In today’s digital age, managing personal finances has become increasingly convenient and efficient, thanks to online banking apps. Gone are the days of queuing at the bank or relying solely on spreadsheets to track expenses. Instead, online banking apps have transformed how individuals monitor, manage, and optimize their financial lives.

From budgeting tools to instant payments and AI-driven insights, these apps offer a suite of features that empower users to take control of their money like never before. This comprehensive guide explores how online banking apps are revolutionizing personal finance management.

1. Convenience and Accessibility

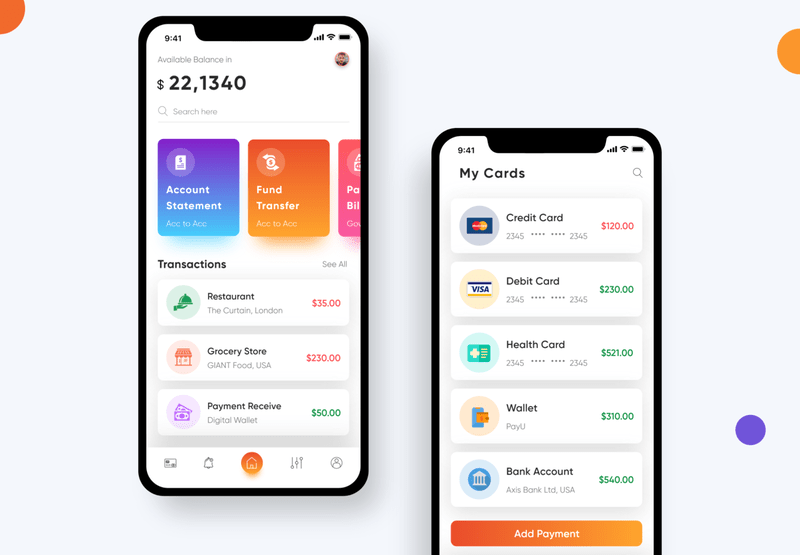

One of the primary ways online banking apps are transforming personal finance management is by making banking services accessible anytime, anywhere. Users can check their account balances, transfer money, pay bills, and even apply for loans—all from the palm of their hand.

a) 24/7 Access to Financial Services

With online banking apps, users no longer need to plan their bank visits around traditional business hours. Transactions can be completed instantly, whether it’s midnight or midday, providing unparalleled flexibility and convenience.

b) Global Reach

Online banking apps allow users to manage their finances while traveling abroad, eliminating the need to visit physical branches in foreign locations. This global accessibility ensures that users stay connected to their finances wherever they go.

2. Budgeting and Expense Tracking

Effective personal finance management begins with understanding where and how money is spent. Many online banking apps offer built-in budgeting tools and expense tracking features that help users gain insights into their spending habits.

a) Automated Categorization of Transactions

Online banking apps often use AI-driven algorithms to automatically categorize transactions into predefined categories, such as groceries, dining, utilities, and entertainment. This allows users to see where their money is going at a glance, making it easier to identify areas where they can cut back or save.

b) Customizable Budgeting Goals

Users can set custom budgeting goals within the app, such as limiting dining expenses to a specific amount per month. Notifications and alerts are sent when spending approaches or exceeds these limits, helping users stick to their financial goals.

c) Visual Insights and Reports

Most apps offer detailed visual insights, such as graphs and charts, to help users understand their spending patterns over time. These insights make it easier to track financial progress, set new goals, and adjust budgets accordingly.

3. Savings and Investment Tools

Online banking apps are not just about managing spending; they also offer tools to help users save and grow their wealth. From automated savings plans to investment options, these apps empower users to build their financial future.

a) Automated Savings Plans

Many online banking apps allow users to set up automated savings plans, such as rounding up transactions to the nearest dollar and depositing the difference into a savings account. This “set it and forget it” approach helps users save money effortlessly.

b) Savings Challenges and Gamification

To encourage saving, some apps incorporate gamification elements, such as savings challenges and rewards. These features motivate users to save more by making the process fun and engaging.

c) Investment Integration

Several online banking apps have partnered with investment platforms, offering users access to stocks, mutual funds, and other investment options directly within the app. This integration makes it easier for users to grow their wealth without navigating multiple platforms.

d) Micro-Investing Features

For users who are new to investing or have limited funds, micro-investing features allow them to start investing small amounts, such as rounding up purchases and investing the spare change. This makes investing accessible to a broader audience.

4. Instant Payments and Transfers

Traditional banking methods for sending money, such as wire transfers, can be time-consuming and expensive. Online banking apps streamline this process by offering instant payments and transfers, often at no additional cost.

a) Peer-to-Peer (P2P) Transfers

P2P transfer features, such as Zelle, Venmo, and PayPal integrations, enable users to send and receive money instantly from friends and family. Whether splitting a dinner bill or paying a roommate for rent, these transfers are quick and convenient.

b) Contactless Payments

Many online banking apps support contactless payments through digital wallets such as Apple Pay, Google Pay, and Samsung Pay. This allows users to make payments with a simple tap of their phone, providing a seamless and secure payment experience.

c) Bill Payments and Subscriptions Management

Users can pay bills directly from the app, schedule recurring payments, and track subscriptions. This helps prevent late fees and ensures that all financial obligations are met on time.

5. Enhanced Security and Fraud Protection

Security is a major concern for online banking, and app developers are continually enhancing security measures to protect users’ financial information. Online banking apps offer a range of security features that make managing finances safer than ever before.

a) Two-Factor Authentication (2FA)

Two-factor authentication adds an extra layer of security by requiring users to verify their identity through a second method, such as a one-time code sent to their phone. This helps protect against unauthorized access.

b) Biometric Authentication

Many apps support biometric authentication methods, such as fingerprint scanning or facial recognition, making it easier and more secure to access accounts.

c) Real-Time Fraud Alerts

Online banking apps monitor transactions for signs of suspicious activity and send real-time alerts to users if potential fraud is detected. This allows users to take immediate action, such as freezing their card or contacting customer support.

d) Data Encryption

Apps use encryption to protect sensitive data during transmission, ensuring that personal and financial information remains secure.

6. Credit Monitoring and Improvement Tools

Credit scores play a critical role in determining financial opportunities, such as loan approvals and interest rates. Online banking apps often offer tools to help users monitor and improve their credit scores.

a) Credit Score Tracking

Users can access their credit score directly from the app, along with detailed explanations of factors affecting their score. This transparency helps users understand what actions they can take to improve their credit.

b) Credit Improvement Tips

Some apps offer personalized tips and recommendations for improving credit scores, such as paying down specific debts or reducing credit card usage.

c) Fraud Protection and Identity Theft Monitoring

Certain online banking apps offer identity theft monitoring services, helping users detect and respond to unauthorized credit activity before it becomes a major issue.

7. Personalized Financial Insights

Artificial intelligence (AI) and machine learning (ML) play a major role in delivering personalized financial insights. By analyzing users’ spending habits, income patterns, and financial goals, online banking apps can offer tailored recommendations.

a) Spending Analysis

AI-powered analysis can identify patterns in users’ spending habits and suggest changes to achieve savings goals. For example, the app may highlight monthly subscriptions that go unused or suggest alternatives for reducing costs.

b) Custom Financial Goals

Users can set specific financial goals, such as saving for a vacation or building an emergency fund. The app provides recommendations and progress updates to help users stay on track.

c) Debt Reduction Strategies

Online banking apps may analyze a user’s debt and offer strategies for paying it off faster, such as the avalanche or snowball method, which prioritize debt repayment based on interest rates or balance sizes.

8. Financial Planning for the Future

Beyond managing day-to-day expenses, online banking apps offer tools to help users plan for their financial future. These tools may include retirement planning calculators, tax optimization advice, and estate planning resources.

a) Retirement Savings Calculators

Users can estimate how much they need to save for retirement and receive recommendations on how to reach their savings goals.

b) Tax Planning Assistance

Some online banking apps integrate with tax filing software or offer tools to help users understand their tax obligations and identify potential deductions.

c) Estate Planning Features

Certain apps offer features that guide users through the estate planning process, including creating wills, setting up trusts, and designating beneficiaries.

9. AI-Powered Virtual Assistants

AI-powered virtual assistants are becoming common in online banking apps, offering users a more interactive way to manage their finances. These assistants can answer questions, provide spending advice, and help with transactions.

a) Conversational Banking

Users can interact with virtual assistants through voice or text to perform tasks such as checking balances, transferring money, or setting spending limits.

b) Proactive Alerts

Virtual assistants can provide proactive alerts, such as reminding users of upcoming bills, flagging unusual spending, or suggesting ways to meet savings goals.

10. Challenges and Considerations

While online banking apps offer numerous benefits, there are also challenges and considerations to keep in mind:

a) Privacy Concerns

Users must be mindful of how their data is collected, stored, and used. Reading the app’s privacy policy and understanding data-sharing practices is essential.

b) Cybersecurity Risks

Although apps employ robust security measures, no system is entirely immune to cyberattacks. Users should take precautions, such as using strong passwords and enabling 2FA.

c) Digital Divide

Not everyone has access to smartphones or reliable internet, limiting the reach of online banking apps. Efforts are needed to bridge this gap and ensure that everyone can benefit from digital banking services.

Shaping the Future of Personal Finance

Online banking apps have undeniably transformed personal finance management, making it more accessible, efficient, and user-friendly. By offering a wide range of features, from budgeting and savings tools to instant payments and personalized insights, these apps empower users to take charge of their financial lives. As technology continues to evolve, we can expect even more innovative solutions to emerge, further enhancing the way we manage our money and paving the way for a financially empowered future.