Insurance is a crucial component of financial planning, providing protection against unforeseen risks and expenses. But with so many types of insurance available, choosing the right coverage can feel overwhelming. From life insurance to health insurance, auto insurance to home insurance, each type serves a unique purpose. This blog post will guide you through the various types of insurance, helping you understand what they cover and why you might need them.

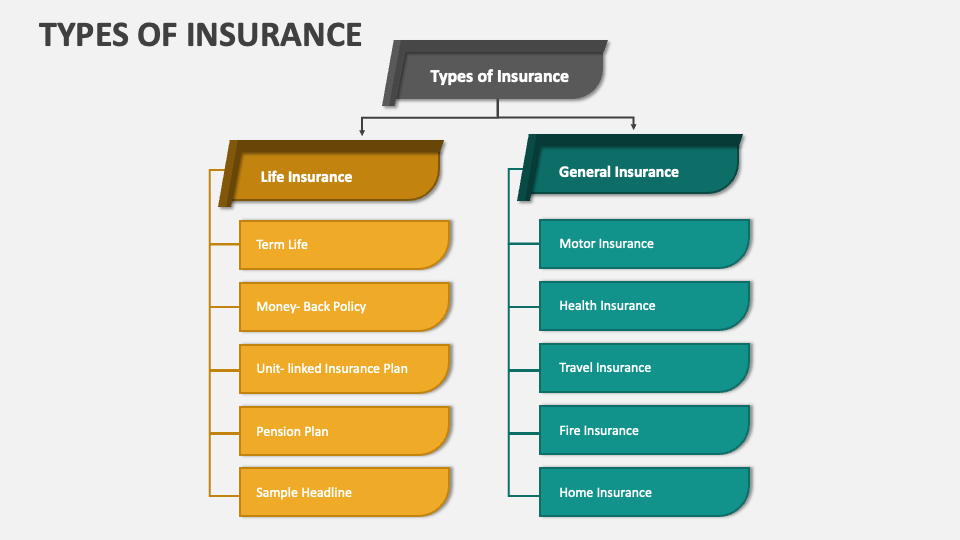

1. Life Insurance

Life insurance is designed to provide financial protection to your loved ones in the event of your death. The death benefit paid out by a life insurance policy can help cover funeral expenses, pay off debts, and provide income to dependents.

There are two primary types of life insurance:

- Term Life Insurance: This is the most affordable option, providing coverage for a specific period (typically 10, 20, or 30 years). If you die during the term, your beneficiaries receive a death benefit.

- Permanent Life Insurance: This includes whole life, universal life, and variable life policies. These policies last for your entire lifetime and accumulate cash value over time. They are more expensive but can serve as an investment vehicle as well.

2. Health Insurance

Health insurance helps cover medical expenses, reducing the financial burden when you need medical care. With health insurance, you typically pay a monthly premium, along with copayments, deductibles, and coinsurance for medical services.

Health insurance comes in several forms:

- Employer-Sponsored Insurance: Many employers offer health insurance as a benefit. This plan is often more affordable because the employer shares the cost of premiums.

- Individual Health Insurance: If you are self-employed or your employer does not offer coverage, you can purchase an individual health insurance plan through the marketplace or directly from an insurer.

- Government-Sponsored Insurance: Programs like Medicaid and Medicare provide health coverage to eligible individuals, including low-income families, seniors, and those with disabilities.

3. Auto Insurance

Auto insurance is mandatory in most states and provides protection against damages or injuries resulting from car accidents. Depending on the type of coverage you choose, auto insurance can cover a variety of situations:

- Liability Insurance: This covers damages to other people and their property if you are at fault in an accident. It typically includes bodily injury liability and property damage liability.

- Collision Insurance: This covers damage to your vehicle if you collide with another vehicle or object, regardless of who is at fault.

- Comprehensive Insurance: This provides coverage for non-collision-related incidents, such as theft, vandalism, natural disasters, and animal accidents.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with someone who has little or no insurance.

4. Homeowners Insurance

Homeowners insurance protects your home and personal belongings from damage or loss. It also provides liability coverage if someone is injured on your property. Homeowners insurance typically covers:

- Dwelling Coverage: This protects the structure of your home in case of damage from fire, wind, hail, and other risks.

- Personal Property Coverage: This covers the contents of your home, such as furniture, electronics, clothing, and appliances, if they are damaged or stolen.

- Liability Protection: This covers legal expenses if someone is injured on your property or if you or a member of your household causes injury or damage to others.

- Additional Living Expenses: If your home becomes uninhabitable due to a covered loss, this helps pay for temporary housing and living expenses.

5. Renters Insurance

While homeowners insurance covers property owners, renters insurance is designed for tenants. It protects personal property from loss or damage and provides liability coverage if someone is injured in your rental unit.

Renters insurance typically covers:

- Personal Property: Protection for your belongings, including furniture, electronics, clothing, and personal items, from events like theft, fire, or water damage.

- Liability Protection: Coverage if someone is injured while on your rental property or if you cause damage to someone else’s property.

- Additional Living Expenses: If your rental property becomes uninhabitable due to a covered event, renters insurance will help with temporary living costs.

6. Disability Insurance

Disability insurance provides income replacement if you are unable to work due to illness or injury. It can help cover your living expenses during a period of disability. There are two main types of disability insurance:

- Short-Term Disability Insurance: This covers a portion of your salary for a short period, typically up to six months.

- Long-Term Disability Insurance: This covers a portion of your salary for an extended period, often until you reach retirement age or are able to return to work.

Disability insurance is essential if you rely on your income to cover daily expenses and want to ensure financial security in the event of an unexpected illness or injury.

7. Long-Term Care Insurance

Long-term care insurance covers the cost of care for individuals who are unable to perform daily activities on their own due to chronic illness, injury, or aging. This insurance helps cover expenses for nursing home care, assisted living, home health care, and other services.

Long-term care insurance is especially important for older adults, as the cost of long-term care can be prohibitively expensive without insurance. It’s crucial to plan for the future and consider this coverage as part of your overall retirement plan.

8. Travel Insurance

Travel insurance provides coverage for unexpected events that may disrupt your travel plans, such as trip cancellations, delays, or lost luggage. It can also cover medical emergencies and evacuation if you’re traveling abroad.

Travel insurance policies vary depending on the type of coverage:

- Trip Cancellation Insurance: Reimburses you for non-refundable travel expenses if you need to cancel your trip for a covered reason.

- Medical Insurance: Covers medical expenses if you become ill or injured while traveling.

- Baggage Insurance: Reimburses you for lost, damaged, or stolen luggage.

9. Umbrella Insurance

Umbrella insurance provides additional liability coverage beyond the limits of your existing policies, such as auto or homeowners insurance. It is designed to protect you from major claims and lawsuits that could otherwise threaten your financial stability.

Umbrella insurance is particularly valuable if you have significant assets or are at risk of being sued, as it provides an extra layer of protection above and beyond your standard policy limits.

10. Pet Insurance

Pet insurance helps cover the cost of veterinary care for your pets. It can include coverage for accidents, illnesses, surgeries, and even preventive care such as vaccinations.

Pet insurance policies differ in terms of coverage and cost, but they typically offer:

- Accident and Illness Coverage: Helps pay for treatments related to accidents or illnesses.

- Wellness Coverage: Covers routine care such as vaccinations, flea and tick prevention, and wellness exams.

- Hereditary and Congenital Conditions: Some policies cover conditions that are hereditary or congenital, which may not be covered under regular pet insurance plans.

11. Business Insurance

Business insurance is essential for protecting your business from financial loss. There are several types of business insurance:

- General Liability Insurance: Covers legal expenses and damages if your business is sued for negligence or other claims.

- Property Insurance: Protects your business’s physical assets, including buildings, equipment, and inventory.

- Workers’ Compensation Insurance: Provides coverage for employees who are injured on the job, covering medical costs and lost wages.

- Professional Liability Insurance: Also known as errors and omissions insurance, this covers professionals against claims of negligence or mistakes made in their professional services.

Type of insurance

Choosing the right type of insurance is essential for protecting your health, property, income, and loved ones. While it may seem overwhelming at first, understanding the different types of insurance and their coverage options can help you make informed decisions. By evaluating your personal circumstances, you can determine which types of insurance best suit your needs. Whether you’re looking for life insurance, health insurance, auto insurance, or any other form of coverage, it’s important to shop around, compare policies, and work with a trusted insurance provider to find the right protection for your future.