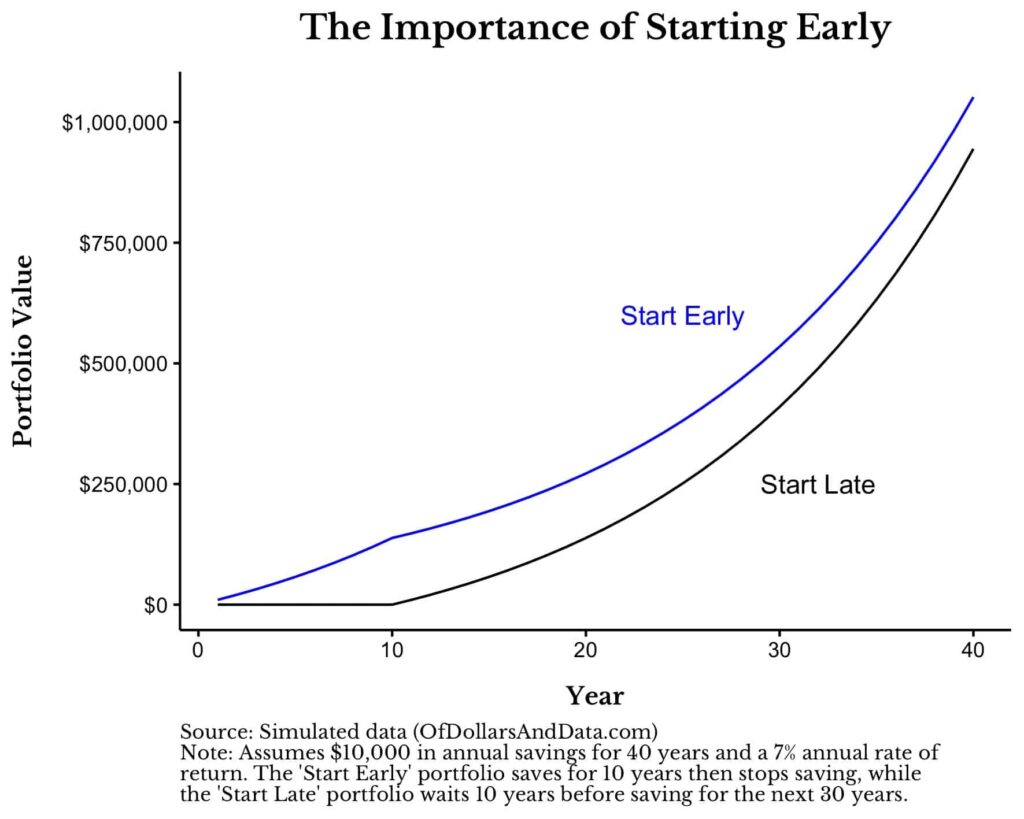

Chloe and Liam are two friends. Let me tell you their story.

At 22, Chloe got her first full-time job. She got the idea after reading a blog post like this one. She chose to “save early,” even though she could only afford to put $200 a month into a simple S&P 500 index fund. She did this every year for ten years, but when she turned 32, she stopped giving money. Life got busy with a mortgage, kids, and new bills. She never put in another penny.

Liam, on the other hand, was more interested in his job. He didn’t want to think about saving until he was “making good money.” Liam finally felt financially stable at 32, the same age Chloe stopped working. He thought it was time to get serious and started saving $800 a month, which was four times what Chloe was saving. He worked hard at this for the next 33 years, until he retired at age 65.

Which person do you think got more money?

It wasn’t even close. Chloe saved for just ten years and retired with more than $1.2 million. Liam saved four times as much money for more than three times as long and retired with just under $1.1 million.

Welcome to the most powerful, misunderstood, and life-changing thing in personal finance: compound interest. This is the main reason why the most important financial decision you’ll ever make isn’t how much you save, but when you start.

I’ve seen it a thousand times as a writer about money. People are waiting. They wait for the next raise, for the debt to be paid off, and for the “perfect time.” But there is no such thing as the perfect time. Yesterday was the best time. Right now, as you read this sentence, is the next best time. This isn’t just another article that tells you what to do; it’s your 4000-word wake-up call. We’re going to break down the excuses, make the process easier to understand, and show you how the simple choice to save early can make you a millionaire, even if you don’t have a lot of money.

The 8th Wonder of the World: Breaking Down the Magic of Compound Interest

People often say that Albert Einstein called compound interest the “eighth wonder of the world.” Even though the quote may not be true, the feeling is right. It’s a simple idea that has a lot of power.

What is it then?

Simple Interest: You put money into an account and only earn interest on the money you put in (the principal). It’s a straight line.

Compound Interest: You get interest on both your principal and the interest that has built up. Your money begins to make money. Then, the money that your money made starts to make its own money.

This “money making money” effect is what makes wealth grow like a snowball. At first, the growth is hard to see. A few cents turn into a few dollars. But as time goes on, the snowball rolls down the hill, getting bigger and faster until it turns into an unstoppable avalanche of growth.

The Structure of the Growth Engine: Principal, Time, and Rate of Return

The compounding machine has three important levers:

- Principal: The amount of money you start with and keep adding to over time. People are obsessed with this because they think they need a lot to make a difference. They are not right.

- Rate of Return: The amount of growth your money gets as a percentage. The stock market has historically given an average annual return of about 10% over the long term, but this is not always the case.

- Time: How long you plan to keep your money invested. This is the key part. This is the lever that has the biggest effect on the final result.

When you save early, you are getting the most out of the most powerful tool: time. You are giving the snowball the most time to grow. Every year you wait to start saving is a year you take away from your future self. Not only are you taking away the contributions, but also the exponential growth that those contributions could have led to for decades.

Let’s take another look at Chloe and Liam with a visual breakdown. (Assuming a 10% return on average each year):

| Chloe (Started at 22) | |

|---|---|

| Monthly Payment | $200 |

| Time of Contribution: 10 years (from age 22 to 32) | |

| Total Contribution: $24,000 | |

| Growth Period | 43 years (up to age 65) |

| Final Amount at 65 | ~$1,225,000 |

| Liam (Started at 32) |

| :— | :— |

| Monthly Payment | $800 |

| Time to Contribute | 33 years (Age 32 to 65) |

| Total Contribution: $316,800 |

| Growth Period: 33 years (up to age 65) |

| Final Amount at 65 | ~$1,090,000 |

Check out those numbers. Chloe put in a total of $24,000 of her own money. Liam gave more than $316,000, which is more than 13 times what Chloe gave! But he got less in the end. Why? Chloe’s first $24,000 had an extra ten years to grow and make more money. Liam’s huge contributions could never catch up to that decade of early growth.

This isn’t a joke. It’s numbers. It’s the proof that “time in the market beats timing the market” and “starting early beats starting big” are both true when it comes to making money.

The Psychology of Procrastination: Why We Don’t Save Early

Why do so many smart, capable people not act if the math is so clear? The reasons are not often logical; they are very psychological. The first step to breaking down these mental walls is to understand them.

Barrier 1: “I Don’t Make Enough Money.”

This is the most common reason. The idea that the little bit you can save isn’t worth it. It feels like bringing a squirt gun to a forest fire to save $20 or $50 a month. It doesn’t seem like it matters.

What to Do About It: Change your focus from the amount to the habit. In your 20s, your goal shouldn’t be to save a million dollars; it should be to make saving a habit. Setting up a small automatic payment, like $25 a month, does two things. First, it makes saving a must-do part of your financial life. Second, it starts the compounding engine, even if it is slow at first. These basic habits are what make up financial capability, according to a FINRA Foundation study. Over the course of 40 years, that small seed of $25 a month can grow into a huge oak tree.

Barrier 2: The Weight of Debt (Especially Student Loans)

A lot of young people graduate with a lot of student loan debt. When you have a negative net worth, it feels wrong to invest, and the logical part of your brain screams, “I should put every extra penny toward this debt!”

How to Get Over It: You don’t have to choose one or the other. It’s a plan that works for both sides. You should definitely have a plan to pay off high-interest debt quickly, like credit cards. But you can’t afford to put your savings on hold for 10 to 20 years while you pay off your student loans. The interest rate on federal student loans is usually between 4% and 7%, which is lower than the average return on the stock market, which is around 10%.

Think about a balanced way to do things. If your employer will match your 401(k) contributions, make sure you put in enough to get the full match. You get free money and a 100% return right away. After that, you can use the extra money to pay off your debt or save for your own retirement. If you want to know more, read our guide on [Interlink: How to Prioritize Savings vs. Debt Repayment].

Barrier 3: “YOLO” Culture and Lifestyle Inflation

When you get your first real paycheck, it feels like a lot of money. You can now afford the nice apartment, the new car, the dinners out, and the vacations you see all over social media. The “you only live once” way of thinking can ruin your long-term wealth. This is called lifestyle inflation, and it means that your spending goes up at the same rate as your income, leaving you with nothing to save.

“Pay yourself first” is a golden rule of personal finance for a reason. Before you pay your rent, bills, or bar tab, you should pay your future self. Set up an automatic transfer from your checking account to your investment account on the day you get paid. You don’t even get a chance to miss or spend the money before it’s gone. This easy task of automating is the best way to protect yourself from lifestyle inflation.

Barrier 4: The Fear and Difficulty of Investing

The stock market can look like a scary, complicated casino made for Wall Street sharks. Words like “ETFs,” “mutual funds,” and “asset allocation” can be scary and make it hard to think clearly. Doing nothing seems safer than doing the “wrong” thing and losing money.

How to Get Over It: You don’t have to be Warren Buffett. Buffett has said many times that the best thing for most people to do is to invest in a low-cost S&P 500 index fund. Companies like Vanguard, Fidelity, and Charles Schwab offer these funds, which are very easy to understand. You are getting a small piece of 500 of the biggest companies in the U.S. It has a lot of different types of investments, is cheap, and has done well over time. Keep things simple.

Your “Save Early” Starter Pack: Useful Things to Do Right Now

Okay, you believe me. There are no more excuses. You’re ready to put your cash to work. But how do you do it, exactly? This is a practical, step-by-step guide to getting started on your savings journey right now.

Step 1: Open the Right Account (The 3 Best Options)

The place you save is almost as important as saving itself. A regular savings account at a bank won’t work because the interest rates are almost zero. You need an account for investments.

- A 401(k) or 403(b) with an employer match: This is, without a doubt, the best place to start. You need to put in enough money to get the full match if your employer has a retirement plan and matches a percentage of your contributions. For instance, if they match 100% of your contributions up to 5% of your salary, you must put in 5%. If you don’t do this, you’re literally turning down a 100% return on your money. It’s included in your pay. Take it.

- A Roth IRA: You open this account on your own. For young people who want to save, a Roth IRA is the best option. You put in money that has already been taxed, so your investments grow completely tax-free, and you don’t have to pay any taxes when you take the money out in retirement. This is a huge benefit because your tax bracket will probably be much higher in the future. You can give up to $7,000 in 2024 (this limit changes from time to time). Vanguard, Fidelity, and Schwab are all major brokerages where you can open a Roth IRA.

- A taxable brokerage account is a regular investment account that doesn’t have any special tax benefits. If you’ve already maxed out your 401(k) match and Roth IRA contributions, or if you want to save for something other than retirement with more freedom, this is a great choice.

Step 2: Make everything automatic

Don’t depend on willpower. Don’t trust “remembering” to send money. Automation is the key to being consistent.

- For your 401(k): Your employer takes care of this through payroll. You don’t have to worry about it.

- For your Roth IRA or brokerage account: Sign in to your account and set up a regular automatic transfer from your checking account. Pick a date soon after you get paid. You can pay $50 a month, $100 a month, or whatever you can afford. Start now. You can always raise it later.

Step 3: Pick your investment (keep it simple!)

People get stuck here. Don’t. For almost all beginners, the choice is easy.

- Target-Date Funds: This is the simplest choice of all. A target-date fund, like the “Target Retirement 2065 Fund,” changes the way it invests automatically to become more conservative as you get closer to retirement. You choose the fund that is closest to the year you want to retire, and the fund manager takes care of the rest. It’s a “one and done” fix.

- Low-Cost Index Funds: This is the option that requires a little more work, but it’s still very easy. As I said before, putting money into a broad-market index fund like an S&P 500 ETF (like VOO or IVV) or a Total Stock Market ETF (like VTI) is a great idea. You can diversify your investments right away for very little money.

Step 4: “Found Money”—How to Start When You Don’t Have Any Money

Do you feel like you really don’t have a single dollar to spare? It’s time to look for “found money.”

- Use a micro-investing app: Apps like Acorns and Stash are made just for this problem. Acorns, for example, connects to your debit card and rounds up your daily purchases to the nearest dollar. It then invests the extra money for you. You automatically invest $0.50 when you buy that $3.50 coffee. It’s a simple way to save early without even trying.

- Do a Subscription Audit: Look at your bank statements and find every subscription you have that you don’t use, like streaming services, gym memberships, and app subscriptions you forgot about. Be tough. Every cancellation is free money.

- The “One Thing” Cut: Don’t try to change everything about your life. Cut back on just one thing. Do you eat out for lunch three times a week? Go back to once. Do you get a latte every day? Make your own coffee. The point of this exercise isn’t just to save a little money; it’s to show yourself that you can find money to save. You can save money by making this one change and then automatically moving that money to your investment account.

- Use Your Next Raise: When you get a raise, act like it never happened. Before lifestyle inflation takes it, raise your automatic 401(k) or IRA contribution by that amount right away. This is the best way to easily increase how much you save.

The Long-Term Vision: What Saving Early Really Gets You

We’ve talked a lot about numbers, but what do they mean for your life? It’s not just about having a seven-figure bank account when you retire. It’s about giving yourself freedom and choices.

- Freedom from Financial Stress: Having a growing nest egg makes you feel very safe. You can now deal with an unexpected car repair or medical bill without it being a code-red crisis.

- The Power to Take Calculated Risks: Do you want to change jobs to one that pays less but makes you happier? Do you want to start your own business? Want to travel for a year? When you have a lot of money saved up, you can make decisions based on what you love, not just what you have to do to pay your bills. People often call this “F-You Money,” and blogger JL Collins explains it very well.

- Achieving Financial Independence, Retire Early (FIRE): The FIRE movement is a group of people who are very dedicated to saving and investing so they can retire many years earlier than usual. It shows how powerful it is to start early and save a lot, even though it’s not for everyone. What if you could choose to work part-time or work on a passion project instead of retiring at 40? That is possible if you save early. Look into groups that are focused on becoming financially free to get ideas.

- Leaving a Generational Legacy: You don’t have to keep all the money you make. If you start saving early, you can build up a nest egg so big that it will not only support you in retirement but also give your children or grandchildren a financial head start, setting them up to “save early” and keep the cycle of generational wealth going.

Your Future Self Is Begging You

Remember Chloe and Liam? A choice they made in their early 20s was the only thing that kept them from having a retirement full of money worries and multi-million-dollar outcomes. Chloe gave her money the one thing it needed most: time. No matter how much money Liam threw at the problem later, he couldn’t get that time back.

You are at a unique, powerful, and short-lived time in your financial life. The dollar you put in today is the most valuable dollar you have. It will work harder and longer for you than any dollar you will ever make in the future.

Don’t wait for the right time. Don’t put it off until you make more money. Don’t let fear or how hard things are stop you. Get an account. Set up a small donation to happen automatically. Begin with a fund that is simple and cheap.

Start now. Do it now. The choice to save early is the closest thing you’ll ever have to a financial superpower. Your future self will thank you for it, maybe from a beach, a mountaintop, or just the comfort of a home where money problems are a thing of the past. They will be grateful that you understand that saving doesn’t mean denying yourself today; it means giving yourself freedom in the future.

SOURCE:

https://www.nerdwallet.com/article/investing/average-stock-market-return

https://investor.vanguard.com/investment-products/etfs/profile/voo