In today’s fast-paced digital world, online banking has become an essential tool for managing finances efficiently. Gone are the days when you had to visit a bank branch for simple transactions. With just a few clicks, you can handle everything from paying bills to transferring money, all from the comfort of your home or on the go.

If you’re new to online banking or are considering switching from traditional banking methods, this guide will walk you through the steps of setting up and managing your online bank account.

1. Why Choose Online Banking?

Before we dive into the steps, it’s important to understand the benefits of online banking. Unlike traditional banking, which requires you to visit a branch for nearly every transaction, online banking provides the convenience of accessing your account anytime, anywhere. Whether you’re at home, in a coffee shop, or traveling abroad, you can perform a variety of banking activities, including:

- Checking your balance

- Transferring money between accounts

- Paying bills

- Setting up automatic deposits

- Viewing account statements

- Applying for loans

Furthermore, online banking is generally more cost-effective. Many online banks offer lower fees compared to traditional banks because they have fewer overhead costs. Additionally, most online banks provide higher interest rates on savings accounts, making them a great option for those looking to grow their money.

2. Setting Up Your Online Bank Account

Setting up an online bank account is a straightforward process, but there are several steps to ensure that you do it correctly. Follow this step-by-step guide to get started:

Step 1: Choose the Right Bank

The first step in setting up an online bank account is selecting a bank that suits your needs. There are many options available, including traditional banks that offer online services and fully digital banks. When choosing a bank, consider the following factors:

- Account Types: Do you need a checking, savings, or both types of accounts? Make sure the bank offers the account that fits your financial needs.

- Fees: Check for any monthly maintenance fees, ATM withdrawal fees, or other charges. Some online banks offer fee-free accounts, while others may charge for certain services.

- Interest Rates: Compare interest rates for savings accounts and CDs. Many online banks offer higher interest rates than traditional banks.

- Customer Support: Look for a bank with accessible customer support channels, such as live chat, email, or phone support.

Step 2: Gather Your Information

To open an online bank account, you’ll need to provide some personal information, including:

- Full Name: Your legal name as it appears on your identification documents.

- Date of Birth: To confirm your eligibility (typically 18 or older).

- Address: Your current residential address.

- Social Security Number (SSN): For identity verification purposes.

- Phone Number and Email: For communication and account alerts.

- Proof of Identification: A driver’s license, passport, or another government-issued ID.

Step 3: Complete the Application Process

Once you’ve gathered all the necessary documents, go to the bank’s website and begin the application process. The bank may ask for additional information such as your employment status and annual income. Some banks might even ask for a minimum deposit to activate your account. Follow the prompts and submit your application. Most banks will approve your application within a few minutes, although some might take a few days to process.

Step 4: Set Up Account Security

Security is a top priority when managing your online bank account. To ensure your account remains safe from unauthorized access, follow these security best practices:

- Create a Strong Password: Choose a unique, complex password that includes a combination of letters, numbers, and special characters. Avoid using easily guessable information like your name or birthdate.

- Enable Two-Factor Authentication: Many banks offer two-factor authentication (2FA), which adds an extra layer of protection. This usually involves receiving a code on your phone or email every time you log in to your account.

- Set Up Account Alerts: Most banks allow you to set up alerts for various activities, such as low balances or large transactions. This helps you monitor your account in real time and detect any unusual activity quickly.

Step 5: Fund Your Account

Once your account is set up, you’ll need to deposit funds. Depending on the bank, there are several methods you can use to fund your online account:

- Direct Deposit: Have your paycheck or government benefits automatically deposited into your account.

- Wire Transfer: Transfer funds from another bank account or institution.

- Check Deposit: Some online banks offer mobile check deposit, allowing you to take a photo of your check and deposit it directly into your account.

- Transfer from Another Bank: Link your new online bank account to an existing account at a different bank to transfer funds.

3. Managing Your Online Bank Account

Once your online bank account is up and running, it’s important to stay on top of your finances. Managing your account efficiently ensures that you maintain a healthy financial status and avoid any surprises.

Monitor Your Transactions Regularly

Online banking makes it easy to track your spending and monitor transactions. Regularly review your account statements to make sure there are no unauthorized charges. Most online banks offer tools that allow you to categorize your spending, helping you track where your money goes.

You can also set up automatic payments for recurring expenses, such as utilities or subscriptions, to ensure that you never miss a payment. This can also help avoid late fees and improve your credit score.

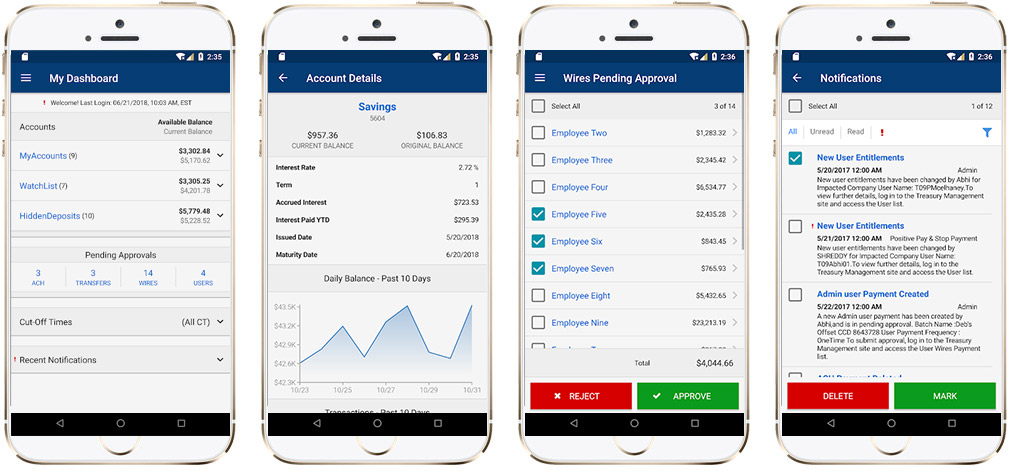

Use Mobile Banking Apps

Most online banks offer mobile banking apps that allow you to manage your account from your smartphone or tablet. These apps typically provide all the features available on the desktop version, including viewing your balance, transferring funds, paying bills, and making mobile check deposits. Many apps also send notifications for important account activities, such as low balances or upcoming bill payments.

Set Up Budgeting and Saving Goals

Many online banks offer budgeting tools that allow you to set financial goals. You can create savings goals for specific purposes, such as building an emergency fund or saving for a vacation. Some banks even offer automatic savings features, where a portion of your funds is automatically transferred to your savings account on a regular basis.

4. Common Online Banking Features

Once you have an active account, you’ll be able to take full advantage of the various features that online banks offer. Here are some of the most useful features that make online banking convenient:

- Bill Pay: Most online banks provide bill pay services, where you can set up one-time or recurring payments for bills like electricity, phone, and insurance.

- Mobile Check Deposit: As mentioned earlier, you can deposit checks directly into your account using your phone’s camera.

- ATM Access: Even though you’re banking online, you can still access your money at thousands of ATMs nationwide. Some banks offer fee-free access at certain ATMs, while others may charge a small fee for out-of-network withdrawals.

- Peer-to-Peer Payments: Send money to friends or family members directly from your bank account using peer-to-peer payment systems like Zelle or Venmo, which are integrated into many online banking platforms.

5. Troubleshooting and Customer Support

While online banking is convenient, technical issues can sometimes arise. If you ever have trouble accessing your account or encounter any other problems, here’s how to resolve them:

- Check for System Maintenance: Sometimes, online banking platforms undergo maintenance or updates that may temporarily prevent you from accessing your account. Check the bank’s website or app for any maintenance notifications.

- Contact Customer Support: If you’re experiencing issues, contact customer support for assistance. Many banks offer 24/7 support through live chat, phone, or email.

- Reset Your Password: If you forget your password or suspect your account has been compromised, use the bank’s password reset feature to regain access.

6. Conclusion

Managing your online bank account is a great way to simplify your financial life and gain greater control over your money. By selecting the right bank, following the steps to set up your account, and using the tools available to track your spending, save money, and manage bills, you can ensure that your online banking experience is both secure and convenient.

Remember, always prioritize security and monitor your account regularly for any unauthorized transactions. With the right knowledge and tools, managing your online bank account can be both easy and rewarding, allowing you to focus on your financial goals and everyday needs.