In today’s fast-paced world, finding ways to save money is more important than ever. One significant expense that many drivers overlook is auto insurance. While it’s essential to have car insurance to protect yourself financially, it doesn’t mean you have to pay more than necessary.

By comparing auto insurance rates, you can ensure you’re getting the best deal without sacrificing coverage. This article will guide you through the process of comparing auto insurance rates and provide valuable tips on how to save money without compromising on your protection.

Why You Should Compare Auto Insurance Rates

Auto insurance premiums can vary widely depending on several factors, including the insurer, the coverage you choose, your driving history, and even your credit score. By comparing auto insurance rates, you can avoid overpaying and potentially find better coverage for a lower price. It’s a simple process that could lead to significant savings.

The cost of auto insurance isn’t something that stays static. It can change over time based on various factors, such as the type of car you drive, your location, and your driving habits. If you haven’t compared auto insurance rates recently, you could be paying far more than necessary.

Factors That Influence Auto Insurance Rates

Before diving into the process of comparing rates, it’s essential to understand the various factors that influence how much you’ll pay for auto insurance. These factors can affect your premium significantly and vary from one insurance company to another.

Your Driving Record

Insurance companies view drivers with clean records as less risky, so those without any accidents or violations typically pay lower premiums. If you have a history of accidents, speeding tickets, or other violations, you may pay more for your insurance.

The Type of Car You Drive

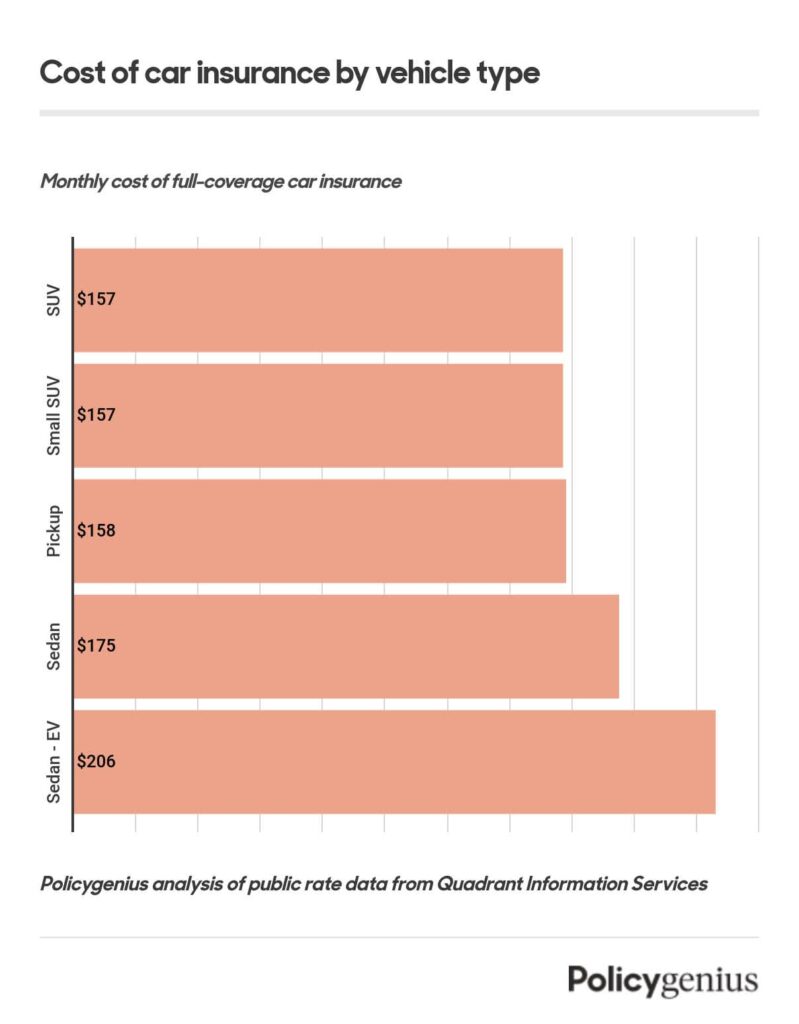

Some cars are more expensive to insure than others. Luxury vehicles, sports cars, and cars with higher repair costs tend to have higher premiums.

On the other hand, vehicles with excellent safety ratings and low repair costs may help lower your rates.

Your Location

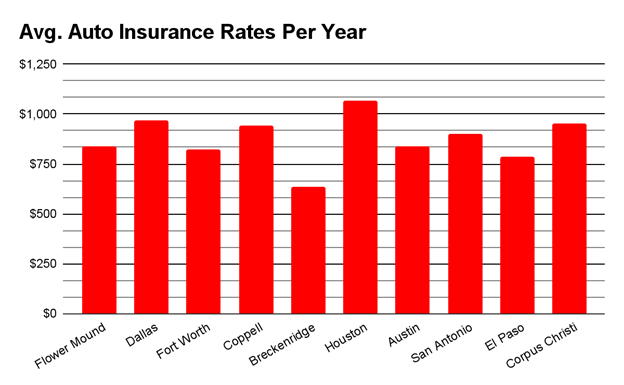

Where you live can have a significant impact on your auto insurance rates. Urban areas with high traffic and a greater likelihood of accidents often come with higher premiums. In contrast, rural areas with fewer cars on the road may have lower rates.

Your Age and Gender

Younger drivers, especially teenagers, tend to pay higher premiums due to the higher risk of accidents associated with inexperience. Additionally, statistics show that males, particularly those under 25, are more likely to be involved in accidents, so they may face higher rates.

Your Credit Score

Many insurers use your credit score as a factor in determining your premium. Drivers with higher credit scores are often seen as more responsible and are likely to pay lower premiums. On the flip side, poor credit scores can lead to higher rates.

Coverage Type

The amount of coverage you choose also plays a significant role in the cost of your insurance. Basic liability coverage is cheaper than comprehensive or collision coverage, which may offer more extensive protection. It’s essential to balance the level of coverage with the premium you’re willing to pay.

Deductible Amount

The deductible is the amount you pay out of pocket before your insurance kicks in. Choosing a higher deductible can lower your monthly premium, but it means you’ll pay more if you need to file a claim. Weighing your deductible choices carefully can help you save money.

How to Compare Auto Insurance Rates

Now that you understand the factors that influence your premium, it’s time to dive into comparing auto insurance rates. Here’s how you can make the process easier and ensure you get the best deal.

Gather Information About Your Current Coverage

Before you start comparing, it’s helpful to know the details of your current policy. This includes the coverage limits, the deductible, and any additional features or endorsements you have. Having this information on hand will allow you to compare like-for-like policies and determine if you’re getting good value.

Research Multiple Insurance Providers

Don’t settle for the first quote you receive. It’s essential to shop around and get quotes from multiple insurance providers. Many companies offer online quote tools that make it easy to compare rates without picking up the phone. Aim for at least three or four quotes to get a comprehensive view of the available options.

Consider Independent Insurance Agents

Independent insurance agents can help you navigate the process of comparing auto insurance rates. They have access to a variety of insurance companies and can help you find the best coverage at the best price. Their expertise can be particularly useful if you have unique insurance needs or a complicated driving history.

Use Online Comparison Tools

Online tools like comparison websites can simplify the process of comparing auto insurance rates. These platforms allow you to enter your information once and receive quotes from multiple providers in just a few minutes. Keep in mind, though, that these tools may not always provide the most comprehensive selection of insurers.

Evaluate Coverage and Customer Service

When comparing rates, don’t just focus on the premium. It’s essential to consider the level of coverage each insurer offers and their customer service reputation. You want to ensure that the company will be responsive if you need to file a claim or get assistance. Checking online reviews and ratings can help you gauge the reliability of an insurer.

Ask About Discounts

Many auto insurers offer discounts for things like bundling multiple policies (e.g., home and auto), having a clean driving record, or taking a defensive driving course. Be sure to ask about any discounts that may apply to your situation. Even small discounts can add up to significant savings over time.

When to Shop for Auto Insurance

Timing can play a crucial role in securing the best auto insurance rates. While you can shop for auto insurance at any time, certain situations may prompt you to reevaluate your coverage.

- At Renewal Time

Your auto insurance premiums may change when it’s time to renew your policy. This could be due to changes in your driving record, a change in your credit score, or general rate increases by your insurer. Take the opportunity to compare rates from other insurers when your policy is up for renewal. - When You Move

Moving to a different area can affect your auto insurance rate. Urban areas with higher traffic volumes often lead to higher premiums, while rural areas may have lower rates. If you’re moving, it’s worth shopping around for new quotes based on your new location. - When You Purchase a New Car

When you buy a new car, your auto insurance needs may change. The make, model, and year of your vehicle will impact your premium. Be sure to get quotes from multiple insurers to find the best rate for your new car. - After Major Life Changes

Significant life changes, such as getting married, having a child, or retiring, can also impact your insurance rates. Insurance companies may offer discounts for these changes, or they may adjust your premiums based on your new life circumstances.

Conclusion

Comparing auto insurance rates is a smart way to save money while still maintaining the coverage you need to protect yourself on the road. By understanding the factors that influence your premium and following the tips in this article, you can make an informed decision and secure a policy that fits your budget and coverage needs.

Remember, auto insurance rates are not set in stone. Shopping around, considering discounts, and using online tools can help you find a better deal. By staying proactive and comparing rates regularly, you can ensure that you’re always paying a fair price for the coverage you need.

Ultimately, comparing auto insurance rates is a simple yet effective way to put more money back in your pocket, all while staying protected on the road. Don’t wait for your renewal notice to take action—start comparing today and see how much you could save!