If you’re looking for a way to grow your savings with minimal effort, a High Yield Savings Account (HYSA) could be your perfect solution. Whether you’re saving for a rainy day, an emergency fund, or a future goal, an HYSA offers several benefits over traditional savings accounts. In this post, we’ll explore why you should consider a High Yield Savings Account for your money and how it can help you achieve your financial goals faster.

What Is a High Yield Savings Account?

A High Yield Savings Account is a type of savings account that offers significantly higher interest rates compared to regular savings accounts. These accounts are often offered by online banks, credit unions, and some traditional banks. With an HYSA, your money grows faster thanks to the higher annual percentage yield (APY), which can help you earn more in interest.

Benefits of a High Yield Savings Account

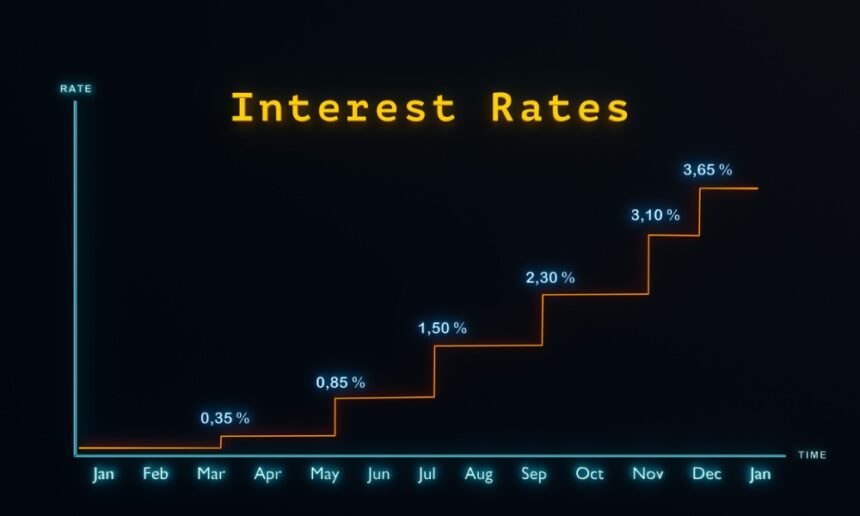

Better Interest Rates One of the most appealing features of a High Yield Savings Account is its higher interest rates. While traditional savings accounts may offer interest rates as low as 0.01% APY, an HYSA can offer rates from 0.50% to 4.00% APY or even higher, depending on the bank and current market conditions. This means your money can grow faster, helping you accumulate savings more efficiently.

Low Risk HYSAs are incredibly low-risk investments, making them ideal for those who want to preserve their capital while earning some interest. Unlike stocks or bonds, your savings are not subject to market fluctuations. Furthermore, most HYSAs are insured by the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Administration (NCUA), meaning your money is protected up to $250,000 per depositor, per institution.

Easy Access to Funds Unlike certificates of deposit (CDs) or long-term investments, High Yield Savings Accounts offer liquidity. You can easily access your funds when you need them without penalty. This makes them ideal for an emergency fund or short-term savings goals. Many accounts also allow you to make transfers or withdrawals online, making it even more convenient to manage your money.

Compounding Interest One of the key ways your savings grow in an HYSA is through compounding interest. Most High Yield Savings Accounts compound interest daily or monthly, which means your interest is calculated on both the principal balance and the interest you’ve already earned. Over time, this compounding effect can significantly boost the amount of money in your account.

No Maintenance Fees Many traditional savings accounts come with monthly maintenance fees that can eat into your earnings. However, most High Yield Savings Accounts have low or no maintenance fees, meaning you get to keep more of the interest you earn. Be sure to read the account terms to confirm the fee structure before committing.

How to Choose the Right High Yield Savings Account

When selecting an HYSA, there are several factors to consider to ensure you get the best value for your money:

Interest Rate Of course, the most important factor to consider is the interest rate. Compare the APYs offered by different banks and credit unions to find the best rate. Keep in mind that rates can change, so it’s essential to check regularly and make adjustments if needed.

Fees and Restrictions Look for accounts with low or no fees, as fees can quickly reduce the amount of interest you earn. Also, pay attention to any withdrawal restrictions or limits on the number of transactions per month.

Minimum Deposit Requirements Some High Yield Savings Accounts require a minimum deposit to open the account. Make sure you can meet this requirement, and be aware of any minimum balance thresholds to avoid fees or losing the high interest rate.

Accessibility Consider how easy it is to access your account. Does the bank offer mobile or online banking? Can you easily transfer funds between your HYSA and other accounts? These features can enhance your experience and make managing your money more convenient.

Are High Yield Savings Accounts Right for You?

A High Yield Savings Account is an excellent option for anyone looking to grow their money with little risk and effort. Whether you’re saving for an emergency fund, a major purchase, or simply want a safe place to park your cash, an HYSA can help you earn more interest than a regular savings account.

However, if you’re looking to make aggressive investment moves and earn higher returns, you might want to explore other options like stocks, mutual funds, or real estate. But for conservative savers who want a safe, easy way to grow their money, a High Yield Savings Account is hard to beat.

A High Yield Savings Account

A High Yield Savings Account offers a simple yet powerful way to earn more from your savings. With higher interest rates, low risk, and easy access to your money, it’s an ideal choice for anyone looking to grow their wealth over time.

Before opening an account, be sure to compare rates, fees, and terms to find the best option for your financial needs. By taking advantage of a High Yield Savings Account, you can maximize your savings potential and work toward your financial goals with confidence.