In today’s fast-paced world, online banking has become an essential part of managing finances. Gone are the days of standing in long lines at the bank to deposit a check or check your account balance. With the rise of technology, financial institutions now offer convenient online banking services that allow customers to manage their money from anywhere in the world. But what exactly is online banking, and how does it work?

What Is Online Banking?

Online banking, also known as internet banking or web banking, refers to the use of the internet to conduct financial transactions through a bank’s secure website or mobile app. Instead of having to visit a physical branch, customers can access their bank accounts, check balances, pay bills, transfer funds, and perform a variety of other banking services from the comfort of their home or on the go.

This form of banking has revolutionized the way we handle our finances, making it more convenient, efficient, and accessible. Whether you’re transferring money to a friend, setting up automatic bill payments, or managing investments, online banking offers an array of tools that help customers stay on top of their financial goals.

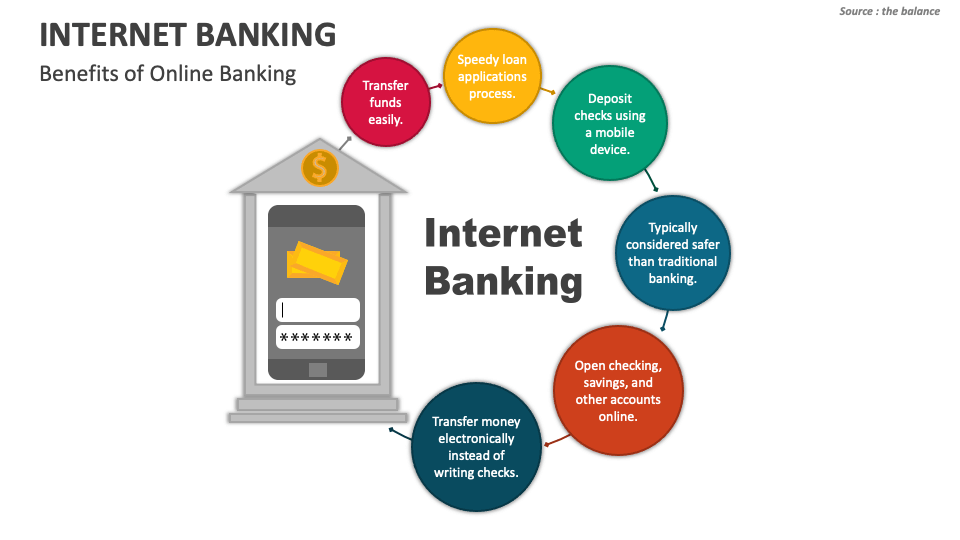

The Benefits of Online Banking

The popularity of online banking continues to rise, and for good reason. Here are some of the key benefits that make it a preferred choice for many people:

Convenience and Accessibility With online banking, you no longer need to visit a physical branch during business hours. You can access your accounts 24/7, regardless of time zone or location. Whether you’re at home, at work, or traveling, online banking puts your bank at your fingertips.

Cost Savings Online banking can often reduce or eliminate fees associated with traditional banking, such as check-writing fees, ATM withdrawal fees, and monthly service charges. Many online banks also offer higher interest rates on savings accounts because they don’t have the overhead costs of maintaining physical branches.

Efficiency Completing banking transactions online is often faster and more efficient than doing so in person. Transfers and payments can be processed immediately, and you can track your spending in real-time, giving you a clearer picture of your financial situation.

Security Online banking platforms are designed with security in mind. Banks use encryption technology and multi-factor authentication to protect customer data. Additionally, online banking provides features like alerts for unusual activity, helping you quickly spot any potential fraud.

Financial Management Tools Online banking platforms often come with built-in tools to help you manage your finances more effectively. From budgeting tools to tracking your spending, these tools give you insight into your financial habits and help you make smarter decisions.

How Does Online Banking Work?

At its core, online banking allows you to perform various financial tasks through a bank’s secure website or app. But how exactly does it work? Let’s break down the process into simple steps:

Opening an Online Account To start using online banking, you first need to open an account with a bank that offers online banking services. This can typically be done either in-person at a branch or online through the bank’s website. Some banks offer completely online account openings, allowing you to open a checking, savings, or business account without leaving your home.

Logging In Once your account is set up, you will receive login credentials, including a username and password. You’ll use these credentials to log in to your account on the bank’s website or mobile app. Many banks also offer additional layers of security, such as multi-factor authentication, where you’ll need to enter a one-time code sent to your phone or email.

Navigating the Interface After logging in, you’ll be taken to your account’s dashboard, which provides an overview of your financial accounts, balances, and recent transactions. From here, you can choose to perform various banking tasks, such as transferring money, paying bills, or checking your account balance.

Making Transactions One of the most common uses of online banking is transferring money. Whether you need to send money to someone, pay for services, or move funds between your accounts, online banking makes these transactions quick and easy. You simply enter the amount, the recipient’s information, and any relevant details, then confirm the transaction.

Bill Payments and Recurring Transactions Many online banking services offer the ability to set up automatic bill payments. This feature allows you to pay bills on a scheduled basis, ensuring that you never miss a due date. Whether it’s your monthly rent, utilities, or subscription services, automatic bill pay saves you time and ensures timely payments.

Monitoring Your Account Online banking makes it easy to track your spending and monitor your account for any unusual activity. You can access recent transactions, view statements, and check balances in real time. Many banks also offer mobile apps that provide push notifications, keeping you informed of any changes to your account.

Types of Online Banking Services

While all online banking services provide basic functions like account management, transfers, and payments, there are various types of online banking platforms that cater to different needs.

Traditional Bank Online Banking This is the most common form of online banking and is offered by traditional banks with physical branches. These banks allow customers to access their accounts online while still offering the option to visit a branch in person. Examples of traditional banks with online banking include Wells Fargo, Chase, and Bank of America.

Online-Only Banks As the name suggests, online-only banks operate exclusively through the internet. These banks do not have physical branches and offer all of their services through their website or mobile app. They often offer competitive interest rates and lower fees due to their lack of brick-and-mortar infrastructure. Examples include Ally Bank, Chime, and Marcus by Goldman Sachs.

Mobile Banking Mobile banking refers to banking services that are accessed primarily through a mobile app on a smartphone or tablet. While many traditional and online-only banks offer mobile banking apps, there are also mobile-first banking platforms that focus entirely on mobile experiences, such as Revolut or Monzo.

Business Banking Online Services For business owners, online banking can be a vital tool for managing company finances. Business banking services include the ability to make payroll deposits, pay taxes, handle transactions with vendors, and access business loans. These services are offered by both traditional banks and online-only banks.

Security Measures in Online Banking

With the increase in digital banking comes the risk of cybercrime and identity theft. To protect customer information, online banking platforms implement a range of security measures:

Encryption Banks use encryption technology to protect data as it travels across the internet. This ensures that sensitive information, such as login credentials and transaction details, remains secure.

Multi-Factor Authentication (MFA) To increase security, many banks use MFA, which requires customers to verify their identity through multiple methods (e.g., password and a code sent via SMS or email) before accessing their accounts.

Fraud Monitoring Many online banking platforms offer fraud monitoring services. This involves monitoring account activity for suspicious behavior, such as unusual login attempts or large, unexpected transactions. Alerts are sent to the account holder when potential fraud is detected.

Security Questions and Biometric Authentication Some banks also allow customers to set up security questions or use biometric authentication (fingerprint or facial recognition) for added protection when logging in.

Common Online Banking Features

Each online banking platform may offer slightly different features, but some of the most common ones include:

- Account Overview: View your balances, recent transactions, and account details.

- Funds Transfer: Transfer money between your accounts or send payments to others.

- Bill Pay: Schedule and manage payments for utilities, credit cards, and other recurring expenses.

- Mobile Deposits: Deposit checks using your smartphone’s camera.

- Alerts and Notifications: Receive updates on account activity, payments, and security.

Conclusion

Online banking has transformed the way we manage our finances, offering a convenient and efficient way to perform a wide range of banking activities. Whether you’re looking to check your balance, pay a bill, or transfer funds, online banking provides a secure, user-friendly platform to meet your financial needs.

+

By understanding how online banking works and its various features, you can take full advantage of the benefits it offers and manage your finances with ease.

In a world where time is precious and convenience is key, online banking remains a top choice for millions of people. As technology continues to evolve, we can expect even more advanced features and better security measures, making online banking an even more integral part of our financial lives.