In today’s complex financial landscape, the role of a money manager is more crucial than ever. Whether you’re an individual looking to grow your wealth, a business striving to optimize its finances, or an institutional investor seeking professional guidance, money managers play a vital role in achieving financial goals.

This comprehensive guide delves into the key roles and responsibilities of a money manager, exploring how they operate, the skills they bring to the table, and the value they provide to clients.

1. What is a Money Manager?

A money manager, often referred to as an investment manager, is a professional responsible for managing an individual’s, company’s, or institution’s investment portfolio. They use their expertise in financial markets, investment strategies, and risk management to make informed decisions that align with their clients’ financial objectives.

Money managers can work independently, for a financial advisory firm, or for large institutions like banks, hedge funds, and mutual funds.

- Advertisement -

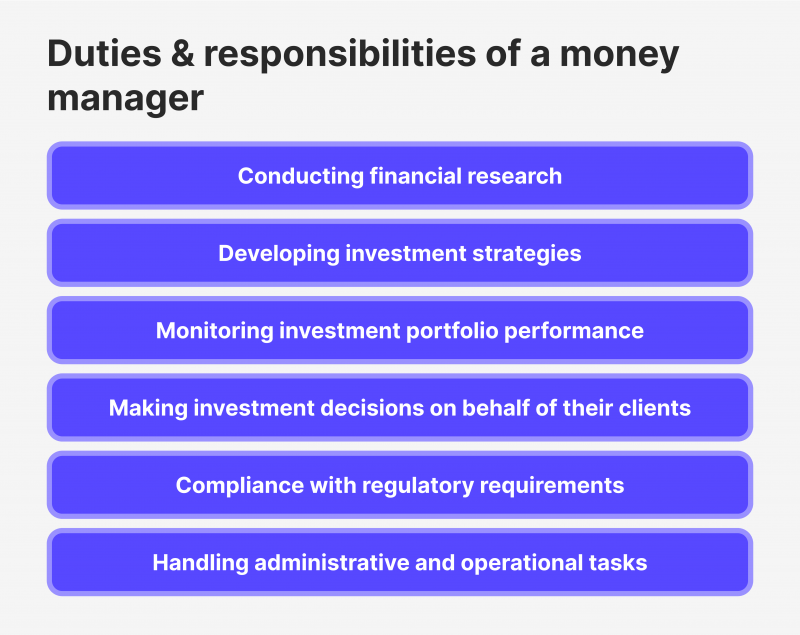

2. Key Responsibilities of a Money Manager

a) Developing an Investment Strategy

One of the primary responsibilities of a money manager is to create a tailored investment strategy for their clients. This involves assessing the client’s financial goals, risk tolerance, time horizon, and liquidity needs. Based on this assessment, the money manager formulates a plan that outlines the types of assets to be included in the portfolio, such as stocks, bonds, mutual funds, ETFs, and alternative investments.

b) Portfolio Diversification and Asset Allocation

A well-diversified portfolio minimizes risk and enhances the potential for returns. Money managers allocate assets across different investment categories to reduce the impact of market volatility. This process involves selecting a mix of equities, fixed income securities, real estate, commodities, and other asset classes to achieve the client’s desired level of risk and return.

c) Conducting Market Research and Analysis

To make informed investment decisions, money managers must stay up-to-date with market trends, economic data, geopolitical events, and industry developments. They analyze historical data, track market performance, and evaluate potential risks and opportunities in different sectors. This research helps them identify promising investment opportunities and make timely decisions.

d) Monitoring and Adjusting the Portfolio

Financial markets are dynamic, and economic conditions can change rapidly. Money managers continuously monitor their clients’ portfolios to ensure they remain aligned with their goals. If market conditions shift or a particular investment underperforms, the manager may adjust the portfolio by buying, selling, or rebalancing assets. This active management helps to maximize returns and minimize risks over time.

e) Risk Management

Managing risk is a critical aspect of a money manager’s role. They use various strategies, such as diversification, hedging, and setting stop-loss orders, to mitigate potential losses. Understanding the client’s risk tolerance is essential, as it guides the manager’s approach to risk management. For example, a conservative investor may prioritize capital preservation, while an aggressive investor may seek high returns despite higher risk.

f) Financial Planning and Advisory Services

Many money managers provide comprehensive financial planning services beyond investment management. This includes retirement planning, tax optimization, estate planning, and debt management. By offering holistic advice, money managers help clients achieve their long-term financial objectives while ensuring their investments are aligned with their broader financial plan.

g) Reporting and Communication

Regular communication is key to building trust with clients. Money managers provide periodic reports that detail portfolio performance, market outlook, and any changes made to the investment strategy. They meet with clients to discuss their financial goals, address concerns, and update them on market trends. Clear and transparent communication ensures clients understand their investments and remain confident in their financial journey.

3. Types of Money Managers

There are various types of money managers, each specializing in different areas of finance and catering to specific client needs. Understanding these distinctions can help clients choose the right professional for their financial goals.

a) Personal Financial Advisors

Personal financial advisors work with individual clients to manage their investments, plan for retirement, and achieve other financial goals. They often provide personalized advice and develop strategies tailored to each client’s unique circumstances.

b) Institutional Money Managers

Institutional money managers handle large-scale investments for organizations such as pension funds, insurance companies, endowments, and corporations. They manage significant amounts of capital and often specialize in particular asset classes or investment strategies.

c) Portfolio Managers

Portfolio managers oversee the management of mutual funds, hedge funds, and exchange-traded funds (ETFs). They are responsible for making investment decisions on behalf of fund investors, aiming to achieve specific objectives such as growth, income, or capital preservation.

d) Wealth Managers

Wealth managers provide a comprehensive range of financial services, including investment management, estate planning, tax advisory, and more. They typically serve high-net-worth individuals (HNWIs) and families with complex financial needs.

e) Robo-Advisors

Robo-advisors are automated, algorithm-driven platforms that provide investment management services with minimal human intervention. They offer low-cost, passive investment options tailored to a client’s risk tolerance and goals. While not traditional money managers, they represent a growing trend in the financial industry.

4. Skills and Qualities of a Successful Money Manager

To excel in their role, money managers must possess a unique blend of technical expertise, interpersonal skills, and a strong ethical foundation. Key skills and qualities include:

a) Analytical Skills

Money managers must analyze vast amounts of financial data, market trends, and economic indicators to make informed decisions. Strong analytical skills enable them to identify patterns, evaluate risks, and seize investment opportunities.

b) Communication Skills

Clear communication is essential for explaining complex financial concepts, investment strategies, and market conditions to clients. Money managers must be able to convey information in a way that clients understand, fostering trust and confidence.

c) Problem-Solving Abilities

The financial markets are unpredictable, and money managers must quickly adapt to changing conditions. Problem-solving skills allow them to navigate challenges, such as market downturns or underperforming assets, and implement effective solutions.

d) Ethical Conduct

Ethics and integrity are fundamental in the financial industry. Money managers must prioritize their clients’ best interests, adhere to regulatory standards, and avoid conflicts of interest. Acting with transparency and honesty builds long-term client relationships.

e) Technical Knowledge

Money managers must stay informed about the latest financial products, investment strategies, tax regulations, and technological advancements. This expertise enables them to make informed decisions and offer valuable insights to clients.

f) Risk Assessment and Management

Effective risk management requires the ability to assess potential risks and implement strategies to mitigate them. Money managers must balance risk and reward to achieve their clients’ financial goals while minimizing exposure to unnecessary risks.

5. The Value of Professional Money Management

Engaging a professional money manager offers several benefits that can enhance an individual’s or organization’s financial well-being:

a) Expertise and Experience

Money managers bring years of experience and a deep understanding of financial markets. Their expertise allows them to navigate complex market conditions, identify profitable opportunities, and avoid common pitfalls.

b) Time Savings

Managing investments can be time-consuming, especially for those with busy lives or other professional responsibilities. A money manager handles the day-to-day tasks of portfolio management, freeing clients to focus on their personal and professional pursuits.

c) Tailored Financial Solutions

Every client has unique financial goals and challenges. Money managers create customized strategies that address specific needs, such as retirement planning, saving for education, or building a diversified investment portfolio.

d) Access to Exclusive Opportunities

Professional money managers often have access to exclusive investment opportunities, such as private equity, hedge funds, and alternative assets. These opportunities may not be available to individual investors, offering potential for higher returns.

e) Risk Mitigation

A money manager’s ability to assess and manage risk can protect clients from significant losses during market downturns. By diversifying portfolios and employing risk management strategies, they help clients achieve consistent, long-term growth.

6. Challenges Faced by Money Managers

While the role of a money manager offers many rewards, it also comes with challenges:

a) Market Volatility

Financial markets are inherently volatile, and money managers must navigate sudden market swings while protecting their clients’ investments. Adapting to changing conditions and making quick decisions is critical.

b) Regulatory Compliance

The financial industry is heavily regulated to protect investors and maintain market integrity. Money managers must stay compliant with regulations, including fiduciary standards, disclosure requirements, and ethical guidelines.

c) Client Expectations

Clients often have high expectations for their money managers, particularly during periods of market volatility. Meeting or exceeding these expectations requires effective communication, a clear investment strategy, and consistent performance.

d) Technological Disruptions

Advancements in technology, such as robo-advisors and AI-driven analytics, are changing the landscape of money management. Traditional money managers must adapt to these changes to remain competitive.

7. Choosing the Right Money Manager

Selecting a money manager is a critical decision that can significantly impact an individual’s or organization’s financial future. Consider the following factors when choosing a money manager:

a) Qualifications and Experience

Look for a money manager with relevant credentials, such as a Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA) designation. Experience in managing similar client portfolios is also essential.

b) Investment Philosophy

Every money manager has an investment philosophy that guides their decisions. Ensure that their approach aligns with your financial goals, risk tolerance, and values.

c) Transparency and Communication

A good money manager should provide clear and transparent communication, including regular performance reports and updates. They should be willing to answer questions and explain their strategies in detail.

d) Fees and Costs

Understand the fees charged by the money manager, including management fees, transaction costs,