Let’s be honest. Investing can often feel like a privilege. Wall Street “gurus” use flashing tickers, complicated charts, and jargon-filled commentary that can make anyone feel like they need a PhD in economics just to get started. For an extended period, the narrative suggested that achieving wealth required exceptional stock selection skills, adept market timing, or a substantial inheritance.

But what if I told you that one of the best, most reliable, and, dare I say, simplest ways to make your money grow doesn’t need any of that? What if the key to long-term financial success was to be a little bit lazy?

Welcome to the wonderful world of index funds!

This isn’t a plan to get rich quickly. It’s a plan to get rich slowly, steadily, and with a high chance of success. Warren Buffett, one of the best investors of all time, is a big fan of this strategy. And in this complete guide, we’ll go over everything you need to know about getting started with index funds and their close relatives, exchange-traded funds (ETFs).

By the end of this 4000+ word journey, you’ll know what index funds are and how to build your own portfolio. Grab a cup of coffee, settle in, and prepare to discover a more efficient and straightforward approach to investing.

What Are Index Funds, and Why Should I Care?

An index fund is a type of mutual fund or ETF that tries to copy the performance of a specific market index. A market index is like a “best of” album for a certain part of the stock market. The S&P 500 is an index that shows the 500 biggest publicly traded companies in the US, for example.

An index fund doesn’t try to pick individual winning stocks with a team of expensive analysts. Instead, it buys all (or a representative sample) of the stocks in the index it tracks. An S&P 500 index fund will have shares of all 500 companies in the S&P 500, that is what it does.

This “passive” approach is the opposite of “active” management, which is when fund managers try to beat the market by buying and selling securities. The data clearly shows that, over the long term, very few active managers are able to beat their benchmark indices.

Warren Buffett’s Wise Words About Index Funds

You shouldn’t just believe me. Warren Buffett, who is the CEO of Berkshire Hathaway, has been a strong supporter of index funds for regular investors for a long time. He wrote in a letter to shareholders in 2016:

“Over the years, I’ve been asked for investment advice a lot, and in the process of answering, I’ve learned a lot about how people act. My usual suggestion has been a low-cost S&P 500 index fund. To follow that advice, the investor should invest in an index fund every so often. A low-cost index fund is the best stock investment for most investors.”

His logic is simple: when you buy a broad market index fund, you’re betting on the economy’s long-term growth and innovation. And in the past, that has been a fantastic bet.

Why Index Funds Are a Game-Changer: The Undeniable Allure

So, what is it about index funds that makes them so great? Here are the main benefits that have made them a key part of building a modern portfolio.

- The Benefits of Diversification (Without the Stress)

Don’t put all your eggs in one basket, as the saying goes. This principle is best shown by index funds. When you buy one share of a broad market index fund, you are instantly invested in hundreds or even thousands of different companies.

This built-in diversification lowers the risk of putting all your money into one company. If one company in the index does poorly, the performance of all the other companies will help protect your overall portfolio. It would take a lot of time and money to build a portfolio like this on your own by buying individual stocks. You can achieve this with just one purchase of index funds.

You might want to read our upcoming article, “Interlink: Understanding Asset Allocation for Long-Term Growth,” for more information on how to build a well-rounded investment portfolio.

- The Unbeatable Edge of Low Prices

This feature is probably the best thing about index funds. They don’t have the high overhead costs that come with actively managed funds because they are passively managed. There aren’t any teams of highly paid analysts to pay, and there isn’t much trading going on in the fund.

The fund’s expense ratio, which is the annual fee as a percentage of your investment, shows that these costs are lower. An actively managed mutual fund usually has an expense ratio of 1% or more. On the other hand, many index funds have expense ratios of 0.10% or less. Some companies, like Fidelity, even have index funds with no fees!

A 1% difference may not seem like much, but over the course of many years of investing, it can make a huge difference in your returns. If you invest $10,000 and earn a 7% return annually for 30 years with a 1% expense ratio, your investment would grow to approximately $57,435. It would grow to about $73,048 with an expense ratio of 0.10%. The difference of over $15,000 is entirely due to a small fee!

If you are keen to learn more about how fees can cut into your investment returns, read our next post, “Interlink: The Hidden Robbers of Your Portfolio: A Deep Dive into Expense Ratios.”

- The “Set It and Forget It” Method: Simple and Stress-Free

Putting money into index funds is easy and fun. You don’t have to spend hours every week looking up individual stocks or trying to guess what the market will do next. You can also think of it as “set it and forget it.”

Your job is to choose index funds, decide how often to invest (more on this later), and move on. This hands-off approach not only saves you time and stress, but it also helps you avoid common mistakes that can ruin an investment plan, like selling in a panic when the market goes down.

- Getting More Than Average Returns by Just Following the Market

The beautiful irony of investing in index funds is that if you just try to match the market’s performance, you will probably do better than most professional investors. Most actively managed funds don’t do better than their benchmark indices over the long term, especially when you take into account their higher fees.

Investing in low-cost index funds almost guarantees you the market’s return, which has been pretty good in the past.

What is the difference between index funds and ETFs?

People often discuss index funds and ETFs (exchange-traded funds) at the same time. They are very similar, but there are a few important differences to know about.

A mutual fund is a type of index fund. You buy and sell shares directly from the fund company. The fund company sets the price once a day after the market closes.

On the other hand, an ETF trades on an exchange just like a stock. You can buy and sell shares at any time during the trading day, and the price changes as a result.

Here’s a quick breakdown:

| Feature | Index Mutual Fund | Exchange-Traded Fund (ETF) |

|---|---|---|

| Trading | Once per day at the net asset value (NAV) | Throughout the day at market price |

| Minimum Investment | May have a minimum initial investment | Can buy as little as one share |

| Commissions | Often no commission to buy/sell | May have brokerage commissions (though many are now commission-free) |

| Automatic Investing | Easy to set up automatic investments | Can be a bit more complex to automate |

Export to Sheets

Bottom line: For most long-term, buy-and-hold investors, the differences are small. Both are excellent ways to build a low-cost, diverse portfolio. Your preferences and the platform you use usually determine which option you select.

How to Start Investing in Index Funds: A Step-by-Step Guide

Are you ready to jump in? You can start investing in index funds with this useful, step-by-step guide.

Step 1: Figure out your “why”—your financial goals

It’s important to understand what you’re investing your money in before proceeding. Are you putting money away for retirement in 30 years? Are you planning to make a down payment for a house in five years? What about your child’s education?

The kinds of index funds you choose will depend on your investment goals, which will also affect your time frame and risk tolerance.

Helpful Hint: This week, set aside 30 minutes to sit down and write down your money goals. Be clear. Instead of saying “save for retirement,” say “save $1 million for retirement by age 65.” This amount will be your North Star as you invest.

Step 2: Get a Brokerage Account

You need a brokerage account to buy ETFs and index funds. A brokerage is like a store where you can buy and sell investments. The good news is that it’s now easier than ever to open a brokerage account.

Some of the best and most well-known brokerage firms for beginners are

- Vanguard is the first company to offer index funds, and its funds are known for being cheap. Link to the source: vanguard.com

- Fidelity has many low-cost index funds, some of which have no expense ratios at all. Link to the source: fidelity.com

- Charles Schwab is another great option with a good reputation and many commission-free ETFs and low-cost index funds. Link to the source: schwab.com

Opening an account is usually easy and can be done online in just a few minutes. For funding, you’ll need to give some personal information, like your Social Security number and bank account information.

Step 3: Pick Your Index Funds

This step can be challenging, but it doesn’t have to be. Most beginners only need a simple portfolio of a few broad-market index funds.

Here are some common types of index funds to think about:

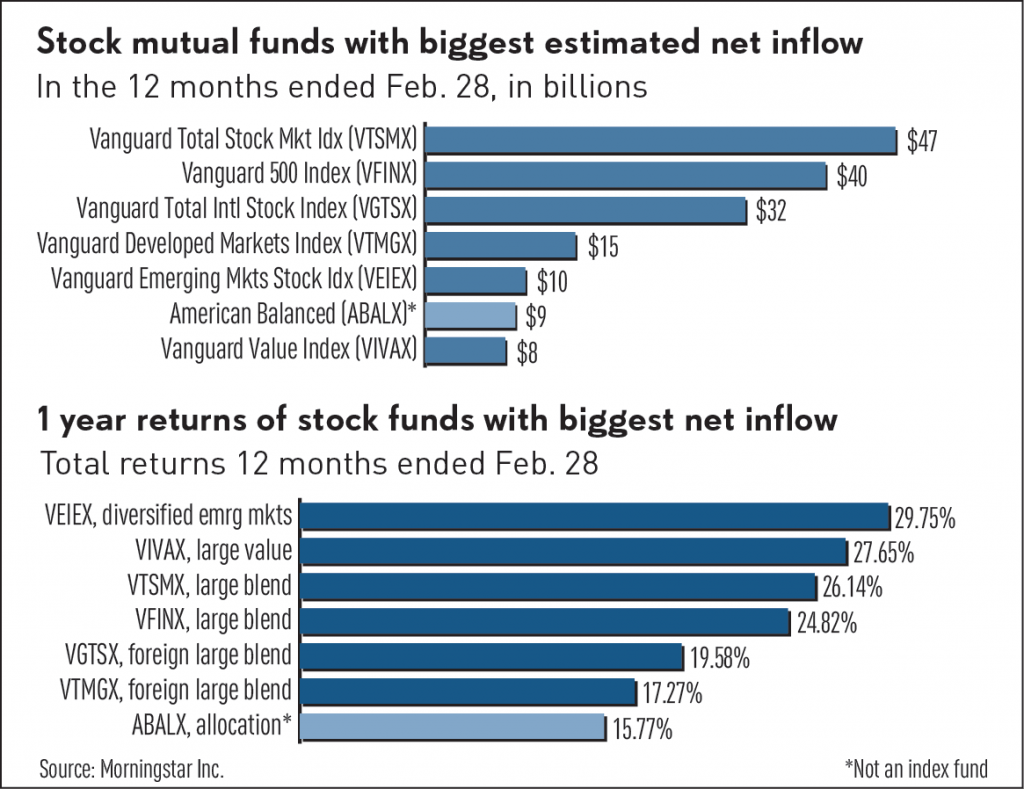

- The Total Stock Market Index Fund is a great all-in-one choice because it provides you with access to the whole U.S. stock market, from big companies to small ones. The Vanguard Total Stock Market Index Fund (VTSAX) and the Schwab Total Stock Market Index (SWTSX) are two examples.

- The S&P 500 Index Fund, as we said before, follows the 500 biggest companies in the U.S. It gives you excellent access to the core U.S. stock market. The Fidelity 500 Index Fund (FXAIX) and the iShares Core S&P 500 ETF (IVV) are two popular choices.

- Total International Stock Market Index Fund: If you want to spread your investments out beyond the U.S., an international index fund is a good idea. This will let you invest in companies in both developed and developing markets. Find funds like the Vanguard Total International Stock Index Fund (VTIAX).

- The Total Bond Market Index Fund is a beneficial choice because bonds are usually less volatile than stocks and can help keep your portfolio stable. The Fidelity U.S. Bond Index Fund (FXNAX) is a good place to start if you want to invest in a total bond index fund.

A Simple Portfolio to Get You Started (the “Three-Fund Portfolio”):

The “three-fund portfolio” is a common and useful strategy for beginners. It usually includes:

- An index fund for the whole U.S. stock market

- An index fund for the whole international stock market

- A Total Bond Market Index Fund for the U.S.

Your age, risk tolerance, and how long you plan to keep the money will determine how much you put into each fund. A good rule of thumb is to have the same number of bonds as you are old. For example, a 30-year-old might have 30% in bonds and 70% in stocks.

Step 4: Put money into your account and buy something.

Once you’ve selected your index funds, it’s time to deposit money into your brokerage account and make your first investment. Usually, you can move money from your bank account electronically.

To buy, just enter the ETF or index fund’s ticker symbol, how much you want to invest, and place your order. You’re now an investor!

Step 5: Put your investments on autopilot

This is probably the best piece of advice for long-term success. Set up regular automatic transfers from your bank account to your brokerage account. These could be weekly, biweekly, or monthly. Thereafter, set up automatic payments to your chosen index funds.

There are two main benefits to this strategy, which is called dollar-cost averaging:

It maintains your discipline: Automating your investments eliminates emotional factors. You will always invest, regardless of what the market does.

It makes your purchase price more even. When the market is down, your fixed dollar amount buys more shares. It buys fewer shares when the market is up. This strategy can lower the average cost per share over time.

Tip: Start with a small amount that you can handle and won’t want to stop. Because of the power of compounding, even $50 or $100 a month can add up to a lot of money over time. You can make your automatic contributions bigger as your income goes up.

Things You Shouldn’t Do on Your Index Fund Journey

Investing in index funds is pretty easy, but there are a few common mistakes to watch out for.

- Trying to Time the Market: The idea of buying low and selling high is tempting, but it’s a waste of time. Even experts can’t always get the timing of the market right. Stay on track with your automated investment plan.

- When the market declines, people often panic and sell. Market corrections and bear markets are normal parts of investing. While a decline in your portfolio value can be unsettling, it’s crucial to avoid panicked selling. Keep in mind that you’re in it for the long haul. The market has consistently rebounded and achieved new highs.

- Chasing “Hot” Funds: You’ll probably see articles about the “best performing fund of the year.” Don’t let the urge to chase past performance get the best of you. What goes up must come down, and the people who win today often lose tomorrow. A portfolio of broad-market index funds that is well-diversified is a much better plan.

- Ignoring Fees: We’ve talked about how fees are important. A lot. Always monitor the expense ratios of the index funds you are considering.

- Not Rebalancing: Your asset allocation may change over time as some investments do better than others. Once a year, you should look over your portfolio and make sure it is back to your target allocation. This means selling some of your best-performing assets and buying more of your worst-performing ones. It’s a disciplined way to buy low and sell high. This subject will be covered in depth in our next article, “Interlink: The Art of Rebalancing: Keeping Your Portfolio on Track.”

Useful Advice for Your Daily Money Life

Investing in index funds shouldn’t be a chore for you. Here are some useful tips to help you make it a normal part of your finances:

- “Pay Yourself First”: Treat your investment payments like any other bill. Your future self should be the first person you pay each month. Make sure that your automatic transfers to your brokerage account happen on the day you get paid.

- The “Found Money” Rule says that whenever you get money you didn’t expect, like a bonus, a tax refund, or a gift, you should plan to put at least some of it into your index funds.

- Make a picture of your financial goals to help you see them. This could be a picture of the place you want to retire to or a chart that shows how far you’ve come. A visual reminder can be a strong reason to stay on track.

- Do an annual financial check-up: Just like you go to the doctor once a year for a check-up, you should take one day a year to look over your investments, rebalance them if you need to, and see how far you’ve come toward your goals.

- Learn More About Personal Finance and Investing: It’s beneficial to stay up-to-date on these topics, but don’t get too obsessed. NerdWallet and this blog are both excellent sources of information. But don’t check your portfolio every day. These resources can make people anxious for no reason and cause them to make decisions too quickly.

- The Long-Term Vision focuses on the benefits of compounding. The real magic of investing in index funds isn’t in the returns you get in a single year; it’s in the power of compounding over many years. Compounding occurs when your investment returns begin to generate their own returns. It’s a snowball effect that can turn small, regular investments into a lot of money.

Think about putting $500 a month into a low-cost index fund portfolio that makes an average of 8% a year.

- Your portfolio would be worth about $91,500 after 10 years of investing $60,000.

- Your portfolio would be worth more than $296,500 after 20 years of investing $120,000.

- You would have put in $180,000 after 30 years, and your portfolio would be worth a mind-blowing $745,000.

- If you put in $240,000 over 40 years, your portfolio would be worth more than $1.7 million.

- This is what consistency, low costs, and time can do. This is why index funds are so powerful.

Your journey begins now.

Investing doesn’t have to be scary. You now have enough information from this guide to take charge of your financial future. It takes time to get rich with index funds; it’s not a sprint. It’s about having self-control, being patient, and believing that the world economy will grow over time.

So, what are you waiting for? Please consider taking that initial small step today. Your future self will be grateful for it.