Let’s be honest. To most of us, the phrase “personal finance” sounds as exciting as watching paint dry. It makes you think of grumpy old men in suits, complicated spreadsheets full of numbers you can’t understand, and a lot of saying “no” to things you like. It seems like too much to handle, too complicated, and, to be honest, like something you can worry about “later.”

But what if I told you that managing your money isn’t about limiting yourself? What if I told you that this is the most powerful tool you have to make the life you really want?

What if “personal finance” is just a fancy way of saying “freedom”?

Freedom from the stress of living paycheck to paycheck every month. Freedom from the heavy burden of debt. You can quit a job you hate, travel the world, start a business, support your family, or just sleep well at night knowing you have a safety net.

Being a math genius or making a six-figure salary is not what it takes to master your personal finances. As a financial writer who has helped thousands of people go from financial chaos to clarity, I can tell you this. It’s about learning a few basic rules and making simple, regular habits. That’s all.

This isn’t going to be a boring, jargon-filled talk. This is your guide. We will explain personal finance from the ground up in this guide, which is over 4000 words long. We’ll divide it into five simple, manageable parts and give you step-by-step advice that you can start using right away. So get a cup of coffee, open your mind, and let’s begin your path to financial freedom.

So, what is personal finance, really?

Managing your money and making financial decisions is what personal finance is all about. It includes everything from how you make, save, and spend your money to how you invest it, protect it, and spend it. It’s the planned way of making your money work for you so you can reach your goals.

Plan it out like a road trip. Your goal is to be financially free, whatever that means to you. Your car is how you make money. The fuel is your money. The budget is the map. The bumps and potholes are extra costs, and the roadside assistance is your insurance. You wouldn’t go on a trip across the country without a map or gas, but a lot of us go through our financial lives without a plan at all.

It’s not smart to chase get-rich-quick schemes if you want to manage your money well. It’s about making a system for your money that is stable, strong, and works for you. There are five main parts that make up this system. Let’s take them apart.

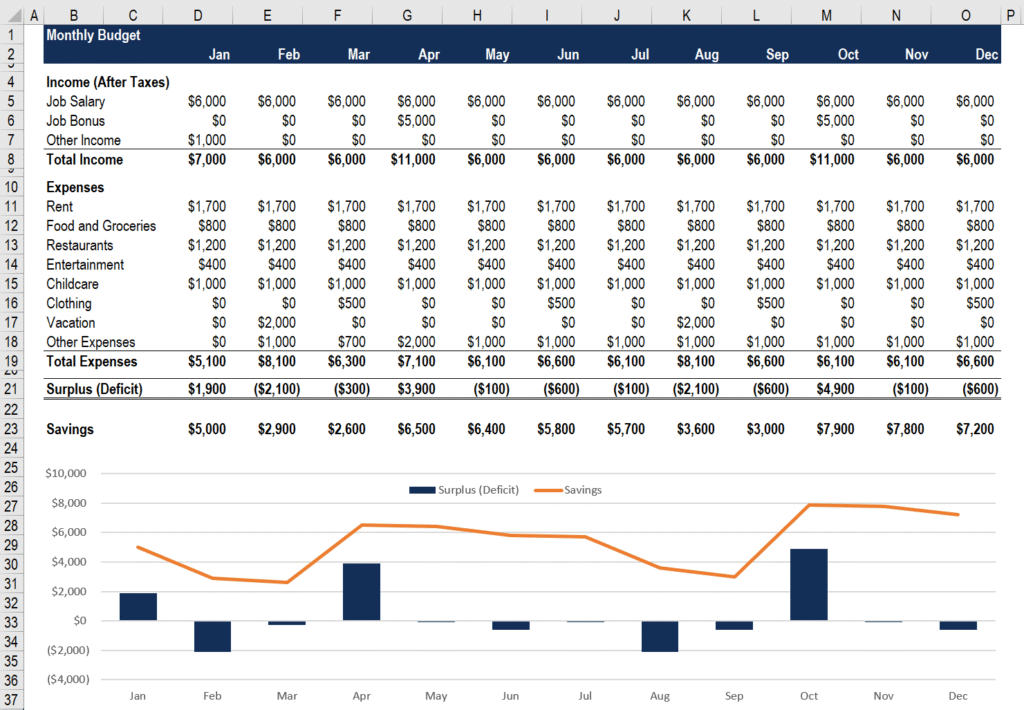

Budgeting—The Plan for Your Money

A budget is not a financial diet. It is not about cutting back or punishing yourself. A budget is just a plan that tells you how much you can spend. You tell your money where to go instead of wondering where it went. You can’t see where you’re going without a budget.

Why You Have to Make a Budget

A budget is the most important part of managing your money. You can’t save, pay off debt, or invest wisely if you don’t know how much money is coming in and going out. A well-made budget shows you the truth about your finances, pointing out areas where you waste money and areas where you can save. It changes money from something that stresses you out into something you can control.

Three Easy Steps to Make Your First Budget

Put aside complicated software for a moment. You only need a notebook, a simple spreadsheet, or a free app.

Step 1: Keep track of your reality. For one month, write down every single expense. Every cup of coffee, every subscription, and every impulse buy. Just keep track, don’t judge. You can write things down on your phone or in a small notebook. The goal is to get a very clear picture of how you spend your money right now. You can’t change things if you don’t keep track of them.

Step 2: Figure Out How Much Money You Make. Add up all the money you made this month. This is a paycheck after taxes for most people. If you have side jobs or income that changes from month to month, use a conservative average from the last few months.

Step 3: Make Your Plan (Choose a Method). Now you need to make your plan for the future. There are a lot of ways to make a budget, but these are two of the best for beginners:

- The 50/30/20 Rule: This is a great place to start, thanks to Senator Elizabeth Warren. You divide your income after taxes like this:

- 50% to Needs: These are the things you need to live, like housing, utilities, groceries, transportation, and the least amount of debt payments.

- 30% for wants: This is the fun stuff, like going out to eat, doing hobbies, using streaming services, and traveling. This group is very important because it adds fun to your plan, which makes it last.

- 20% to Savings & Debt Repayment: This is for your future. This part goes toward building your emergency fund, paying off high-interest debt quickly, and investing.

- The Zero-Based Budget: This method gives every dollar a job. You take your monthly income and divide it into different groups, like expenses, savings, and debt, until you have no money left. The formula is easy: Income minus expenses equals $0. This is a very effective way to plan your spending. This is the idea behind apps like You Need A Budget (YNAB).

Pro Tip: Make Your Budget Automatic

To make a budget work, you need to stick to it. To stick to it, you need to automate it. On payday, set up automatic transfers to your savings account. Use your bank’s bill pay feature to set up automatic payments for bills that come up every month. When you automate the most important things, you know exactly how much money you have left over for fun things, which makes it much less likely that you will spend too much.

Saving Putting Your Future Self First

Putting some of your current income aside for later is what saving money means. It’s the most important link between who you are now and what you want to do in the future. Budgeting shows you how to save, but saving is its own discipline. “Paying yourself first” is a key idea in good personal finance.

The Two Most Important Accounts for Saving Money

Not all savings are the same. You need to have clear goals for your savings, starting with these two accounts.

- The Emergency Fund: This is your money-saving tool. A high-yield savings account is an example of a separate, liquid account that holds 3 to 6 months’ worth of necessary living expenses. This isn’t an investment; it’s protection. It’s what keeps a flat tire or an unexpected medical bill from turning into a huge financial disaster that puts you in debt. A Bankrate survey found that most Americans can’t afford a $1,000 emergency. Your top priority for saving money right now is to build this fund.

- Sinking Funds: What about big, predictable costs like car repairs, vacations, or gifts for the holidays? These are not emergencies. You set up “sinking funds” for them, which are small savings accounts where you put away a little money each month. Want to go on a $1,200 vacation in a year? You “sink” $100 a month into your vacation fund. This proactive saving keeps you from going over budget or going into debt for things you need to buy.

How to Save Money When You Think You Can’t

- Start Really Small: Can’t save $100 a month? Okay. Are you able to save $20? Can you keep $5? Start with a small amount that seems silly. The goal is to make it a habit.

- The “Round-Up” Method: Use apps like Acorns that automatically round up your purchases to the nearest dollar and invest the difference. It’s a simple way to save money without having to think about it.

- The “No-Spend” Challenge: For a weekend or even a whole week, don’t spend any money except on things you really need. Put the money you would have spent into your savings.

- Treat it Like a Bill: Your savings should be a fixed amount in your budget, just like your rent or electricity. Set it up to run on its own and act like you never had it.

Managing Your Debt—Your Way to Freedom

Debt can feel like a bad word that makes you feel bad and stressed. In modern personal finance, though, it’s a tool that can be used for good (like a mortgage to buy a home) or bad (like high-interest credit card debt for things you don’t need). It’s very important for your financial health to manage it well.

Good Debt vs. Bad Debt

Not all debts are the same. Knowing the difference is important.

- Good Debt: This type of debt usually has a low interest rate and is used to buy something that will likely grow in value or help you make more money. A reasonable mortgage, federal student loans for a degree that will pay off, or a loan for a small business are all good examples.

- Bad Debt: This is debt with a high interest rate that isn’t backed by an asset. People use it to buy things that lose value or to eat. For example, think of credit card debt, payday loans, and loans for expensive cars. This is the debt that actively destroys wealth.

Your Plan of Action for Dealing with Bad Debt

Debt with a lot of interest is a financial emergency. It’s like trying to fill a bucket that has a hole in it. You have to fill in the hole. These are two well-known strategies:

- The Debt Snowball (for motivation): Dave Ramsey made this idea famous. You write down all of your debts, from the smallest to the largest, no matter what the interest rate is. You pay the least amount possible on all of your debts, but you put every extra dollar toward the smallest one. You get a quick mental boost when it’s paid off! You then take the money you were using to pay off that debt and put it toward the next smallest one. As it rolls down the hill, the “snowball” gets bigger.

- The Debt Avalanche (for math): This method has you write down your debts in order of interest rate, from highest to lowest. You pay the least amount on all of them, but you pay off the one with the highest interest rate first. This will save you the most money in interest over time, according to math.

Keep Your Credit Score Safe

A three-digit number shows how good you are at paying your bills. A higher score means you can get lower interest rates on credit cards, car loans, and mortgages, which can save you thousands of dollars over your lifetime. The Consumer Financial Protection Bureau (CFPB) says that payment history and amounts owed are the most important factors in calculating a credit score. You can get your score for free from sites like Credit Karma or from many credit card companies. Always pay your bills on time and keep your credit card balances low. It’s one of the most important numbers for your money.

Investing Actively Building Your Wealth

Saving is about keeping your money safe for a short to medium amount of time. Investing is about making your money grow over the long term. This is how you make real money. It’s how your money starts working for you instead of you always working for it. This is where the magic of compound interest comes in: your money makes money on itself.

Investing Is Not a Game

Let’s get this straight right away. Putting money on something that might not happen in the short term is gambling. Investing is the smart way to put money into things that have a history of growing over time. There are always risks, but disciplined, long-term investing is a planned strategy, not a gamble.

How to Start Investing as a Beginner

You don’t need to know a lot about Wall Street or have a lot of money to get started.

- Use Your Retirement Accounts: The easiest way to start investing is through retirement accounts that give you tax breaks.

- 401(k)/403(b): This is the first place to go if your employer offers one. Many of them offer a “match,” which means they will give you money if you do. This is a quick, full return on your money. This is unbeatable.

- Roth IRA: A retirement account that you set up yourself. You put in money after taxes with a Roth, and it grows tax-free for retirement. This is an amazing tool for young people who don’t pay a lot of taxes.

- Index funds make it easy: You don’t have to choose individual stocks. You probably shouldn’t, though. Investing in low-cost, broad-market index funds or ETFs is the easiest and most recommended way for beginners to start. For example, an S&P 500 index fund lets you own a small part of 500 of the biggest companies in the U.S. It has a long history of good returns, is simple, and is well-diversified. Read our [Interlink: Beginner’s Guide to Investing in Index Funds] for more information.

- Start Small and Be Consistent: The most important thing for making money through investments is not how much you start with, but how early you start. Because of compound growth, a dollar you put away in your 20s is worth a lot more than a dollar you put away in your 40s. Start with what you can afford, set up automatic payments, and let time do the rest.

Protection:How to Keep Yourself Safe from Disaster

The last part of personal finance is protection. You can make a great financial house by budgeting, saving, and investing, but if you don’t have insurance, a single bad event could wipe it all out. Insurance is the act of paying an insurance company to take on your risk. It’s the safety net that keeps you and your loved ones safe.

The Basic Insurance Everyone Should Think About

- Health Insurance: In the U.S., medical debt is one of the most common reasons people go bankrupt. A study by the American Journal of Public Health brings attention to this problem. Health insurance is not up for discussion.

- Auto Insurance: Most states require you to have liability insurance if you own a car. If you cause an accident, it protects you financially.

- Renter’s/Homeowner’s Insurance: This covers your things in case of theft, fire, or another disaster. Liability coverage is also included in homeowner’s insurance. If you rent, you absolutely need renter’s insurance, which is surprisingly cheap.

- Term Life Insurance: If you have a spouse or children who rely on your income, you need life insurance. Term life insurance is cheap and easy to understand. It covers you for a set amount of time (like 20 or 30 years) and pays out a benefit if you die during that time. It makes sure that your loved ones don’t have to deal with a money problem.

- Disability Insurance: Your ability to make money is more important than your car or house. If you get sick or hurt and can’t work, disability insurance will pay you part of your income. It’s one of the most important but often forgotten ways to protect yourself.

Putting It All Together: Your Personal Finance Plan

We talked about the five pillars. How do you put them into action now? This is a simple, step-by-step guide for a beginner.

- Step 1: Make a Simple Budget. Keep track of your spending for a month and make a simple 50/30/20 plan.

- Step 2: Build up an emergency fund. Your first goal is to save $1,000. This gives you a small but strong buffer. Set up a different savings account for it.

- Step 3: Get Your Full Employer 401(k) Match. If your employer matches your contributions, make sure you put in enough to get the full amount. This is money that you don’t have to pay back.

Step 4: Attack High-Interest Debt. Use the Snowball or Avalanche method to quickly pay off any debt with an interest rate of 7% or more, like credit cards. - Step 5: Fully Fund Your Emergency Fund. Now, keep adding to your emergency fund until you have enough money to cover 3–6 months of basic living costs.

- Step 6: Open and Fund a Roth IRA. Start putting money into a Roth IRA. Your goal should be to max out your contributions each year. Put your money into a simple, low-cost target-date or index fund.

- Step 7: Save more for retirement. After paying off your bad debt and filling up your emergency fund, you should save more for retirement. Between your 401(k) and IRA, try to save at least 15% of your gross income for retirement.

- Step 8: Save for Other Goals & Build Wealth. Now that you’re on track for retirement, you can start putting money into a taxable brokerage account for other long-term goals, like a down payment on a house.

- Step 9 (Ongoing): Review and Protect. Every year, check your insurance coverage and your budget and goals every few months to make sure you’re still on track.

This journey is a long one, not a short one. Start with Step 1 and only think about that. Step 2 comes after that becomes a habit. This is how you break down the big idea of “personal finance” into a series of small, doable steps. You can do it. Your freedom from money is waiting.