In today’s financial landscape, a good credit score plays a pivotal role in determining your access to loans, credit cards, and even rental properties. Whether you’re looking to buy a home, finance a car, or simply qualify for better interest rates, understanding credit scores is essential. In this guide, we’ll delve into the intricacies of credit scores, their importance, and actionable steps you can take to improve yours.

By the end, you’ll have a clear understanding of what influences your credit score and the best strategies for boosting it.

What is a Credit Score?

A credit score is a numerical representation of your creditworthiness, derived from your credit history. It’s used by lenders to evaluate your likelihood of repaying borrowed money. The score typically ranges from 300 to 850, with a higher score indicating better creditworthiness. There are several credit scoring models, but the most commonly used is the FICO® Score, which takes into account five key factors:

Payment History (35%): This is the most significant factor in your credit score. It looks at your track record of making on-time payments, including credit cards, loans, and other debts.

Credit Utilization (30%): This measures the ratio of your credit card balances to your credit limits. High utilization can indicate that you’re relying too heavily on credit, which may be seen as risky.

Length of Credit History (15%): A longer credit history is beneficial because it provides more data on your borrowing behavior, helping lenders predict your future financial habits.

Types of Credit in Use (10%): A mix of different types of credit accounts (credit cards, mortgages, auto loans, etc.) can positively affect your score. It shows you can manage various forms of debt.

New Credit (10%): Opening several new credit accounts within a short period can lower your score, as it might signal financial distress or risk.

Why is Your Credit Score Important?

A good credit score is more than just a number; it can significantly impact your financial life. Here’s why:

Better Interest Rates: Lenders offer better rates to individuals with higher credit scores, which can save you a considerable amount of money over time.

Increased Credit Limit: A strong credit score may result in higher credit limits, which can improve your credit utilization ratio and further boost your score.

Easier Access to Loans: Whether you’re applying for a mortgage, car loan, or personal loan, a higher credit score makes you a more attractive borrower to lenders.

Employment Opportunities: Some employers check credit scores during the hiring process, especially for roles that involve financial responsibilities. A good score can make a positive impression.

Better Insurance Rates: In certain states, insurance companies use credit scores to determine premiums. A higher score might lead to lower insurance costs.

Renting a Home: Landlords often check credit scores to assess potential tenants. A poor score could hinder your chances of securing the rental property you desire.

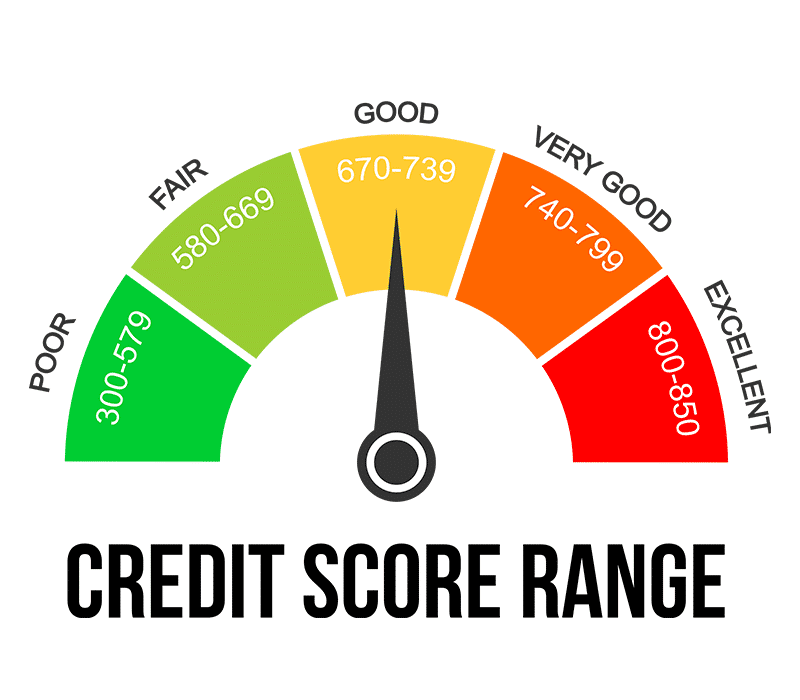

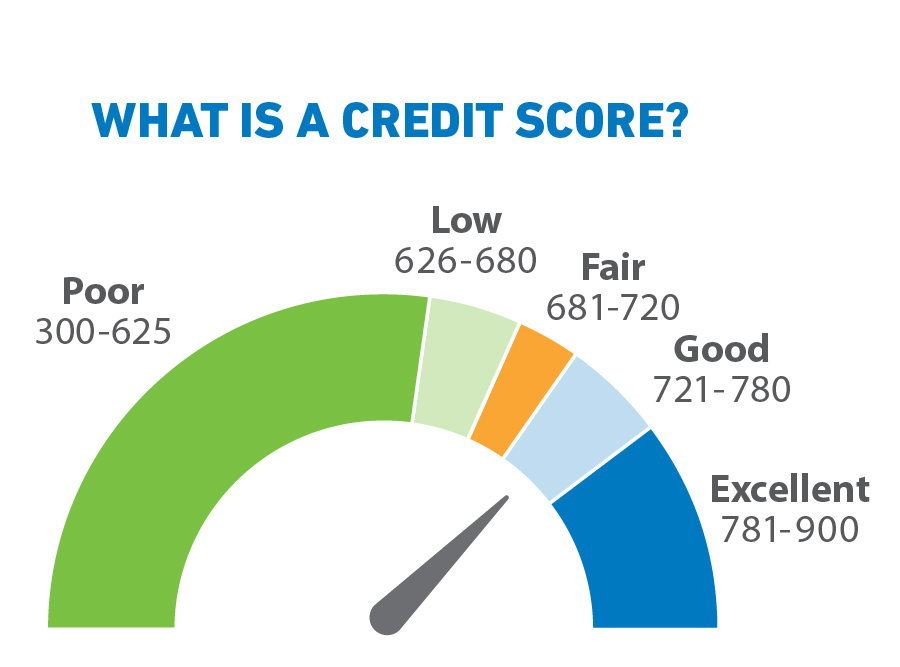

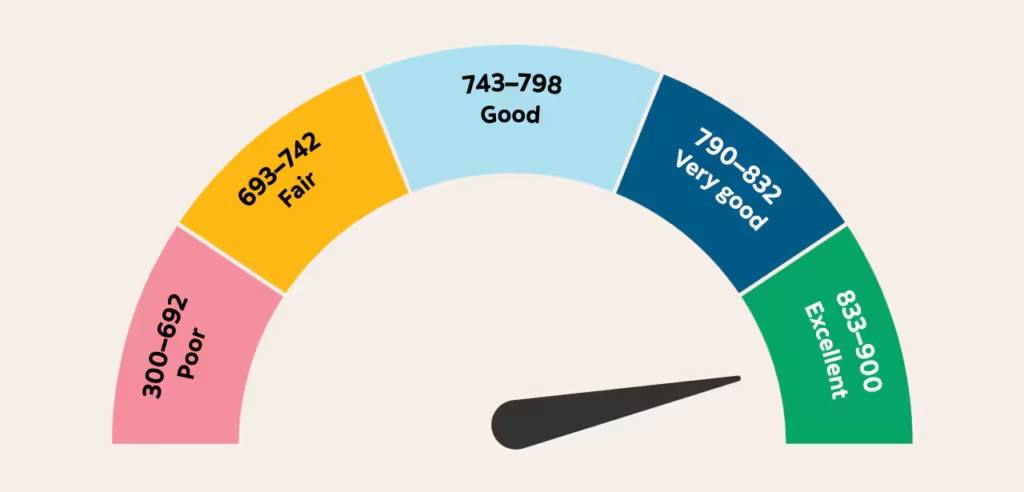

Understanding the Different Credit Score Ranges

Credit scores are usually categorized into different ranges. Here’s a breakdown of what each range means:

- 300-579 (Poor): Individuals in this range may have difficulty getting approved for loans or credit cards. If they are approved, the terms may come with high-interest rates.

- 580-669 (Fair): This range indicates a fair credit history. While you may still qualify for loans, the terms might not be as favorable as those for higher scores.

- 670-739 (Good): This is considered a solid score. Individuals in this range typically qualify for better loan terms and credit card offers.

- 740-799 (Very Good): A very good score indicates you are a low-risk borrower. You’ll likely receive better interest rates and higher credit limits.

- 800-850 (Excellent): With an excellent credit score, you’ll have access to the best loan terms, the lowest interest rates, and an easier time securing credit.

How to Improve Your Credit Score

Improving your credit score doesn’t happen overnight, but with consistent effort and smart financial habits, you can boost your score over time. Here are actionable steps to help you improve your credit score:

1. Pay Your Bills on Time

Payment history is the most significant factor influencing your credit score. Late payments can have a substantial negative impact, so it’s crucial to pay all your bills on time. Set up reminders or automated payments to ensure you never miss a due date.

2. Reduce Your Credit Card Balances

Your credit utilization ratio plays a key role in your score. Aim to keep your credit card balances below 30% of your credit limit. If possible, pay off your balance in full each month to avoid interest charges and keep your score in top shape.

3. Avoid Opening Too Many New Accounts

While opening new credit accounts can temporarily lower your score, the long-term impact is positive if you manage your accounts well. However, avoid opening multiple credit cards or loans in a short period, as each inquiry can slightly lower your score.

4. Review Your Credit Report Regularly

Mistakes or inaccuracies on your credit report can drag down your score. Review your report regularly to identify any errors. If you find discrepancies, dispute them with the credit reporting agency.

5. Maintain a Mix of Credit Accounts

Having a variety of credit accounts can improve your score. A combination of revolving credit (credit cards) and installment loans (mortgages or auto loans) can demonstrate your ability to handle different types of credit.

6. Keep Old Accounts Open

The length of your credit history matters, so it’s beneficial to keep older accounts open, even if you’re not using them. Closing accounts can shorten your credit history and negatively affect your score.

7. Consolidate or Pay Down High-Interest Debt

If you have multiple high-interest debts, consider consolidating them with a personal loan or a balance transfer credit card to lower your interest rates. This can make it easier to pay down your debt and improve your credit score.

8. Settle Any Collections Accounts

If you have accounts in collections, paying them off or negotiating a settlement can improve your credit score. Contact the creditor or collection agency to discuss possible solutions.

Common Credit Score Myths

There are plenty of misconceptions surrounding credit scores. Let’s clear up some of the most common myths:

- Myth 1: Checking Your Credit Score Lowers It

While a hard inquiry from a lender can impact your score, checking your own score does not. You can review your score as often as you like without affecting it. - Myth 2: Carrying a Balance Improves Your Credit Score

Carrying a balance on your credit card doesn’t improve your score. In fact, it can hurt your credit utilization ratio and lower your score. Paying your balance in full is the best strategy. - Myth 3: Closing Old Accounts Helps Your Score

Closing old accounts can hurt your score because it reduces the length of your credit history and increases your credit utilization ratio. Keep your old accounts open if possible.

The Role of Credit Scores in Financial Planning

Your credit score is an integral part of your financial journey. By understanding the factors that influence your score and consistently following good financial habits, you can set yourself up for financial success.

Whether you’re planning to purchase a home, take out a loan, or simply want to secure better interest rates, improving your credit score can help you achieve your goals.

Conclusion

A good credit score opens doors to better financial opportunities. By paying your bills on time, maintaining a low credit utilization ratio, and keeping a diverse mix of credit, you can significantly improve your score over time.

Regularly reviewing your credit report for errors and avoiding common mistakes will also help you stay on track. Improving your credit score may require patience, but the rewards are worth it. So take action today, and start making improvements that will benefit your financial future.