of Fidelity’s Crypto Services

- Regulated Environment One of the key selling points of Fidelity’s Crypto Services is the emphasis on regulatory compliance. Fidelity operates in partnership with the U.S. government’s regulatory frameworks, ensuring that transactions meet legal standards and protecting investors from fraudulent activities.

- Security As cryptocurrency investments require high levels of security, Fidelity leverages its extensive experience in safeguarding assets. The platform uses advanced encryption techniques and secure custody solutions to protect digital assets, which gives investors peace of mind when it comes to storing their crypto holdings.

- Institutional-grade Custody Solutions Fidelity’s custodial services are one of the core offerings aimed at institutional investors. The platform provides cold storage options, which involve keeping cryptocurrencies offline to prevent hacks, ensuring the safety of assets for long-term investors.

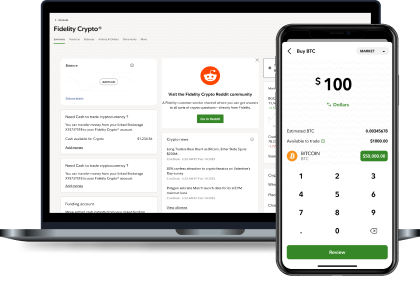

- User-Friendly Experience Even though Fidelity’s crypto services cater to sophisticated investors, they also provide user-friendly platforms for those just starting in crypto trading. The platform’s simple interface makes buying and selling cryptocurrencies a smooth experience, while educational resources and customer support are available for assistance.

- Comprehensive Research Tools Fidelity’s platform goes beyond just offering access to buy and sell. It provides investors with a suite of research tools, including charts, market trends, and expert analyses, which are crucial for making well-informed investment decisions.

Benefits of Using Fidelity’s Crypto Services

- Reputable Brand: Fidelity’s trusted reputation as a leader in the investment industry brings confidence to those exploring the world of cryptocurrency.

- Diversified Investment Options: Fidelity allows users to add crypto assets to their existing portfolios of stocks, bonds, and mutual funds, helping diversify their investments.

- Access to Institutional Services: For high-net-worth individuals, Fidelity’s institutional-grade services offer the benefits of professional-grade trading and custodial services.

Potential Drawbacks to Consider

While Fidelity’s crypto services are strong contenders in the space, there are some limitations to consider:

- Limited Cryptocurrencies: Fidelity currently offers a limited selection of cryptocurrencies compared to some dedicated crypto exchanges. If you’re looking to invest in altcoins beyond Bitcoin and Ethereum, you may need to consider other platforms.

- Geographic Restrictions: Fidelity’s crypto services are available in select countries, which may restrict access for some investors.

Is Fidelity’s Crypto Services the Right Fit for You?

For investors who already trust Fidelity for their traditional investment needs, adding crypto assets to their portfolio through Fidelity’s Crypto Services could be a natural next step. The platform’s security, regulatory compliance, and institutional-grade custodial solutions make it a strong choice for anyone serious about investing in cryptocurrencies.

However, if you’re an experienced crypto trader looking for a broader range of digital assets or more specialized tools, you might want to explore other options. For those new to crypto investing or seeking a trusted platform to start with, Fidelity’s services provide a solid foundation to build upon.

Conclusion

Fidelity’s Crypto Services are an excellent option for those looking to enter the world of cryptocurrency with a trusted brand. The platform’s regulatory compliance, security features, and user-friendly experience make it an appealing choice for both novice and seasoned investors. Whether it’s the right fit for you depends on your specific investment needs, but with Fidelity, you can rest assured that you are dealing with one of the most reputable names in finance.

If you’re ready to explore Fidelity’s Crypto Services, now might be the right time to consider adding crypto to your portfolio with a secure and reliable platform.