Being an entrepreneur is a thrilling journey. You are in charge of your time and work, and you are building something from scratch. However, it’s important to acknowledge that the thrilling highs are often accompanied by less glamorous realities. One of the scariest things for any freelancer or small business owner is the word “taxation.”

When people hear the word “taxation,” they often think of complicated forms, keeping track of every penny, and the constant fear of a costly audit. Navigating the tax system can be difficult, wasting time and energy that could be better spent on growing your business. But what if there was an easier way? A way through the tax maze that is made just for the little guys?

Enter presumptive taxes. It may sound technical, but at its core, it’s a very simple idea: a simpler, more efficient way to pay your taxes. This guide will help you fully understand this game-changing idea. We will demystify presumptive taxation, delve into its intricate details, and provide you with the necessary knowledge to assess its suitability for your freelance career or small business.

Breaking Down Presumptive Taxation: A Way to Help the Little Guy

A presumptive taxation scheme is a simple way to figure out how much money you owe in taxes. The tax authorities don’t want you to have to keep track of every single expense and revenue stream to find out your net profit. Instead, they assume that your profit is a certain percentage of your total turnover or gross receipts. You then pay taxes on this assumed income.

Think of it as a legal and government-approved way to avoid paying taxes. These plans, which are used in various ways worldwide, aim to help small taxpayers comply with the law. This approach not only saves you time and money on accounting and auditing fees, but it also makes small businesses more likely to pay their taxes, which is important for any economy.

The basic idea is simple: freelancers and small businesses don’t always have the time or money to keep detailed records of their finances. A presumptive taxation system acknowledges this reality and offers a practical alternative to the complexities of traditional taxation.

The Two Sides of the Coin: Looking at the Good and Bad of Presumptive Taxation

Like any other financial plan, presumptive taxation offers both advantages and disadvantages. Before making a choice, it is important to fully understand both.

The Shining Armor: The Benefits of Presumptive Taxation

Less compliance work: This is the main benefit. You won’t have to spend all night going through receipts and bills anymore. With a presumptive scheme, you don’t need to keep detailed records as much, and in many cases, you don’t need to keep them at all. This gives you more time to focus on the most important parts of your business.

Lower Costs: When accounting is easier, you don’t need to hire as many expensive accountants and tax professionals. It’s always a beneficial idea to get professional help, but managing your money on a daily basis becomes much less expensive.

No More Audit Jitters (Mostly): For many people, the thought of a tax audit is very stressful. If you choose a presumptive taxation scheme, you may not have to go through mandatory audits as long as you report your income at the required rate or higher.

Predictable Tax Liability: Because your tax is based on a set percentage of your turnover, it’s much easier to figure out how much you’ll owe in taxes each year. This simplifies the process of planning and budgeting, thereby preventing unpleasant surprises at the end of the financial year.

Encourages Formalization and Digital Transactions: By making taxes easier to understand, governments encourage small businesses that aren’t registered to do business to do so and pay taxes. Furthermore, many presumptive tax schemes offer a lower tax rate for businesses that receive a higher percentage of their payments through digital channels, thus promoting financial transparency.

The Flaws in the System: The Problems with Presumptive Taxation

Inflexible Expense Claims: This is the worst thing about it. If you use a presumptive scheme, you can’t claim deductions for your real business costs because the assumed profit rate is thought to have already taken these into account. If your actual costs exceed the assumed percentage, you may owe more tax than under the normal system.

Possibility of a Higher Tax Bill: If your business has a low profit margin, the assumed profit rate could be higher than your actual profit. In this case, choosing the presumptive scheme might not be good for you.

Not being able to get some tax benefits: In some places, businesses that are under a presumptive tax scheme may not be able to carry forward business losses to offset future profits.

Some countries have rules that limit how often you can switch between the presumptive and regular tax systems. In India, if you choose not to participate in the presumptive scheme, you may be unable to rejoin it for a certain period of time.

A Trip Around the World: How Different Countries Handle Presumptive Taxation

Presumptive taxation doesn’t work for everyone. Its use varies a lot from country to country, with different eligibility requirements, presumptive rates, and thresholds. Let’s look at how this easier way of taxing people works in a few important areas:

India: The First Country to Use Presumptive Taxation for Small Businesses

India’s Income Tax Act of 1961 has a well-established system for presumptive taxation. Sections 44AD and 44ADA are the two most important provisions for freelancers and small business owners.

Section 44AD: This exemption is for businesses with fewer than 50 employees. You can choose this plan if your yearly sales are less than ₹2 crore (about $24,000). We assume that 8% of your total turnover constitutes taxable income. But to encourage digital transactions, this rate drops to 6% for money that comes in through banks.

Example: ‘Kiran’s Kirana Store,’ a small store, makes ₹1.5 crore a year, all of which comes from digital payments. If Kiran’s income was ₹1.5 crore, then under the presumptive scheme, her taxable income would be 6% of that, or ₹9 lakhs. If a small business owner used the normal rules to calculate their taxes and their actual profit was, for example, ₹12 lakhs, then the presumptive scheme would be beneficial.

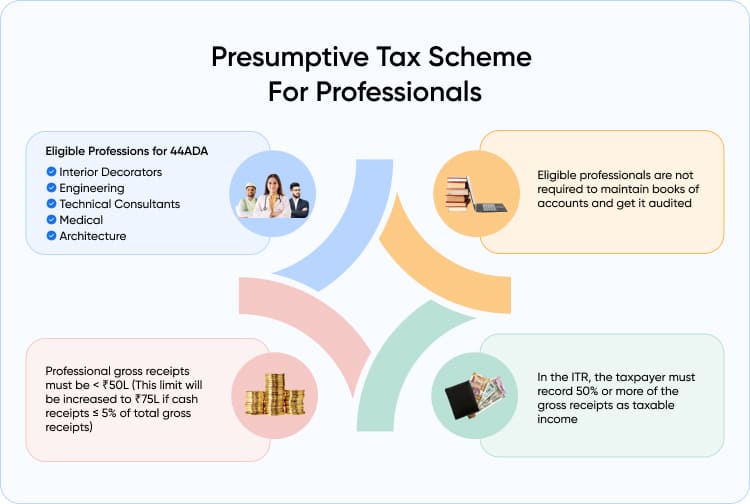

Section 44ADA is excellent for certain professionals, such as freelancers in law, medicine, engineering, architecture, accounting, technical consulting, and interior design. You can claim 50% of your receipts as income if your gross annual receipts are less than ₹50 lakhs (about $60,000). This limit goes up to ₹75 lakhs (about $90,000) for professionals who get at least 95% of their payments in digital form.

Example: Anjali is a freelance graphic designer who makes ₹40 lakhs a year before taxes. Section 44ADA says that her taxable income is 50% of this, which is ₹20 lakhs. She doesn’t have to show proof for the other ₹20 lakhs, which are her business expenses.

For more information about India’s presumptive taxation schemes, you can visit the official Income Tax Department of India website.

The United Kingdom: Easy Expenses for People Who Work for Themselves

The UK doesn’t have a formal “presumptive taxation” system like India does, but it does have a simpler way for sole traders and partners to figure out some of their business costs. This approach is similar to the idea of making it easier for people to follow the rules. People call this “simplified expenses.”

Working from Home: If you work from home for 25 hours or more a month, you can get a flat monthly rate. You can get a flat rate of £10 per month if you work from home for 25 to 50 hours a month, for example.

Vehicles: You can get a flat rate of 45p per mile for the first 10,000 business miles in a tax year for cars and trucks.

Practical Tip: If your actual expenses are significantly higher than the flat rates, it might be more beneficial to calculate them precisely. However, for many freelancers starting out, simplified expenses can be a tremendous time-saver.

If you want to know more about taxes for self-employed people in the UK, you might want to read our article, “Navigating Self-Assessment in the UK.“

The United States: The Place Where Taxes Are Estimated

The US tax system for freelancers and small businesses doesn’t have a direct equivalent of presumptive taxation, but it does work on a “pay-as-you-go” basis through estimated taxes. If you work for yourself, you usually have to pay income tax and self-employment tax (which includes Social Security and Medicare) in four payments over the course of the year.

We use your expected adjusted gross income, taxable income, taxes, deductions, and credits for the year to calculate your estimated tax. This is a little more complicated than a simple presumptive rate, but there are many online calculators and IRS resources that can help.

For freelancers in the US, it’s advisable to allocate 25-30% of their income towards taxes to fulfill federal, state, and local obligations. Having a separate bank account for this can save your life.

For reliable information, refer to the IRS, which provides extensive resources for self-employed individuals.

Europe: A Patchwork of Easy-to-Understand Rules

Different countries in Europe have different ways of taxing small businesses:

The micro-entrepreneur regime is a popular choice for freelancers and small businesses in France. If your turnover is below a certain level (which varies by activity), you can easily figure out how much you owe in social security and income tax. You pay these taxes as a fixed percentage of your turnover. For instance, the income tax for service-based businesses is based on the idea that they make 50% of their turnover.

Germany: The Kleinunternehmerregelung (small business regulation) says that businesses with a turnover below a certain level don’t have to pay Value Added Tax (VAT). This system makes accounting and billing a lot easier.

Italy: The regime forfettario is a flat tax system for freelancers and small businesses that make up to a certain amount of money. It has a flat tax rate of 15% on what it thinks will be profit, and for the first five years, new businesses only have to pay 5%. To figure out the presumed profit, you multiply the turnover by a “profitability coefficient,” which changes depending on the type of work being done.

If you want to know more about the details of European VAT, read our guide called “VAT for Freelancers in the EU.”

Is presumptive taxation the best option for you? A Useful List

Now, the crucial question arises: should you opt for a presumptive tax plan? It depends on your situation. Here is a list of things to think about:

Look at your profit margins. This is the most important step. Please determine your actual or expected profit margin by dividing your profit by your revenue and then multiplying the result by 100. If it is always higher than the expected profit rate that the tax scheme offers, presumptive taxation could be a big win. You might be better off with the regular tax system if it’s lower.

Think about how much it costs to run your business. Do you have a lot of overhead, travel, or equipment costs? If so, not being able to claim these costs under a presumptive scheme could be a big problem.

Think about how fast you want your business to grow. Are you planning to grow it quickly? If you think your business will soon make more money than the presumptive scheme’s eligibility limit, it might be better to start with the standard system to avoid the trouble of switching later.

Check Your Administrative Skills: Be truthful with yourself about your ability and desire to handle detailed bookkeeping. The simplicity of presumptive taxation is a strong argument in its favor, especially if the idea of dealing with taxes makes you feel overwhelmed.

Seek assistance from a tax professional if you are uncertain about your options. They can assess your situation, perform calculations for both presumptive and standard taxation, and assist you in selecting the option that aligns best with your business objectives. Big companies like Deloitte and PwC have many resources and advice for small businesses.

Useful Advice for Doing Well in a Presumptive Taxation System

If you think presumptive taxation is best for you, here are some tips to maximize it:

Keep Basic Records: You don’t have to keep detailed books of accounts, but you do need to keep track of your gross receipts or turnover. You use this to calculate your taxes, and you’ll need to show it if the tax authorities ask.

Have a separate bank account for your business. This is a rule that all freelancers and small business owners should follow, but it’s even more important if you’re on a presumptive scheme. It is much easier to keep track of your business’s income.

Learn about the Advance Tax Requirements: If you live in a country where you are under a presumptive scheme, you may still have to pay advance tax if your total tax bill for the year is expected to be higher than a certain amount. To avoid penalties, make sure you know the due dates and how to pay in your area.

Presumptive taxation usually only applies to income tax, so don’t forget about other taxes. Your business may still have to pay other taxes, like the Goods and Services Tax (GST) or the Value Added Tax (VAT), depending on how much money it makes and what kind of business it is.

It would be beneficial to review your decision annually. Your business is always changing. Over time, your income, costs, and profit margins will change. At the end of each financial year, take the time to think about your choice to use presumptive taxation to make sure it’s still the best choice for you.

The Future of Small Business Taxation: Will It Get Easier?

The fact that many countries are moving toward simpler tax systems for small businesses and freelancers shows that they know how important this sector is and how much it needs to grow. The gig economy is growing, and more and more people are starting their businesses. Because of this, the need for tax systems that are simple to use and work well will only grow.

Presumptive taxation, in its many forms, is a powerful tool that can help freelancers and small business owners confidently deal with the often-confusing world of tax compliance. It lets you focus on what really matters: making your mark on the world and building your dream. Presumptive taxation achieves this by simplifying the process and providing a sense of comfort.

A freelancer or small business owner has to deal with a lot of paperwork, but they also have to be passionate and keep going. If you understand presumptive taxation, you can ensure that the “taxation” aspect of your story is clear and empowering rather than stressful and confusing.

(Source Links & Backlinks):